Rogers 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

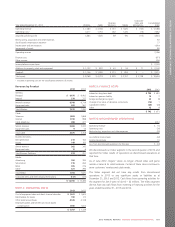

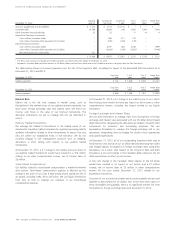

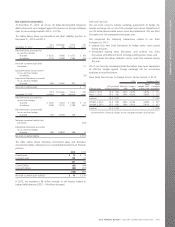

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Property, plant and equipment not yet in service and therefore not

depreciated at December 31, 2013 was $882 million (December 31,

2012 – $917 million). Capitalized interest on property, plant and

equipment was recorded at a weighted average rate of approximately

5.1% (2012 – 5.8%).

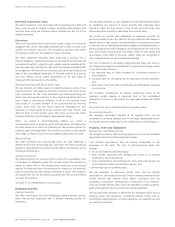

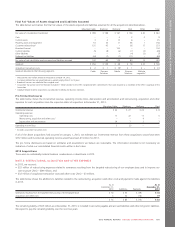

Depreciation Rates Review

We reviewed depreciation rates for all of our property, plant and

equipment in 2013 and made no changes. In 2012, we changed the

estimates of useful lives of certain network, customer premise

equipment, computer equipment and software assets. We accounted

for the impact of these changes prospectively, resulting in depreciation

expense to be lower by approximately $90 million in 2012 compared to

the amount we would have recorded using the previous useful lives.

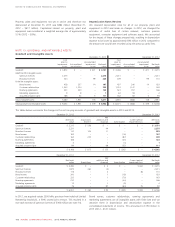

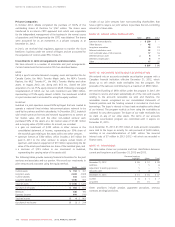

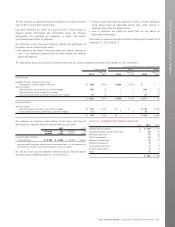

NOTE 13: GOODWILL AND INTANGIBLE ASSETS

Goodwill and Intangible Assets

December 31, 2013 December 31, 2012

Cost

prior to

impairment

losses

Accumulated

amortization

Accumulated

impairment

losses

Net book

value

Cost

prior to

impairment

losses

Accumulated

amortization

Accumulated

impairment

losses

Net book

value

Goodwill $ 3,972 $ – $ 221 $ 3,751 $ 3,436 $ – $ 221 $ 3,215

Indefinite life intangible assets:

Spectrum licences 2,275 – – 2,275 2,231 – – 2,231

Broadcast licences 324 – 99 225 209 – 99 110

Finite life intangible assets:

Brand names 438 257 14 167 437 240 14 183

Customer relationships 1,543 1,234 – 309 1,310 1,147 – 163

Roaming agreements 523 400 – 123 523 357 – 166

Marketing agreements 9 8 – 163 59 – 4

Acquired program rights 168 52 5 111 162 63 5 94

Total intangible assets 5,280 1,951 118 3,211 4,935 1,866 118 2,951

Total goodwill and intangible assets $ 9,252 $ 1,951 $ 339 $ 6,962 $ 8,371 $ 1,866 $ 339 $ 6,166

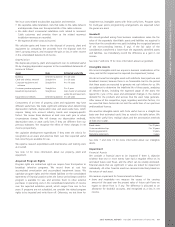

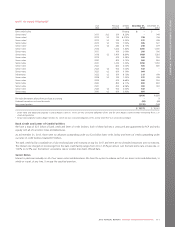

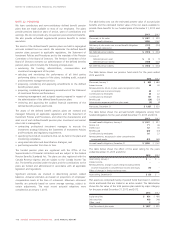

The tables below summarize the changes in the net carrying amounts of goodwill and intangible assets in 2013 and 2012.

December 31, 2012 December 31, 2013

Net book

value

Acquisitions

(Note 7)

Net

additions and

disposals Amortization

Current period

impairment loss

Net book

value

Goodwill $ 3,215 $ 536 $ – $ – $ – $ 3,751

Spectrum licences 2,231 – 44 – – 2,275

Broadcast licences 110 104 11 – – 225

Brand names 183 – – (16) – 167

Customer relationships 163 233 – (87) – 309

Roaming agreements 166 – – (43) – 123

Marketing agreements 4 – 1 (4) – 1

Acquired program rights 94 – 69 (52) – 111

$ 6,166 $ 873 $ 125 $ (202) $ – $ 6,962

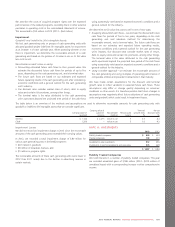

December 31, 2011 December 31, 2012

Net book

value Acquisitions

Net

additions and

disposals Amortization

Current period

impairment loss

Net book

value

Goodwill $ 3,280 $ – $ 2 $ – $ (67) $ 3,215

Spectrum licences 1,875 360 (4) – – 2,231

Broadcast licences 116 – 2 – (8) 110

Brand names 200 – 1 (18) – 183

Customer relationships 232 – 1 (70) – 163

Roaming agreements 210 – – (44) – 166

Marketing agreements 12 – 1 (9) – 4

Acquired program rights 76 – 87 (64) (5) 94

$ 6,001 $ 360 $ 90 $ (205) $ (80) $ 6,166

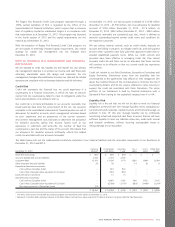

In 2012, we acquired certain 2500 MHz spectrum from Inukshuk Limited

Partnership (Inukshuk), a 50% owned joint venture. This resulted in a

non-cash increase of spectrum licences of $360 million (see note 14).

Brand names, customer relationships, roaming agreements and

marketing agreements are all intangible assets with finite lives and we

amortize them in depreciation and amortization expense in the

consolidated statements of income. This amounted to $150 million in

2013 (2012 – $141 million).

108 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT