Rogers 2013 Annual Report Download - page 72

Download and view the complete annual report

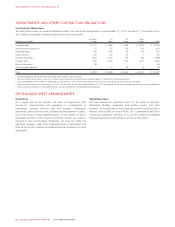

Please find page 72 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

Combined, these limits can enable effective foreign control of up to

46.7%.

The chief executive officer and 80%of the members of the Board of

Directors of the operating licensee must be resident Canadians. There

are no restrictions on the number of non-voting shares that may be

held by non-Canadians at either the holding-company or licensee-

company level. Neither the Canadian carrier nor its parent may be

otherwise controlled in fact by non-Canadians. Subject to appeal to the

federal Cabinet, the CRTC has the jurisdiction to determine as a

question of fact whether a given licensee is controlled by non-

Canadians.

Pursuant to the Telecommunications Act and associated regulations, the

same rules also apply to Canadian telecommunications carriers such as

Wireless, except that there is no requirement that the chief executive

officer be a resident Canadian. We believe we are in compliance with

the foregoing foreign ownership and control requirements.

On June 29, 2012, Bill C-38 amending the Telecommunications Act

passed into law. The amendments exempt telecommunications

companies with less than 10%of total Canadian telecommunications

market measured by revenue from foreign investment restrictions.

Companies that are successful in growing their market shares in excess

of 10%of total Canadian telecommunications market revenues other

than by way of merger or acquisitions will continue to be exempt from

the restrictions.

WIRELESS

Consultation on the Renewal of Cellular and Personal

Communications Services (PCS)Spectrum Licences

In March 2011, Industry Canada released its decisions about the

renewal process for cellular and PCS licences that began expiring at that

time. Key things to note:

• At the end of the current licence term, new cellular and PCS licences

with a 20-year term will be issued to licensees that are in compliance

with all licence conditions.

• The previously existing annual fee of $0.0351 per MHz per

population of the licenced area will continue to apply to all cellular

and PCS licences, including those initially assigned by auction. The

Minister of Industry Canada may review and amend the fees during

the licence term after further consultation with licensees.

• A determination regarding existing research and development

conditions of licence was not released at that time and will be

released separately. A decision has not been made to date, and until

such a time, the current conditions of licence remain in effect.

Consultation on a Policy and Technical Framework for the

700Mhz and 2500-2690Mhz Band and Aspects Related to

Commercial Mobile Spectrum

In March 2012, Industry Canada released its policy and technical

framework for the auction of spectrum in the 700 MHz and 2500–2690

MHz spectrum bands. Key things to note:

• Industry Canada adopted an auction cap for the 700 MHZ (not a set-

aside like in the 2008 Advanced Wireless Services (AWS) spectrum

auction). There are four blocks of spectrum that are considered

“prime”. Large domestic wireless carriers are restricted to a single

block of prime spectrum each, while all other carriers are restricted to

two blocks. Rogers, Bell and Telus are considered large carriers

nationally. SaskTel is considered a large carrier in Saskatchewan, and

MTS is considered a large carrier in Manitoba.

• To encourage rural deployments, single carriers who win two paired

blocks, or two carriers who share their two paired blocks, are

required to use their 700 MHz spectrum to provide coverage to 90%

of their HSPA+ territory within five years and 97%within seven

years. Industry Canada will use Tier 2 licence areas for the 700Mhz

auction. These are 14 large service areas covering all of Canada, and

are generally the same size as individual provinces.

In March 2013, Industry Canada released Licensing Framework for

Mobile Broadband Services (MBS) – 700 MHz Band. Key things to note:

• Industry Canada confirmed that, for the most part, the policy and

technical framework to auction spectrum in the 700 MHz band are

the same as proposed in its March 14, 2012 consultation document.

• The auction will use a combinatorial clock auction (CCA) format,

where bids are made for packages of spectrum licences, rather than

the simultaneous multiple round auction (SMRA) format used in the

past, where bids are made on individual licences.

• Associated entities can apply to bid separately and to have the

auction cap applied individually. These bidders must demonstrate

that they “intend to separately and actively provide services” within a

given licence area for the duration of the spectrum caps (five years

after licensing). Industry Canada has determined that no registered

bidders were associated with each other.

The auction was initially set to begin on November 19, 2013. In

June 2013, Industry Canada moved the application deadline to

September 17, 2013, and the auction start to January 14, 2014.

In October 2013, Industry Canada released its consultation paper,

seeking comments on licencing considerations related to auction

format, rules and processes, as well as on conditions of licence for

spectrum in the 2500–2690 MHz band. The final policy was released on

January 10, 2014.

Key things to note about 2500–2690 MHz spectrum policy:

• Industry Canada adopted a spectrum cap (not an auction cap like in

the 700 MHz auction). No carrier participating in the auction may

possess more than 40 MHz of 2500–2690 MHz spectrum. Rogers is

grandfathered with respect to our holdings in those situations where

we already hold more than 40 MHz of this spectrum. We will not be

required to return spectrum.

• There is no special roll-out requirement for 2500–2690 MHz

spectrum. A general roll-out rule will be determined in the policy.

• The auction is set to commence on April 15, 2015.

• The 2500MHz auction will use Tier 3 licence areas.

Roaming and Tower Sharing Policy

In March 2013, Industry Canada released Revised Frameworks for

Mandatory Roaming and Antenna Tower and Site Sharing, concluding a

consultation initiated in 2012. It sets out the current rules for roaming

and tower and site sharing. Its key terms are:

• All holders of spectrum licences, radio licences and broadcasting

certificates must share towers and antenna sites, where technically

feasible, at commercial rates.

• All licensees were permitted to request roaming from other licensees

at commercial rates.

• The timeframe for negotiating agreements is 60 days, after which

arbitration according to Industry Canada arbitration rules will begin.

• The roaming capabilities must provide connectivity for digital voice

and data services regardless of the spectrum band or underlying

technology used.

68 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT