Rogers 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

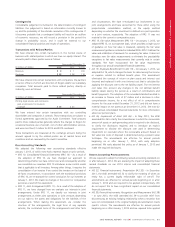

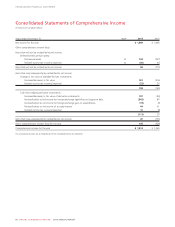

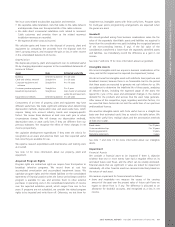

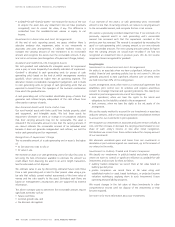

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statements of Comprehensive Income

(In millions of Canadian dollars)

Years ended December 31 Note 2013 2012

Net income for the year $ 1,669 $ 1,693

Other comprehensive income (loss):

Items that will not be reclassified to net income:

Defined benefit pension plans:

Remeasurements 22 134 (237)

Related income tax recovery (expense) 22 (36) 64

Items that will not be reclassified to net income 98 (173)

Items that may subsequently be reclassified to net income:

Change in fair value of available-for-sale investments:

Increase/(decrease) in fair value 181 (216)

Related income tax recovery (expense) (23) 26

158 (190)

Cash flow hedging derivative instruments:

Increase/(decrease) in fair value of derivative instruments 197 (94)

Reclassification to net income for foreign exchange (gain)/loss on long-term debt (343) 85

Reclassification to net income for foreign exchange gain on expenditures (19) (9)

Reclassification to net income of accrued interest 44 61

Related income tax recovery (expense) 10 (8)

(111) 35

Items that may subsequently be reclassified to net income 47 (155)

Other comprehensive income (loss) for the year 145 (328)

Comprehensive income for the year $ 1,814 $ 1,365

The accompanying notes are an integral part of the consolidated financial statements.

90 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT