Rogers 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

COMPETITION

We compete on quality of service, scope of services, network coverage,

sophistication of wireless technology, breadth of distribution, selection

of devices, branding and positioning, and price.

• Wireless technology: we were the first carrier in Canada to launch an

LTE network catering to customers seeking the increased capacity

and speed it provides. We compete with Bell, Telus MTS and Eastlink,

all of whom operate LTE networks and we expect competition to

grow over time as LTE becomes the prevailing technology in Canada.

We also compete with these providers and other regional providers

such as Wind Mobile, on HSPA and GSM networks and with

providers that use alternative wireless technologies, like Wi-Fi

“hotspots”.

• Product, branding and pricing: we compete nationally with Bell and

Telus. We also complete with newer entrants, various regional

players and resellers.

• Distribution: we compete with other service providers for both

dealers and prime locations for our own stores as well as third party

retail distribution shelf space outlets.

• Wireless networks and handset devices: the parity of wireless devices

across networks has dramatically transformed the competitive

landscape, and we expect this to continue and even intensify.

Consolidation among new entrants or with incumbent carriers could

alter the competitive landscape for Wireless regionally or nationally.

• Spectrum: we are currently participating in an auction for 700 MHz

spectrum. Industry Canada has also announced an auction for

additional 2500 MHz spectrum in 2015 in which we may be

restricted from participating in the geographic areas where we

already hold more than 40 MHz of 2500 MHz spectrum. The

outcomes of both of these auctions may increase competition.

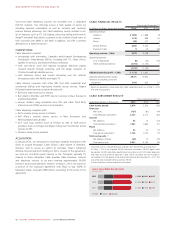

WIRELESS FINANCIAL RESULTS

(In millions of dollars, except percentages)

Years ended December 31

2013 2012 %Chg

Operating revenue

Network revenue $ 6,748 $ 6,719 –

Equipment sales 522 561 (7)

Operating revenue – Wireless 7,270 7,280 –

Operating expenses

Cost of equipment 1(1,535) (1,585) (3)

Other operating expenses (2,578) (2,632) (2)

(4,113) (4,217) (2)

Adjusted operating profit – Wireless $ 3,157 $ 3,063 3

Adjusted operating profit margin as

%of network revenue 46.8%45.6%

Additions to property, plant and equipment $ 865 $ 1,123 (23)

Data revenue included in network revenue $ 3,175 $ 2,722 17

Data revenue as %of network revenue 47%41%

1Includes the cost of equipment sales and direct channel subsidies.

(IN MILLIONS OF DOLLARS)

WIRELESS NETWORK REVENUE

2013

2012

2011

$6,748

$6,719

$6,601

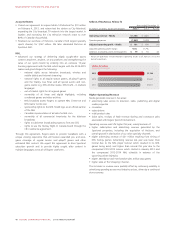

WIRELESS SUBSCRIBER RESULTS 1, 2

(Subscriber statistics in thousands,

except ARPU and churn)

Years ended December 31

2013 2012 Chg

Postpaid

Gross additions 1,409 1,457 (48)

Net additions 228 268 (40)

Total postpaid subscribers 8,074 7,846 228

Monthly churn 1.24%1.29%(0.05)pts

Monthly average revenue per user

(ARPU) $ 67.76 $ 69.30 $ (1.54)

Prepaid

Gross additions 525 627 (102)

Net losses (162) (170) 8

Total prepaid subscribers 1,429 1,591 (162)

Monthly churn 3.85%3.98%(0.13)pts

ARPU $ 15.64 $ 15.84 $ (0.20)

Blended ARPU $ 59.58 $ 59.79 $ (0.21)

1Does not include subscribers from our wireless home phone product.

2ARPU, subscriber counts and subscriber churn are key performance indicators. See

“Key Performance Indicators”.

(IN THOUSANDS)

WIRELESS POSTPAID AND PREPAID SUBSCRIBERS

2013

2012

2011

1,429 8,074

1,591 7,846

1,761 7,574

PostpaidPrepaid

($)

WIRELESS POSTPAID MONTHLY ARPU

2013

2012

2011

$67.76

$69.30

$70.26

(%)

WIRELESS POSTPAID MONTHLY CHURN

2013

2012

2011

1.24%

1.29%

1.32%

Operating Revenue

Our operating revenue depends on the size of our subscriber base, the

average revenue per user and revenue from equipment sales.

Higher Network Revenue

Network revenue includes revenue derived from voice and data services

from postpaid monthly fees, airtime, data usage, long distance charges,

optional service charges, inbound and outbound roaming charges and

certain fees, as well as prepaid usage for airtime, data and other

ancillary charges such as long distance.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 39