Rogers 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The fair values of our Equity Derivatives are based on the quoted market

value of RCI’s Class B Non-Voting shares.

Fair value estimates are made at a specific point in time based on

relevant market information and information about the financial

instruments. The estimates are subjective in nature and involve

uncertainties and matters of judgment.

Our disclosure of the three-level hierarchy reflects the significance of

the inputs used in measuring fair value:

• We determine fair value of financial assets and financial liabilities in

Level 1 by referring to quoted prices in active markets for identical

assets and liabilities.

• Financial assets and financial liabilities in Level 2 include valuations

using inputs based on observable market data, either directly or

indirectly, other than the quoted prices.

• Level 3 valuations are based on inputs that are not based on

observable market data.

There were no material financial instruments categorized in Level 3 as at

December 31, 2013 and 2012.

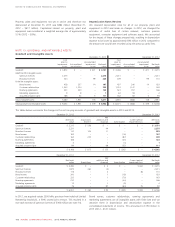

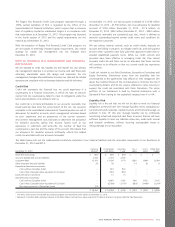

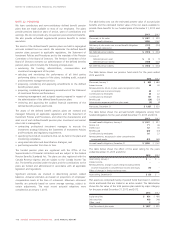

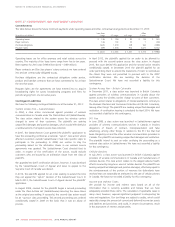

The table below shows the financial instruments carried at fair value by valuation method as at December 31, 2013 and 2012.

Fair value measurements at reporting date

Carrying value Level 1 Level 2

2013

Dec. 31,

2012 2013

Dec. 31,

2012 2013

Dec. 31,

2012

Financial assets

Available-for-sale, measured at fair value:

Investments in publicly traded companies $ 809 $ 624 $ 809 $ 624 $– $–

Held-for-trading:

Debt Derivatives accounted for as cash flow hedges 184 34 ––184 34

Debt Derivatives not accounted for as hedges –3–––3

Expenditure Derivatives accounted for as cash flow hedges 37 13 ––37 13

$ 1,030 $ 674 $ 809 $ 624 $ 221 $50

Financial liabilities

Held-for-trading:

Debt Derivatives accounted for as cash flow hedges $ 133 $ 561 $– $– $ 133 $ 561

Equity Derivatives not accounted for as cash flow hedges 13 –––13 –

$ 146 $ 561 $– $– $ 146 $ 561

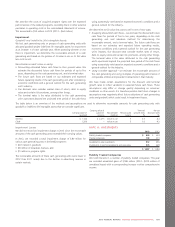

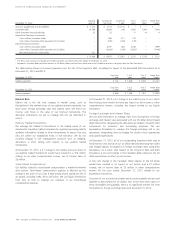

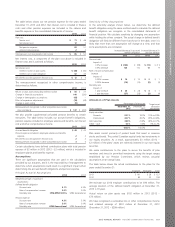

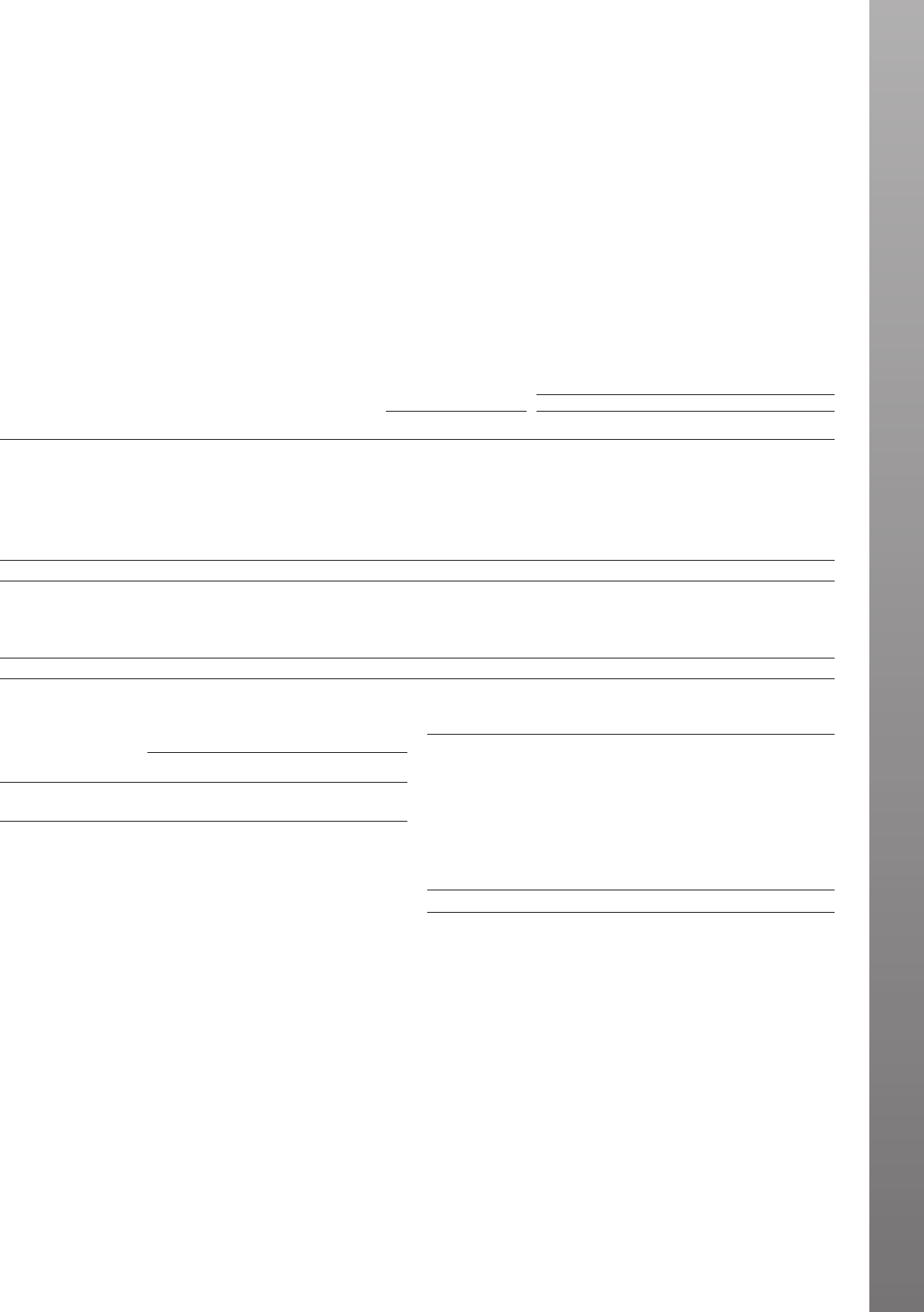

We measure our long-term debt initially at fair value, and then at

amortized cost using the effective interest method, as follows.

2013 2012

Carrying

amount

Fair

value 1

Carrying

amount

Fair

value 1

Long-term debt (including

current portion) $ 13,343 $ 14,463 $ 10,789 $ 12,603

1Long-term debt (including current portion) is measured at level 2 in the three-level fair

value hierarchy, based on year-end trading values as discussed above.

We did not have any non-derivative held-to-maturity financial assets

during the years ended December 31, 2013 and 2012.

NOTE 21: OTHER LONG-TERM LIABILITIES

Note 2013 2012

Deferred pension liability 22 $ 189 $ 343

Supplemental executive retirement plan 22 49 45

Restricted share units 31 28

CRTC commitments 18 9

Deferred compensation 12 13

Deferred inducements 9–

Stock appreciation rights 59

Program rights liability 25

Other 13 6

$ 328 $ 458

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 117