Rogers 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

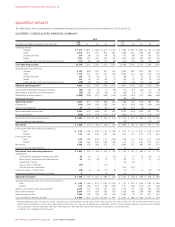

QUARTERLY RESULTS

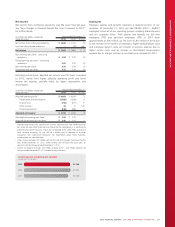

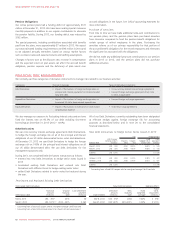

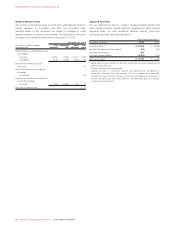

The table below shows our quarterly consolidated financial results and key performance indicators for 2013 and 2012.

QUARTERLY CONSOLIDATED FINANCIAL SUMMARY

2013 2012

(In millions of dollars, except per share amounts)

Full

Year Q4 Q3 Q2 Q1

Full

Year Q4 Q3 Q2 Q1

Operating revenue

Wireless $ 7,270 $ 1,851 $ 1,846 $ 1,813 $ 1,760 $ 7,280 $ 1,920 $ 1,889 $ 1,765 $ 1,706

Cable 3,475 871 873 870 861 3,358 852 838 843 825

Business Solutions 374 98 93 90 93 351 88 86 90 87

Media 1,704 453 440 470 341 1,620 434 392 440 354

Corporate items and intercompany eliminations (117) (30) (28) (31) (28) (123) (33) (29) (32) (29)

Total operating revenue 12,706 3,243 3,224 3,212 3,027 12,486 3,261 3,176 3,106 2,943

Adjusted operating profit (loss)

Wireless 3,157 696 875 821 765 3,063 687 843 796 737

Cable 1,718 433 425 431 429 1,605 421 403 403 378

Business Solutions 106 29 29 25 23 89 27 22 22 18

Media 161 49 55 64 (7) 190 75 50 79 (14)

Corporate items and intercompany eliminations (149) (40) (43) (35) (31) (113) (34) (30) (24) (25)

Adjusted operating profit 14,993 1,167 1,341 1,306 1,179 4,834 1,176 1,288 1,276 1,094

Stock-based compensation (expense) recovery (84) (18) (7) (1) (58) (77) (57) (26) 12 (6)

Restructuring, acquisition and other expenses (85) (24) (38) (14) (9) (92) (10) (7) (33) (42)

Depreciation and amortization (1,898) (508) (477) (463) (450) (1,819) (453) (437) (466) (463)

Impairment of assets ––––– (80) (80) – – –

Operating income 22,926 617 819 828 662 2,766 576 818 789 583

Finance costs (742) (196) (180) (185) (181) (671) (183) (169) (159) (160)

Other income (expense) 81 14 (3) 60 10 250 241 (6) 7 8

Net income before income taxes 2,265 435 636 703 491 2,345 634 643 637 431

Income tax expense (596) (115) (172) (171) (138) (620) (112) (177) (224) (107)

Net income from continuing operations $ 1,669 $ 320 $ 464 $ 532 $ 353 $ 1,725 $ 522 $ 466 $ 413 $ 324

Loss from discontinued operations ––––– (32) – – (13) (19)

Net income $ 1,669 $ 320 $ 464 $ 532 $ 353 $ 1,693 $ 522 $ 466 $ 400 $ 305

Earnings per share from continuing operations:

Basic $ 3.24 $ 0.62 $ 0.90 $ 1.03 $ 0.69 $ 3.32 $ 1.01 $ 0.90 $ 0.79 $ 0.62

Diluted 3.22 0.62 0.90 0.93 0.68 3.30 1.01 0.90 0.77 0.61

Earnings per share:

Basic 3.24 0.62 0.90 1.03 0.69 3.26 1.01 0.90 0.77 0.58

Diluted 3.22 0.62 0.90 0.93 0.68 3.24 1.01 0.90 0.75 0.57

Net income 1,669 320 464 532 353 1,693 522 466 400 305

Loss from discontinued operations ––––– 32––1319

Net income from continuing operations $ 1,669 $ 320 $ 464 $ 532 $ 353 $ 1,725 $ 522 $ 466 $ 413 $ 324

Add (deduct):

Stock-based compensation expense (recovery) 84 18 7 1 58 77 57 26 (12) 6

Restructuring, acquisition and other expenses 85 24 38 14 9 92 10 7 33 42

Impairment of assets ––––– 8080–––

Gain on sale of TVtropolis (47) – – (47) – –––––

Gain on spectrum distribution –––––(233) (233) – – –

Income tax impact of above items (30) (5) (8) (11) (6) (14) 12 (4) (10) (12)

Income tax adjustment, legislative tax change 8– – 8 – 54 – – 54 –

Adjusted net income 1$ 1,769 $ 357 $ 501 $ 497 $ 414 $ 1,781 $ 448 $ 495 $ 478 $ 360

Adjusted earnings per share from continuing operations 1:

Basic $ 3.43 $ 0.69 $ 0.97 $ 0.97 $ 0.80 $ 3.43 $ 0.87 $ 0.96 $ 0.92 $ 0.69

Diluted 3.42 0.69 0.97 0.96 0.80 3.41 0.86 0.96 0.91 0.68

Additions to property, plant and equipment 2,240 703 548 525 464 2,142 707 528 458 449

Pre-tax free cash flow 12,044 279 620 602 543 2,029 296 589 656 488

After-tax free cash flow 11,548 109 506 505 428 1,649 39 561 633 416

Cash provided by operating activities $ 3,990 $ 1,072 $ 1,052 $ 1,061 $ 805 $ 3,421 $ 668 $ 1,146 $ 1,079 $ 528

1Adjusted operating profit, adjusted net income, adjusted basic and diluted earnings per share, pre-tax free cash flow and after-tax free cash flow are Non-GAAP measures and

should not be considered as a substitute or alternative for GAAP measures. They are not defined terms under IFRS, and do not have standard meanings, so may not be a reliable

way to compare us to other companies. See “Non-GAAP Measures” for information about these measures, including how we calculate them.

2As defined. See “Additional GAAP Measures”.

54 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT