Rogers 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FINANCIAL AND OPERATING GUIDANCE

We provide consolidated annual guidance ranges for selected financial metrics on a consolidated basis consistent with

the annual plans approved by our Board of Directors.

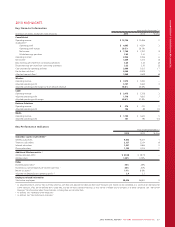

2013 ACHIEVEMENTS AGAINST GUIDANCE

The following table outlines guidance ranges, actual results and

achievements for the selected full year 2013 financial metrics.

(In millions of dollars)

2013

Guidance 2013

Actual Achievement

Consolidated Guidance

Adjusted operating profit 1$4,865 to $5,050 $4,993 ✓

Additions to property,

plant and equipment 22,150 to 2,250 2,240 ✓

Pre-tax free cash flow 12,030 to 2,090 2,044 ✓

Cash income taxes 3650 to 700 496 +

Achieved ✓Exceeded +

1Adjusted operating profit and pre-tax free cash flow are Non-GAAP measures and

should not be considered as a substitute or alternative for GAAP measures. They are

not defined terms under IFRS, and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2Includes additions to property, plant and equipment expenditures for Wireless, Cable,

Media, Business Solutions, and Corporate segments.

3In the third quarter of 2013, we reduced our guidance for cash income taxes to be

approximately $500 million to reflect the results of a number of tax planning

initiatives.

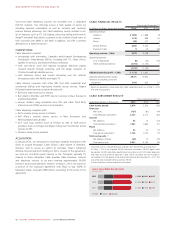

2014 FULL YEAR CONSOLIDATED GUIDANCE

The following table outlines guidance ranges and assumptions for

selected full year 2014 financial metrics, on a consolidated basis that we

set forth on February 12, 2014, which takes into consideration our

current outlook and our actual results for 2013 and are based on a

number of assumptions. Information about our guidance including the

assumptions underlying our guidance is forward-looking and should be

read in conjunction with “About Forward-Looking Information” and

“Risks and Uncertainties Affecting Our Business” and the related

disclosure and information about various economic, competitive and

regulatory assumptions, factors and risks that may cause our actual

future financial and operating results to differ from what we currently

expect.

Full Year 2014 Guidance

(In millions of dollars)

2013

Actual 2014

Guidance

Consolidated Guidance

Adjusted operating profit 1$4,993 $5,000 to $5,150

Additions to property, plant and equipment 22,240 2,275 to 2,375

After-tax free cash flow 11,548 1,425 to 1,500

1Adjusted operating profit and after-tax free cash flow are Non-GAAP measures and

should not be considered as a substitute or alternative for GAAP measures. They are

not defined terms under IFRS, and do not have standard meanings, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2Includes additions to property, plant and equipment expenditures for Wireless, Cable,

Media, Business Solutions, and Corporate segments and excludes purchases of

spectrum licences, such as, but not limited to, the cost for 700MHz spectrum from a

planned national auction in the first half of 2014.

Our 2014 full year consolidated guidance are based on a number of key

assumptions, certain of which we disclosed in our fourth quarter

earnings release issued on February 12, 2014.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 33