Rogers 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Key Achievements

Higher Operating Revenue and Adjusted Operating Profit

• Consolidated operating revenue was 2%higher this year compared

to 2012, led by an increase in data revenue at Wireless, higher

Internet revenue at Cable, higher Next Generation revenue at

Business Solutions and higher subscriber revenue at Media. Revenue

grew by 3%in Cable, 7%in Business Solutions and 5%in Media,

while revenue at Wireless remained unchanged as the increase in

data revenue was offset by the decrease in voice revenue.

• Consolidated adjusted operating profit rose 3%this year to $4,993

million, with consolidated adjusted operating profit margins of 39.3%,

resulting from higher revenue, the realization of cost efficiencies and

shifts in the mix of revenue from products and services sold.

• Postpaid Wireless subscriber growth continued with net additions of

228,000 and lower churn of 1.24%.

• Cable high-speed Internet subscribers grew by 97,000 and cable

telephony lines grew by 79,000, while television households

decreased by 87,000 compared to 2012.

Strong Cash Flow

• Pre-tax free cash flow, defined as adjusted operating profit less

spending on property, plant and equipment, and interest on long-

term debt (net of capitalized interest), increased by 1%compared to

2012 to $2,044 million due to a 3%increase in adjusted operating

profit offset by higher spending on property, plant and equipment.

After-tax cash flow decreased by 6%from 2012 levels to $1,548 due

to a 31%increase in cash taxes.

Strong Balance Sheet and Liquidity Position

• Issued and fully hedged US$2.5 billion of ten and thirty year senior

notes at some of the lowest coupon rates ever achieved for Rogers

corporate debt, in two separate offerings comprising:

– US$500 million of 3.00%senior notes due 2023 and US$500

million of 4.50%senior notes due 2043

– US$850 million of 4.10%senior notes due 2023 and US$650

million of 5.45%senior notes due 2043

• Our overall weighted average cost of debt was 5.50%at

December 31, 2013 compared to 6.10%at December 31, 2012 and

the weighted average term to maturity on our debt was 11.3 years,

compared to 9.2 years at December 31, 2012.

• Ended the year with $4.5 billion of available liquidity, comprised of

$2.3 billion cash on hand, $2 billion available under our bank credit

facility and $0.2 billion available under our $0.9 billion accounts

receivable securitization program.

• In May 2013, each of Fitch Ratings and Standard and Poor’s Ratings

Services upgraded RCI’s senior unsecured debt to BBB+ (from BBB) with

a stable outlook, while Moody’s Investors Service’s comparable rating is

Baa1 with a stable outlook remained unchanged from last year.

Growing Dividends

• We increased our annualized dividend rate in February 2013 by 10%

to $1.74 per Class A Voting and Class B Non-Voting share and paid a

quarterly dividend of $0.435 per share during 2013. We further

increased our annualized dividend on February 12, 2014, by 5%

to $1.83.

New CEO

• Guy Laurence joined Rogers in December 2013, as our new President

and Chief Executive Officer, succeeding Nadir Mohamed who retired

from Rogers. Mr. Laurence brings 30 years of global experience in

the telecommunications and media industries.

Significant Developments

• Exclusive 12-year licensing agreement to broadcast national NHL

games, beginning with the 2014-2015 season was signed. The

agreement grants Rogers the exclusive distribution rights of all

national regular season and playoff games within Canada, in multiple

languages, across all platforms. At the same time, we executed

separate agreements to sublicence certain of these broadcasting

rights to TVA Sports and CBC.

• Strategic acquisitions of Score Media Inc. (theScore), Mountain

Cablevision Ltd. (Mountain Cable), Blackiron Data ULC (Blackiron)

and Pivot Data Centres were completed.

• Rogers First Rewards, a new loyalty program allowing customers to

earn points on their eligible purchases and redeem them online for a

wide selection of Rogers products and services, was launched in the

Greater Toronto Area, Ottawa, Kingston, Sudbury and other cities

throughout Ontario. We also received regulatory approval to launch

a Rogers credit card which augments this loyalty program and will

accelerate the rate at which customers earn points.

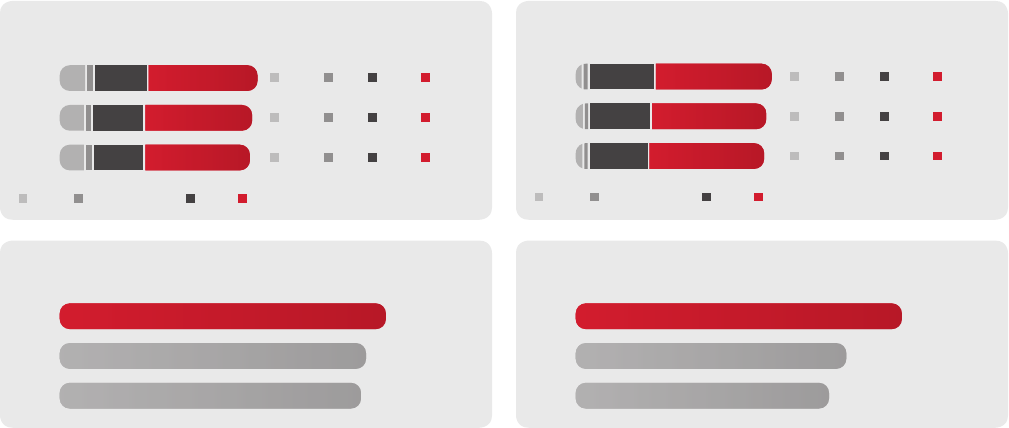

(IN MILLIONS OF DOLLARS)

REVENUE BY SEGMENT

2013

2012

2011

$1,704

$1,620

$1,611

$374

$351

$405

$3,475

$3,358

$3,309

$7,270

$7,280

$7,138

WirelessCableBusiness SolutionsMedia

(IN MILLIONS OF DOLLARS)

ADDITIONS TO CONSOLIDATED PROPERTY, PLANT AND EQUIPMENT

2013

2012

2011

$2,240

$2,142

$2,127

(IN MILLIONS OF DOLLARS)

ADJUSTED OPERATING PROFIT BY SEGMENT

2013

2012

2011

$161

$190

$180

$106

$89

$86

$1,718

$1,605

$1,549

$3,157

$3,063

$3,036

WirelessCableBusiness SolutionsMedia

(IN MILLIONS OF DOLLARS)

CONSOLIDATED TOTAL ASSETS

2013

2012

2011

$23,601

$19,618

$18,362

28 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT