Rogers 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

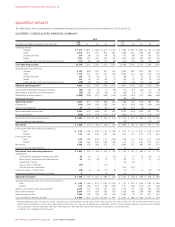

MANAGEMENT’S DISCUSSION AND ANALYSIS

Managing Our Liquidity and Financial Resources

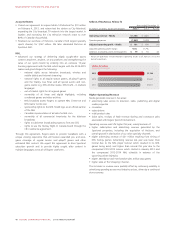

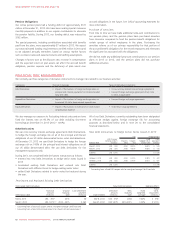

SOURCES AND USES OF CASH

CONSOLIDATED STATEMENTS OF CASH FLOWS

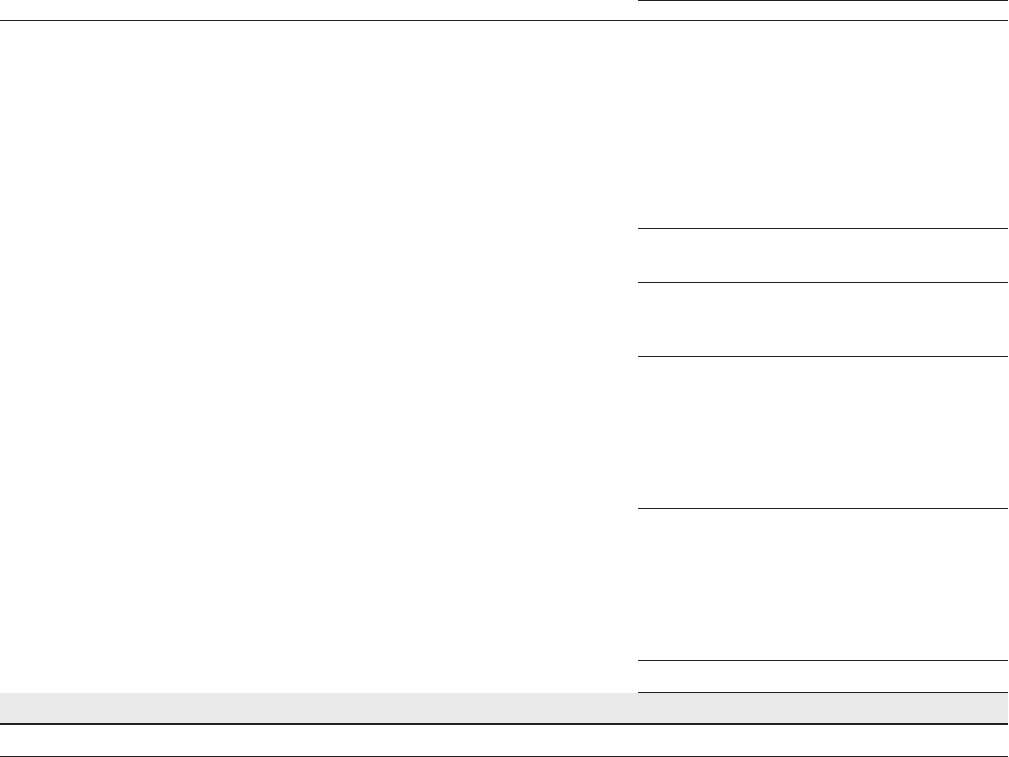

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

CASH FROM OPERATIONS

Net income for the period $ 1,669 $ 1,693 (1)

Depreciation and amortization 1,898 1,819 4

Impairment of assets –80 n/m

Finance costs 742 671 11

Income tax expense 596 610 (2)

Gain on sale of TVtropolis (47) – n/m

Gain on spectrum distribution –(233) n/m

Other 90 89 1

Cash provided by operations before changes in non-cash operating items 4,948 4,729 5

Change in non-cash operating working capital items 238 (248) n/m

5,186 4,481 16

Income taxes paid (496) (380) 31

Interest paid (700) (680) 3

Cash provided by operating activities 3,990 3,421 17

CASHUSED IN INVESTING

Additions to property, plant and equipment (2,240) (2,142) 5

Change in non-cash working capital items related to property, plant and equipment (114) 136 n/m

Acquisitions and strategic initiatives (1,080) (707) 53

Other (39) (121) (68)

Cash used in investing activities (3,473) (2,834) 23

CASH FROM FINANCING

Issuance of long-term debt, net of transaction costs 2,543 2,090 22

Repayment of long-term debt and net settlement of derivatives on termination (725) (1,240) (42)

Proceeds on short-term borrowings 650 – n/m

Dividends paid and repurchase/issuance of Class B Non-Voting shares (897) (1,167) (23)

Cash provided by (used in) financing activities 1,571 (317) n/m

Increase in cash and cash equivalents $ 2,088 $ 270 n/m

Cash and cash equivalents, end of period $ 2,301 $ 213 n/m

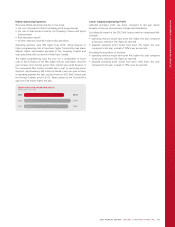

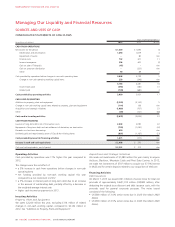

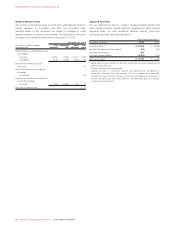

Operating Activities

Cash provided by operations was 17%higher this year compared to

2012.

The changes were the net effect of:

•a5%increase in cash from operations before changes in non-cash

operating items

• net funding provided by non-cash working capital this year

compared to a net investment in 2012

•a3%increase in interest paid on long-term debt due to an increase

in the amount of outstanding debt, partially offset by a decrease in

the weighted-average interest rate

• higher cash income tax payments in 2013.

Investing Activities

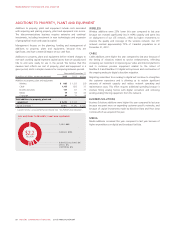

Property, Plant and Equipment

We spent $2,240 million this year, excluding $114 million of related

changes in non-cash working capital, compared to $2,142 million in

2012. See “Additions to Property, Plant and Equipment”.

Acquisitions and Strategic Initiatives

We made net investments of $1,080 million this year mainly to acquire

theScore, Blackiron, Mountain Cable and Pivot Data Centres. In 2012,

we made net investments of $707 million to acquire our 37.5%interest

in MLSE and for certain deposits related to our acquisition of theScore.

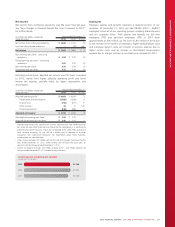

Financing Activities

Debt Issuances

On March 7, 2013 we issued US$1.0 billion of senior notes for total net

proceeds of approximately Cdn$1,015 million (US$985 million), after

deducting the original issue discount and debt issuance costs, with the

proceeds used for general corporate purposes. The notes issued

consisted of the following:

• US$500 million of 3.0%senior notes due in 2023 (the March 2023

Notes)

• US$500 million of 4.5%senior notes due in 2043 (the March 2043

Notes).

58 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT