Rogers 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

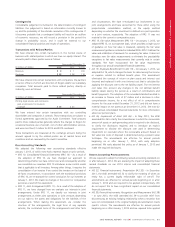

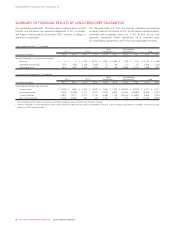

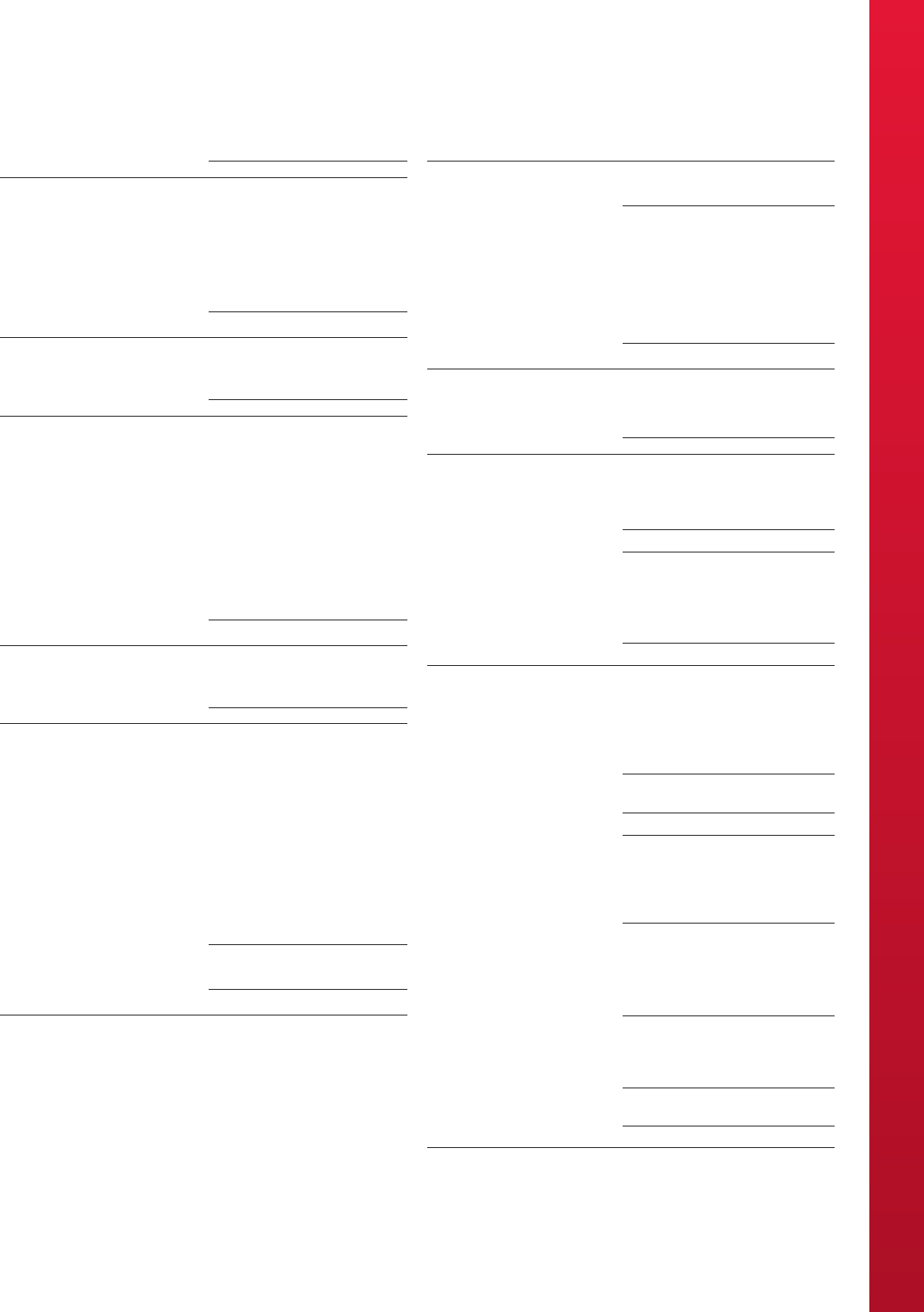

MANAGEMENT’S DISCUSSION AND ANALYSIS

Reconciliation of Adjusted Operating Profit

Years ended December 31

(In millions of dollars) 2013 2012

Operating income $ 2,926 $ 2,766

Add (deduct):

Depreciation and amortization 1,898 1,819

Impairment of assets –80

Stock-based compensation expense 84 77

Restructuring, acquisition and other

expenses 85 92

Adjusted operating profit $ 4,993 $ 4,834

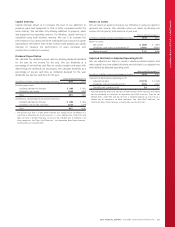

Reconciliation of Adjusted Net Income

Years ended December 31

(In millions of dollars) 2013 2012

Net income from continuing operations $ 1,669 $ 1,725

Add (deduct):

Stock-based compensation expense 84 77

Restructuring, acquisition and other

expenses 85 92

Impairment of assets –80

Gain on sale of TVtropolis (47) –

Gain on spectrum distribution –(233)

Income tax impact of above items (30) (14)

Income tax adjustment, legislative

tax change 854

Adjusted net income $ 1,769 $ 1,781

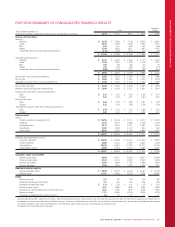

Reconciliation of Pre-tax and After-tax Free Cash Flow

Years ended December 31

(In millions of dollars) 2013 2012

Cash provided by operating activities $ 3,990 $ 3,421

Add (deduct):

Property, plant and equipment

expenditures (2,240) (2,142)

Interest on long-term debt expense,

net of capitalization (709) (663)

Restructuring, acquisition and other

expenses 85 92

Cash income taxes 496 380

Interest paid 700 680

Change in non-cash working capital (238) 248

Other adjustments (40) 13

Pre-tax free cash flow 2,044 2,029

Cash income taxes (496) (380)

After-tax free cash flow $ 1,548 $ 1,649

Reconciliation of Adjusted Net Debt

(In millions of dollars) December 31, 2013 December 31, 2012

Long-term debt $ 12,173 $ 10,441

Current portion of long-term debt 1,170 348

13,343 10,789

Add (deduct):

Net Debt Derivatives liabilities

(assets) (51) 524

Deferred transaction costs 93 69

Short-term borrowings 650 –

Cash and cash equivalents (2,301) (213)

Adjusted net debt $ 11,734 $ 11,169

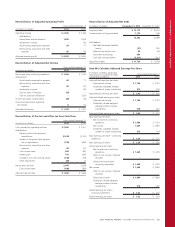

How We Calculate Adjusted Earnings Per Share

(In millions of dollars, except per

share amounts; number of shares

outstanding in millions)

Years ended December 31

2013 2012

Adjusted basic earnings per share:

Adjusted net income $ 1,769 $ 1,781

Divided by: weighted average

number of shares outstanding 515 519

Adjusted basic earnings per share $ 3.43 $ 3.43

Adjusted diluted earnings per share:

Adjusted net income $ 1,769 $ 1,781

Divided by: diluted weighted

average number of shares

outstanding 518 522

Adjusted diluted earnings per share $ 3.42 $ 3.41

Basic earnings per share:

Net income from continuing

operations $ 1,669 $ 1,725

Net income 1,669 $ 1,693

Divided by: weighted average

number of shares outstanding 515 519

Basic earnings per share – continuing

operations $ 3.24 $ 3.32

Basic earnings per share $ 3.24 $ 3.26

Diluted earnings per share:

Net income from continuing

operations $ 1,669 $ 1,725

Effect on net income of dilutive

securities ––

Diluted net income from

continuing operations $ 1,669 $ 1,725

Net income $ 1,669 $ 1,693

Effect on net income of dilutive

securities ––

Diluted net income $ 1,669 $ 1,693

Divided by: diluted weighted

average number of shares

outstanding 518 522

Diluted earnings per share –

continuing operations $ 3.22 $ 3.30

Diluted earnings per share $ 3.22 $ 3.24

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 85