Rogers 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

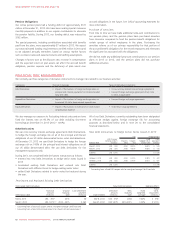

Normal Course Issuer Bid Share Purchases

In February 2013, we renewed our normal course issuer bid for our

Class B Non-Voting shares for another 12-month period. This allowed

us to purchase up to the lesser of 35.8 million Class B Non-Voting

shares and the number of Class B Non-Voting shares that can be

purchased by Rogers under the normal course issuer bid for a total

purchase price of $500 million during a twelve-month period

commencing February 25, 2013 and ending February 24, 2014.

During 2013 we purchased 546,674 Class B Non-Voting shares for

cancellation under the NCIB for a purchase price of $22 million, all of

which were made through the facilities of the TSX in June 2013.

During 2012 we purchased 9,637,230 Class B Non-Voting shares for

cancellation under the NCIB for a purchase price of $350 million.

In February 2014, we filed a notice with the TSX of our intention to

renew our normal course issuer bid for our Class B Non-Voting shares

for another year. Subject to acceptance by the TSX, this notice gives us

the right to buy up to an aggregate $500 million or 35,780,234 Class B

Non-Voting shares of RCI, whichever is less, on the TSX, the NYSE and/

or alternate trading systems any time between February 25, 2014 and

February 24, 2015. The number of Class B Non-Voting shares we

actually buy under the normal course issuer bid, if any, and when we

buy them, will depend upon our evaluation of market conditions, stock

prices, our cash position, alternative uses of cash and other factors.

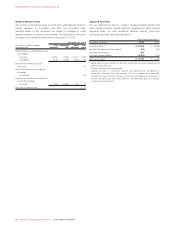

Dividends

In 2013, we declared and paid dividends on each of our outstanding

Class A Voting and Class B Non-Voting shares. We paid $876 million in

cash dividends, an increase of $73 million from 2012. See “Dividend

and Share Information”.

Shelf Prospectuses

Our two shelf prospectuses expired in January 2014. One shelf

prospectus qualified the public offering of our debt securities in each of

the provinces of Canada (Canadian Shelf) and the other shelf

prospectus (together with a corresponding registration statement filed

with the US Securities and Exchange Commission) qualified the public

offering of our debt securities in the United States and Ontario (US

Shelf). We issued an aggregate of US$2.5 billion of debt securities

under the US Shelf during 2013 and, in 2012, we issued an aggregate

of $1.1 billion of debt securities under the Canadian Shelf. We intend

to replace these expired shelf prospectuses with a new Canadian Shelf,

qualifying up to $4 billion of debt securities, and a new US Shelf,

qualifying up to US$4 billion of debt securities. We have no immediate

intention to offer securities pursuant to either of these new shelf

prospectuses. The notice set forth in this paragraph does not constitute

an offer of any securities for sale or an offer to sell or the solicitation of

an offer to buy any securities.

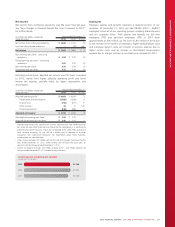

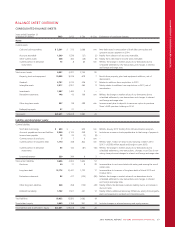

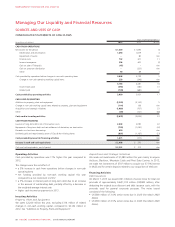

Pre-tax and After-tax Free Cash Flow

Years ended December 31

(In millions of dollars) 2013 2012 % Chg

Adjusted operating profit 1$ 4,993 $ 4,834 3

Property, plant and equipment expenditures (2,240) (2,142) 5

Interest on long-term debt, net of capitalization (709) (663) 7

Pre-tax free cash flow 12,044 2,029 1

Cash income taxes (496) (380) 31

After-tax free cash flow 1$ 1,548 $ 1,649 (6)

1Pre-tax free cash flow, after-tax cash flow and adjusted operating profit are non-

GAAP measures and should not be considered as a substitute or alternative for GAAP

measures. They are not defined terms under IFRS, and do not have standard

meanings, so may not be a reliable way to compare us to other companies. See “Non-

GAAP Measures” for information about these measures, including how we calculate

them.

Pre-tax cash flow was up 1% this year compared to last year due to

higher adjusted operating profit, partially offset by higher additions to

property, plant and equipment and higher interest on our long-term

debt. After-tax free cash flow was 6 percent lower than last year

because of higher cash income taxes.

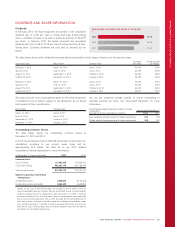

(IN MILLIONS OF DOLLARS)

PRE-TAX FREE CASH FLOW

2013

2012

2011

$2,044

$2,029

$1,973

60 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT