Rogers 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Contingencies

Considerable judgement is involved in the determination of contingent

liabilities. Our judgement is based on information currently known to

us, and the probability of the ultimate resolution of the contingencies. If

it becomes probable that a contingent liability will result in an outflow

of economic resources, we will record a provision in the period the

change in probability occurs, and it could be material to our

consolidated financial position and results of operations.

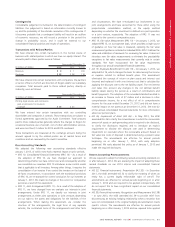

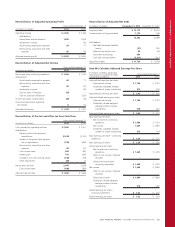

Transactions with Related Parties

We have entered into certain transactions in the normal course of

business with related parties in which we have an equity interest. The

amounts paid to these parties were as follows:

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

Revenues $3 $ 1 200

Purchases $83 $ 38 118

We have entered into certain transactions with companies, the partners

or senior officers of which are Directors of Rogers and/or our subsidiary

companies. Total amounts paid to these related parties, directly or

indirectly, were as follows:

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

Printing, legal services and commission

paid on premiums for insurance

coverage $43 $43 –

We have entered into certain transactions with our controlling

shareholder and companies it controls. These transactions are subject to

formal agreements approved by the Audit Committee. Total amounts

paid to these related parties generally reflects the charges to Rogers for

occasional business use of aircraft, net of other administrative services,

and were less than $1 million for 2013 and 2012 combined.

These transactions are measured at the exchange amount, being the

amount agreed to by the related parties are at market terms and

conditions and are reviewed by the Audit Committee.

New Accounting Standards

We adopted the following new accounting standards effective

January 1, 2013, of which none had a material impact on prior periods.

•IFRS 10, Consolidated Financial Statements (IFRS 10) – As a result of

the adoption of IFRS 10, we have changed our approach to

determining whether we have control over and consequently whether

we consolidate our investees. IFRS 10 introduces a new control model

that is applicable to all investees. Among other things, it requires the

consolidation of an investee if we control the investee on the basis of

de facto circumstances. In accordance with the transitional provisions

of IFRS 10, we re-assessed the control conclusion for our investees at

January 1, 2013. We made no changes in the current or comparative

period as a result of this assessment.

•IFRS 11, Joint Arrangements (IFRS 11) – As a result of the adoption of

IFRS 11, we have changed how we evaluate our interests in joint

arrangements. Under IFRS 11, we classify our interests in joint

arrangements as either joint operations or joint ventures depending

on our right to the assets and obligations for the liabilities of the

arrangements. When making this assessment, we consider the

structure of the arrangements, the legal form of any separate

vehicles, the contractual terms of the arrangements and other facts

and circumstances. We have re-evaluated our involvement in our

joint arrangements and have accounted for these either using the

proportionate consolidation method, or the equity method

depending on whether the investment is defined as a joint operation

or a joint venture, respectively. The adoption of IFRS 11 was not

material to the current or comparative years.

•IFRS 13, Fair Value Measurement (IFRS 13) – On January 1, 2013, we

adopted IFRS 13, on a prospective basis, which provides a single source

of guidance on how fair value is measured, replacing the fair value

measurement guidance contained in individual IFRSs. IFRS 13 defines fair

value and establishes a framework for measuring fair value. It does not

introduce new fair value measurements or eliminate the practicability

exceptions to fair value measurements that currently exist in certain

standards. We have incorporated the fair value requirements

throughout our annual consolidated financial statements.

•IAS 19, Employee Benefits (2011) (IAS 19) – On January 1, 2013, we

adopted IAS 19, which changes the basis for determining the income

or expense related to defined benefit plans. This amendment

eliminated the concept of return on plan assets and interest cost

(income) and replaced it with a net interest cost that is calculated by

applying the discount rate to the net liability (asset). The net interest

cost takes into account any changes in the net defined benefit

liability (asset) during the period as a result of contributions and

benefit payments. The adoption of the amended standard resulted in

an increase in finance costs of $7 million and a decrease in other

comprehensive income, for a net effect of nil in comprehensive

income for the year ended December 31, 2012 and did not have a

material impact on net assets as at December 31, 2012. See note 22

of the annual consolidated financial statements for more information

about our pension plans.

•IAS 36, Impairment of Asset (IAS 36) – In May 2013, the IASB

amended IAS 36 to clarify the circumstances in which the recoverable

amount of assets or cash-generating units is required to be disclosed,

to clarify the disclosures required, and to introduce an explicit

requirement to disclose the discount rate used in determining

impairment (or reversals) where the recoverable amount (based on

fair value less costs of disposal) is determined using a present value

technique. The amendments are effective for annual periods

beginning on or after January 1, 2014, with early adoption

permitted. We early adopted this policy as of January 1, 2013 and

made the required disclosures.

Recent Accounting Pronouncements

We are required to adopt the following revised accounting standards on

or after January 1, 2014. We are assessing the impact of adopting these

revised standards on our 2014 interim and consolidated financial

statements.

•IAS 32, Financial Instruments: Presentation (IAS 32) – In December

2011, the IASB amended IAS 32 to clarify the meaning of when an

entity has a current legally enforceable right of set-off. The

amendments are effective for annual periods beginning on or after

January 1, 2014 and are required to be applied retrospectively. We

do not expect this to have a significant impact on our consolidated

financial statements.

•IAS 39, Financial Instruments: Recognition and Measurement (IAS 39)

– In June 2013, the IASB amended IAS 39 to provide relief from

discontinuing an existing hedging relationship when a novation that

was not contemplated in the original hedging documentation meets

specific criteria. The amendments are effective for annual periods

beginning on or after January 1, 2014 and are required to be applied

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 81