Rogers 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

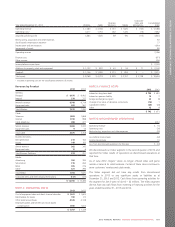

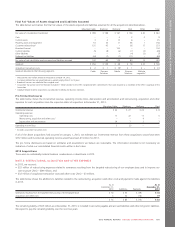

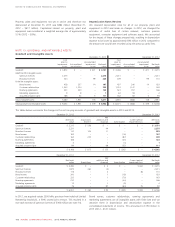

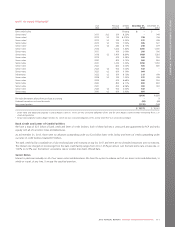

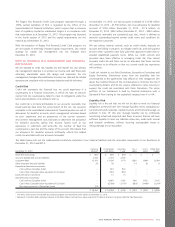

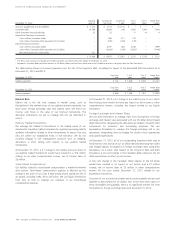

NOTE 7: BUSINESS COMBINATIONS

We made several acquisitions in 2013, which we describe below. We

accounted for these using the acquisition method of accounting in

accordance with IFRS 3, Business Combinations, and included the

results of operations of the acquired entities from the dates of

acquisition in our consolidated statements of income. Goodwill

recognized on these acquisitions is not tax deductible. It represents the

expected operational synergies with the business acquired and/or

intangible assets that do not qualify to be recognized separately.

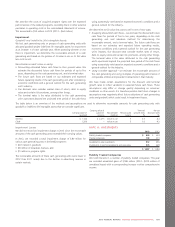

Transactions with Shaw Communications Inc. (Shaw)

In January 2013, we entered into an agreement with Shaw to secure an

option to purchase Shaw’s Advanced Wireless Services (AWS) spectrum

holdings in 2014, and to acquire Mountain Cable, Shaw’s cable system

in Hamilton, Ontario. As part of the agreement, Shaw acquired our

one-third equity interest in TVtropolis.

Spectrum Licence Option Deposit

In 2013, we paid total deposits of $250 million for the option to

purchase Shaw’s AWS spectrum holdings pending regulatory approval,

and included the deposits in other long-term assets in the consolidated

statements of financial position. Under the agreement, $200 million of

this balance is refundable if the transaction does not close. We do not

expect to exercise the spectrum licence option until late 2014, and it is

subject to approval by Industry Canada.

Acquisition of Mountain Cable

On May 1, 2013, we closed the agreement with Shaw to purchase

100% of the common shares of Mountain Cable for cash consideration

of $398 million. Mountain Cable delivers a full bundle of advanced

cable television, Internet and telephony services over its recently

upgraded hybrid fibre and coaxial cable network. The acquisition

expands our cable business in the Southern Ontario area and will allow

us to drive synergies through a larger service area and cost efficiencies.

Sale of TVtropolis

In 2013, we closed the transaction to sell our one-third interest in

TVtropolis after obtaining regulatory approval from the CRTC. We

received proceeds of $59 million and recorded a gain of $47 million in

other income.

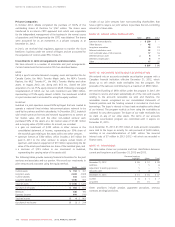

Blackiron Data (Blackiron)

On April 17, 2013, we closed an agreement to acquire 100% of the

common shares of Blackiron for cash consideration of $198 million.

Blackiron provides Business Solutions the ability to enhance its suite of

enterprise-level data centre and cloud computing services along with

fibre-based network connectivity services.

Score Media Inc. (theScore)

On April 30, 2013, we received final regulatory approval to acquire

theScore. We had already paid $167 million on October 19, 2012 to

obtain 100% of the common shares of theScore. These shares were

held in trust until we received regulatory approval and obtained control

of the business. The acquisition builds on our sports broadcasting

capabilities and reinforces our delivery of premium sports content to its

audiences on their platform of choice.

Pivot Data Centres (Pivot)

On October 1, 2013, we purchased 100% of the common shares of

Pivot for cash consideration of $158 million. Pivot further positions

Business Solutions as a leader in Canadian data centre and hosting

services and will enhance Business Solutions’ ability to serve key markets

with enhanced managed and cloud service offering.

Other

In 2013, we completed other individually immaterial acquisitions for

total cash consideration of $40 million.

We also paid deposits totalling $45 million in late 2013 related to the

acquisition of certain dealer stores, which closed on January 2, 2014.

This deposit is included in other long-term assets (note 15). The fair

values of the assets acquired and liabilities assumed in this acquisition is

under review and expected to be finalized in the first quarter of 2014.

104 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT