Rogers 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

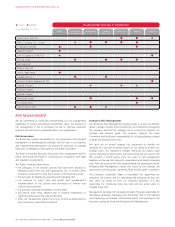

MANAGEMENT’S DISCUSSION AND ANALYSIS

advantage to a competitor. Annual investments in new capabilities,

education and continuous improvement help to maintain and improve

RCI’s security posture. These are focused on protection and prevention,

robust detection and advance preparation and planning to help prevent

a potential breach from turning into a crisis. Risk management

resources continue to be focused in this area.

We use standard industry practices for network and information

technology security, survivability and disaster recovery. Our ongoing

success partly depends on protecting our corporate business-sensitive

data, including personal information about our customers and

employees. We treat this information as intellectual property and

protect it from unauthorized access and compromise. We rely on our

policies and procedures and information technology systems to protect

this information. If we do not secure our data and the privacy of our

customer information, we may not be in compliance with regulatory

standards and it could result in negative publicity, litigation and damage

to our reputation. Any of these outcomes can cause us to lose

customers or public confidence, or experience financial losses.

Impact of Network Failures on Revenue and Customer Service

If our networks or key network components fail, it could, in some

circumstances, result in a loss of service for our customers for an

indefinite period and have an adverse effect on our results and financial

position. We rely on business partners to carry some traffic for some of

our customers. If one of these carriers has a service failure, it might also

cause a service interruption for our customers that would last until we

could reroute the traffic to another carrier.

Unauthorized Access to Digital Boxes or Internet Modems

We use encryption technology developed and supported by our vendors

to protect our cable signals from unauthorized access and to control

access to programming based on subscription packages. We also use

encryption and security technologies to prevent unauthorized access to

our Internet service.

There is no assurance that we will be able to effectively prevent

unauthorized decoding of television signals or Internet access in the

future. If we are unable to control cable access with our encryption

technology, subscriptions to digital programming, including premium

VOD and SVOD, and Internet service revenues may decrease, which

could result in a decline in our cable revenues.

REGULATORY RISKS

Changes in Government Regulations

Substantially all of our business activities are regulated by Industry

Canada and/or the CRTC, and any regulatory changes or decisions

could adversely affect our consolidated results of operations. See

“Regulation in Our Industry”.

Regulatory changes or decisions made by these regulators could

adversely impact our results of operations on a consolidated basis. This

regulation relates to, among other things, licencing, competition, the

cable television programming services that we must distribute, wireless

and wireline interconnection agreements, the rates we may charge to

provide access to our network by third parties, the resale of our

networks and roaming on our networks, our operation and ownership

of communications systems and our ability to acquire an interest in

other communications systems. In addition, the costs of providing

services may be increased from time-to-time as a result of compliance

with industry or legislative initiatives to address consumer protection

concerns or such Internet-related issues as copyright infringement,

unsolicited commercial e-mail, cybercrime and lawful access. Our cable,

wireless and broadcasting licences may not generally be transferred

without regulatory approval.

Generally, our licences are granted for a specified term and are subject

to conditions on the maintenance of these licences. These licencing

conditions may be modified at any time by the regulators. The

regulators may decide not to renew a licence when it expires, and any

failure by us to comply with the conditions on the maintenance of a

licence could result in a revocation or forfeiture of any of our licences or

the imposition of fines.

The licences include conditions requiring us to comply with Canadian

ownership restrictions of the applicable legislation. We are currently in

compliance with all of these Canadian ownership and control

requirements. However, if these requirements are violated, we would

be subject to various penalties, possibly including, in the extreme case,

the loss of a licence.

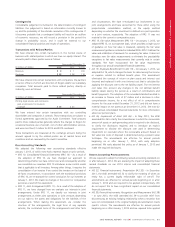

The Wireless Code

The CRTC’s decision to implement its wireless consumer code of

conduct, among other things, effectively requires Canadian wireless

carriers to move away from offering three-year service contracts and

instead offer two-year contracts, and this could change our customer

acquisition and retention costs and subscriber churn. The Wireless Code

also sets billing caps on data roaming and domestic data overage

charges, creates a prohibition on requiring customers to provide 30-

days’ notice of cancellation, and requires the payment of interest on

security deposits, which could also reduce our results of operations.

Our wireless business could be materially adversely affected if laws,

regulation or customer behaviour makes it difficult for us to impose

term commitments or early cancellation fees on customers or receive

the service revenues we anticipate from the term commitments.

Spectrum

Radio spectrum is one of the fundamental assets required to carry on

the wireless business. Our ability to continue to offer and improve

current services and to offer new services depends on, among other

factors, continued access to and deployment of adequate spectrum,

including both the ability to renew current spectrum licenses and

acquire new spectrum licenses.

If we cannot acquire and retain needed spectrum, we may not be able

to continue to offer and improve our current services and deploy new

services on a timely basis including providing competitive data speeds

that customers want. As a result, our ability to attract and retain

customers could be materially adversely affected. In addition, an

inability to acquire and retain needed spectrum could affect network

quality and result in higher capital expenditures, as a consequence of

network densification and other related network upgrades.

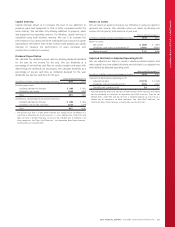

Spectrum Fees

Changes to government spectrum fees could significantly increase our

payments and therefore materially reduce our operating profit.

Spectrum licences are an indefinite life intangible asset and we do not

amortize them, however, any potential increases in spectrum licence

fees may affect our current accounting policies.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 75