Rogers 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Notes to Consolidated Financial Statements

We,us,our,Rogers,Rogers Communications and the Company refer to

Rogers Communications Inc. and our subsidiaries. RCI refers to the legal

entity Rogers Communications Inc., not including our subsidiaries. RCI

also holds interests in various investments and ventures.

NOTE 1: NATURE OF THE BUSINESS

Rogers Communications is a diversified Canadian communications and

media group. Substantially all of our operations and sales are in

Canada. RCI is incorporated in Canada and its registered office is

located at 333 Bloor Street East, Toronto, Ontario, M4W 1G9. RCI’s

shares are publicly traded on the Toronto Stock Exchange (TSX: RCI.A

and RCI.B) and on the New York Stock Exchange (NYSE: RCI).

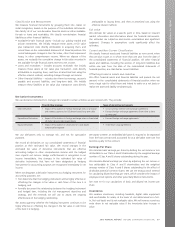

We report our results of operations in four segments:

Wireless Wireless telecommunications operations for

consumers and businesses

Cable Cable telecommunications operations,

including cable television, Internet and

cable telephony for Canadian consumers

and businesses

Business Solutions Network connectivity through our fibre

network assets to support a range of voice,

data, networking, data centre and cloud-

based services for medium and large

Canadian businesses, governments, and

other telecommunications providers

Media A diversified portfolio of media properties,

including television and radio broadcasting,

digital media, multi-platform shopping,

publishing and sports media and

entertainment

Wireless, Cable and Business Solutions are operated by our subsidiary,

Rogers Communications Partnership, and our other wholly owned

subsidiaries. Media is operated by our wholly owned subsidiary Rogers

Media Inc. and its subsidiaries.

See note 3 for more information about our operating segments.

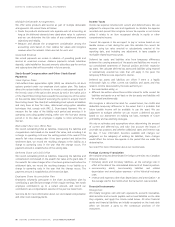

Statement of Compliance

We prepared our consolidated financial statements according to

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB). Our Board of

Directors approved the consolidated financial statements for the years

ended December 31, 2013 and 2012 on February 12, 2014.

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

All amounts, except per share amounts, are in Canadian dollars, which

is our functional currency, and rounded to the nearest million, unless

otherwise noted. We prepare the consolidated financial statements on a

historical cost basis, except for certain financial instruments, liabilities

for cash-settled share-based payments and the net deferred pension

liability, which we measure at fair value as described in the notes.

Basis of Consolidation

Subsidiaries

Subsidiaries are entities we control. We include the financial statements

of our subsidiaries in our consolidated financial statements from the

date we gain control of them until our control ceases. We eliminate all

intercompany transactions and balances on consolidation.

Business Combinations

We account for acquisitions of subsidiaries using the acquisition

method of accounting. We calculate the fair value of the consideration

paid as the fair value at the acquisition date of the following:

• assets given, plus

• equity instruments issued, less

• liabilities incurred or assumed at the date of exchange.

We measure goodwill as the fair value of the consideration transferred,

less the net recognized amount of the identifiable assets acquired and

liabilities assumed, all measured at fair value as of the acquisition date.

When the excess is negative, a bargain purchase gain is recognized

immediately in profit or loss.

We use estimates and judgment to determine the fair value of assets

acquired and liabilities assumed, using the best available information

including information from financial markets. This may include

discounted cash flow analyses which utilize key assumptions such as

discount rates, attrition rates, and terminal growth rates to estimate

future earnings. We expense the transaction costs associated with the

acquisitions as we incur them.

See note 7 for information related to business combinations in 2013

and 2012.

Use of Estimates and Judgments

When preparing our financial statements, management makes

judgments, estimates and assumptions that affect how accounting

policies are applied and the amounts we report as assets, liabilities,

revenue and expenses. Significant changes in the assumptions,

including those related to our future business plans and cash flows,

could materially change the carrying amounts we record. Actual results

could be different from these estimates.

We use estimates that are inherently uncertain in the following key

areas:

• considering inputs to determine the fair value of assets acquired and

liabilities assumed in business combinations (see Basis of

Consolidation, above)

• considering industry trends and other factors to determine the

estimated useful lives of property, plant and equipment (see Property,

Plant and Equipment, below)

• capitalizing direct labour, overhead and interest costs to property,

plant and equipment (see Property, Plant and Equipment, below)

• determining the recoverable amount of non-financial assets when

testing for impairment (see Impairment, below), and

• measuring the fair value of derivative instruments (see note 20),

pension obligations (see note 22) and stock-based compensation

liabilities (see note 24).

94 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT