Rogers 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

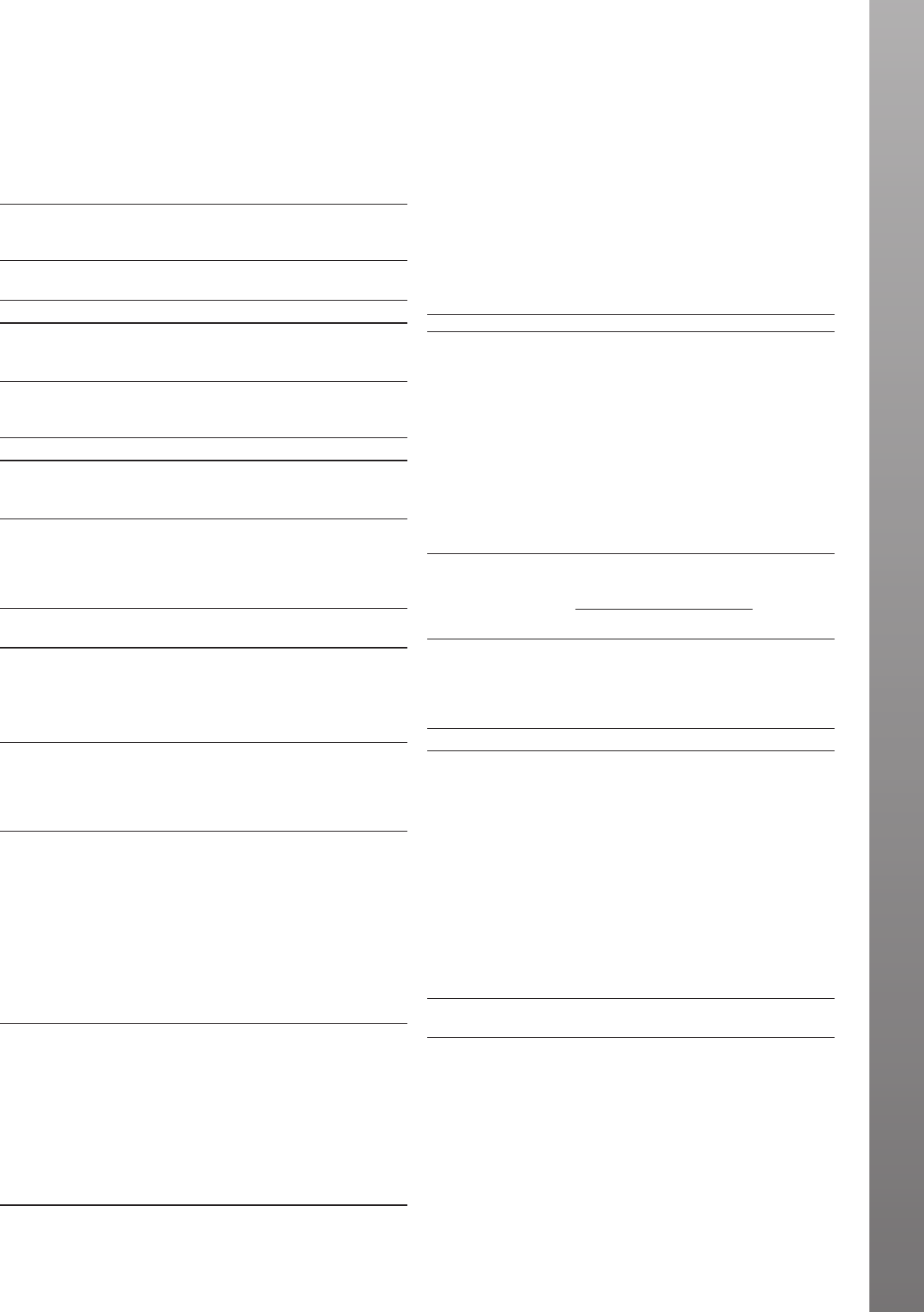

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

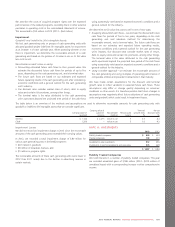

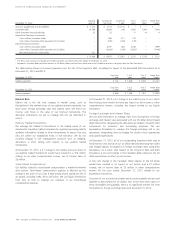

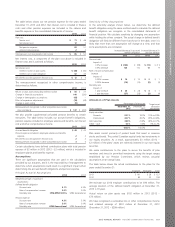

The table below shows our net pension expense for the years ended

December 31, 2013 and 2012. Net interest cost is included in finance

costs and other pension expenses are included in the salaries and

benefits expense in the consolidated statements of income.

2013 2012

Plan cost:

Service cost $71$46

Net interest cost 12 5

Net pension expense 83 51

Administrative expense 22

Total pension cost recognized in net income $85$53

Net interest cost, a component of the plan cost above is included in

finance costs and is outlined as follows.

2013 2012

Net interest cost:

Interest income on plan assets $ (40) $ (40)

Interest cost on plan obligation 52 45

Net interest cost recognized in finance costs $12 $5

The remeasurement recognized in other comprehensive income, is

determined as follows.

2013 2012

Return on plan assets (excluding interest income) $65$37

Change in financial assumptions 140 (220)

Change in demographic assumptions (43) –

Effect of experience adjustments (16) (49)

Change in asset ceiling (9) –

Remeasurement recognized in other comprehensive income

(loss) and equity $ 137 $ (232)

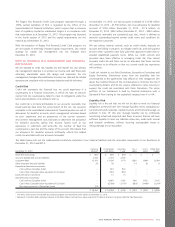

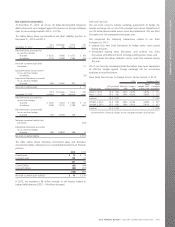

We also provide supplemental unfunded pension benefits to certain

executives. The table below includes our accrued benefit obligations,

pension expense included in employee salaries and benefits, net interest

cost and other comprehensive income.

2013 2012

Accrued benefit obligation $49 $45

Pension expense included in employee salaries and benefits

expense 22

Net interest cost recognized in finance costs 22

Remeasurement recognized in other comprehensive income 35

Certain subsidiaries have defined contribution plans with total pension

expense of $2 million in 2013 (2012 – $2 million), which is included in

employee salaries and benefits expense.

Assumptions

There are significant assumptions that are used in the calculations

provided by our actuaries, and it is the responsibility of management to

determine which assumptions could result in a significant impact when

determining the accrued benefit obligations and pension expense.

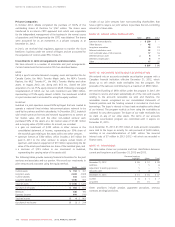

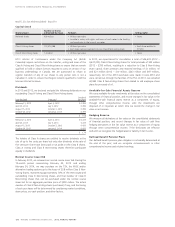

Principal Actuarial Assumptions

2013 2012

Weighted average of significant

assumptions:

Defined benefit obligation

Discount rate 5.1% 4.5%

Rate of compensation increase 3.0% 3.0%

Mortality rate CPM-RPP2014 Priv UP94 Generational

Pension expense

Discount rate 4.5% 5.5%

Rate of compensation increase 3.0% 3.0%

Mortality rate UP94 Generational UP94 Generational

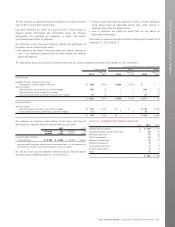

Sensitivity of Key Assumptions

In the sensitivity analysis shown below, we determine the defined

benefit obligation using the same method used to calculate the defined

benefit obligation we recognize in the consolidated statements of

financial position. We calculate sensitivity by changing one assumption

while holding the others constant. The actual change in defined benefit

obligation will likely be different from that shown in the table, since it is

likely that more than one assumption will change at a time, and that

some assumptions are correlated.

Increase/(decrease) in accrued

benefit obligation

Increase/(decrease) in

pension expense

2013 2012 2013 2012

Discount rate

Impact of:

0.5% increase $ (105) $ (99) $ (11) $ (11)

0.5% decrease 120 110 13 9

Rate of future compensation

increase

Impact of:

0.25% increase $14 $15 $3 $1

0.25% decrease (14) (15) (2) (3)

Mortality rate

Impact of:

1 year increase $26 $28 $4 $1

1 year decrease (27) (28) (3) (4)

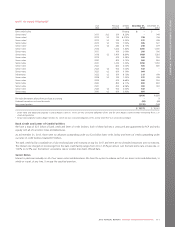

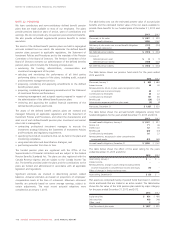

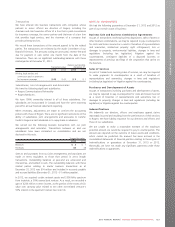

Allocation of Plan Assets

Percentage of plan assets Target asset

allocation

percentage

Asset category

December 31,

2013

December 31,

2012

Equity securities:

Domestic 20.1% 19.3% 10% to 29%

International 40.7% 38.3% 29% to 48%

Debt securities 38.9% 41.8% 38% to 47%

Other – cash 0.3% 0.6% 0% to 2%

100.0% 100.0%

Plan assets consist primarily of pooled funds that invest in common

stocks and bonds. The pooled Canadian equity funds has investments in

our equity securities. As a result, approximately $3 million (2012 –

$2 million) of the plans’ assets are indirectly invested in our own equity

securities.

We make contributions to the plans to secure the benefits of plan

members and invest in permitted investments using the target ranges

established by our Pension Committee, which reviews actuarial

assumptions on an annual basis.

The table below shows the actual contributions to the plans for the

years ended December 31:

Employer Employee Total

2013 $ 101 $ 26 $ 127

2012 85 23 108

We estimate our 2014 employer contributions to be $96 million. The

average duration of the defined benefit obligation at December 31,

2013 is 19 years.

Actual return on plan assets was $102 million in 2013 (2012 –

$75 million).

We have recognized a cumulative loss in other comprehensive income

and retained earnings of $201 million at December 31, 2013

(December 31, 2012 – $299 million).

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 119