Rogers 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

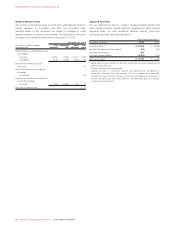

MANAGEMENT’S DISCUSSION AND ANALYSIS

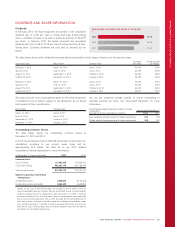

DIVIDENDS AND SHARE INFORMATION

Dividends

In February 2014, the Board approved an increase in the annualized

dividend rate to $1.83 per Class A Voting and Class B Non-Voting

share, a dividend increase to be paid in quarterly amounts of $0.4575

per share. In February 2013 the Board increased the annualized

dividend rate from $1.58 to $1.74 per Class A Voting and Class B Non-

Voting share. Quarterly dividends are only paid as declared by our

Board.

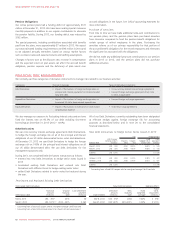

ANNUALIZED DIVIDENDS PER SHARE AT YEAR END

2013

2012

2011

$1.74

$1.58

$1.42

($)

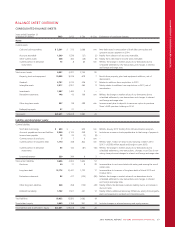

The table below shows when dividends have been declared and paid on both classes of shares over the past two years:

Declaration date Record date Payment date

Dividend

per share

Dividends paid

(in millions)

February 21, 2012 March 19, 2012 April 2, 2012 $0.395 $207

April 25, 2012 June 15, 2012 July 3, 2012 $0.395 $205

August 15, 2012 September 14, 2012 October 3, 2012 $0.395 $204

October 24, 2012 December 14, 2012 January 2, 2013 $0.395 $204

February 14, 2013 March 15, 2013 April 2, 2013 $0.435 $224

April 23, 2013 June 14, 2013 July 3, 2013 $0.435 $224

August 15, 2013 September 13, 2013 October 2, 2013 $0.435 $224

October 23, 2013 December 13, 2013 January 2, 2014 $0.435 $224

We expect that the record and payment dates for the 2014 declaration

of dividends to be as follows, subject to the declaration by our Board

each quarter at their sole discretion:

Record date Payment date

March 14, 2014 April 4, 2014

June 13, 2014 July 4, 2014

September 12, 2014 October 3, 2014

December 11, 2014 January 2, 2015

Outstanding Common Shares

The table below shows our outstanding common shares at

December 31, 2013 and 2012.

In 2013, we purchased a total of 546,674 Class B Non-Voting shares for

cancellation according to our normal course issuer bid for

approximately $22 million. See Note 23 to our 2013 audited

consolidated financial statements for more information.

At December 31 shares outstanding 2013 2012

Common shares 1

Class A Voting 112,462,000 112,462,014

Class B Non-Voting 402,281,178 402,788,156

Total common shares 514,743,178 515,250,170

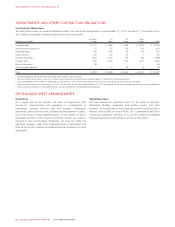

Options to purchase Class B Non-

Voting shares

Outstanding options 6,368,403 8,734,028

Outstanding options exercisable 4,066,698 4,638,496

1Holders of our Class B Non-Voting shares are entitled to receive notice of and to

attend shareholder meetings; however, they are not entitled to vote at these meetings

except as required by law or stipulated by stock exchanges. If an offer is made to

purchase outstanding Class A Voting shares, there is no requirement under applicable

law or our constating documents that an offer be made for the outstanding Class B

Non-Voting shares, and there is no other protection available to shareholders under

our constating documents. If an offer is made to purchase both classes of shares, the

offer for the Class A Voting shares may be made on different terms than the offer to

the holders of Class B Non-Voting shares.

We use the weighted average number of shares outstanding to

calculate earnings per share. See “Non-GAAP Measures” for more

information.

End of period weighted average number of shares

outstanding

(Number of shares outstanding in millions)

Years ended December 31

2013 2012

Basic weighted average number of shares outstanding 515 519

Diluted weighted average number of shares outstanding 518 522

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 65