Rogers 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

REVIEW OF CONSOLIDATED PERFORMANCE

This section discusses our consolidated operating income, net income

and other expenses that do not form part of the segment discussions

above.

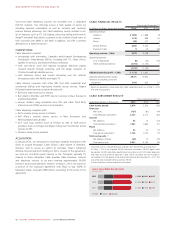

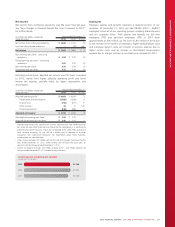

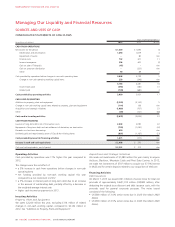

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

Adjusted operating profit 1$ 4,993 $ 4,834 3

Stock-based compensation expense (84) (77) 9

Restructuring, acquisition and other expenses (85) (92) (8)

Depreciation and amortization (1,898) (1,819) 4

Impairment of assets –(80) n/m

Operating income 22,926 2,766 6

Finance costs (742) (671) 11

Other income (expense) 81 250 (68)

Income before income taxes 2,265 2,345 (3)

Income tax expense (596) (620) (4)

Net income from continuing operations 1,669 1,725 (3)

Loss from discontinued operations –(32) n/m

Net income $ 1,669 $ 1,693 (1)

1Adjusted operating profit is a non-GAAP measure and should not be considered as a

substitute or alternative for GAAP measures. It is not a defined term under IFRS and

does not have a standard meaning, so may not be a reliable way to compare us to

other companies. See “Non-GAAP Measures” for information about these measures,

including how we calculate them.

2As defined. See “Additional GAAP Measures”.

n/m: not meaningful.

Adjusted Operating Profit

Please see “2013 Financial Results” for a discussion of the increase in

adjusted operating profit this year.

Stock-Based Compensation Expense

Our stock-based compensation expense for stock options (including

stock appreciation rights), restricted share units and deferred share units

is generally determined by:

• vesting of stock options and share units

• changes in the market price of RCI Class B shares

• offset by the impact of the stock-based compensation derivative

instruments that offset a portion of the price appreciation risk for our

stock-based compensation program starting March 2013. See

“Financial Risk Management” for information about Equity

Derivatives.

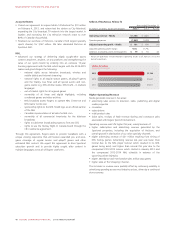

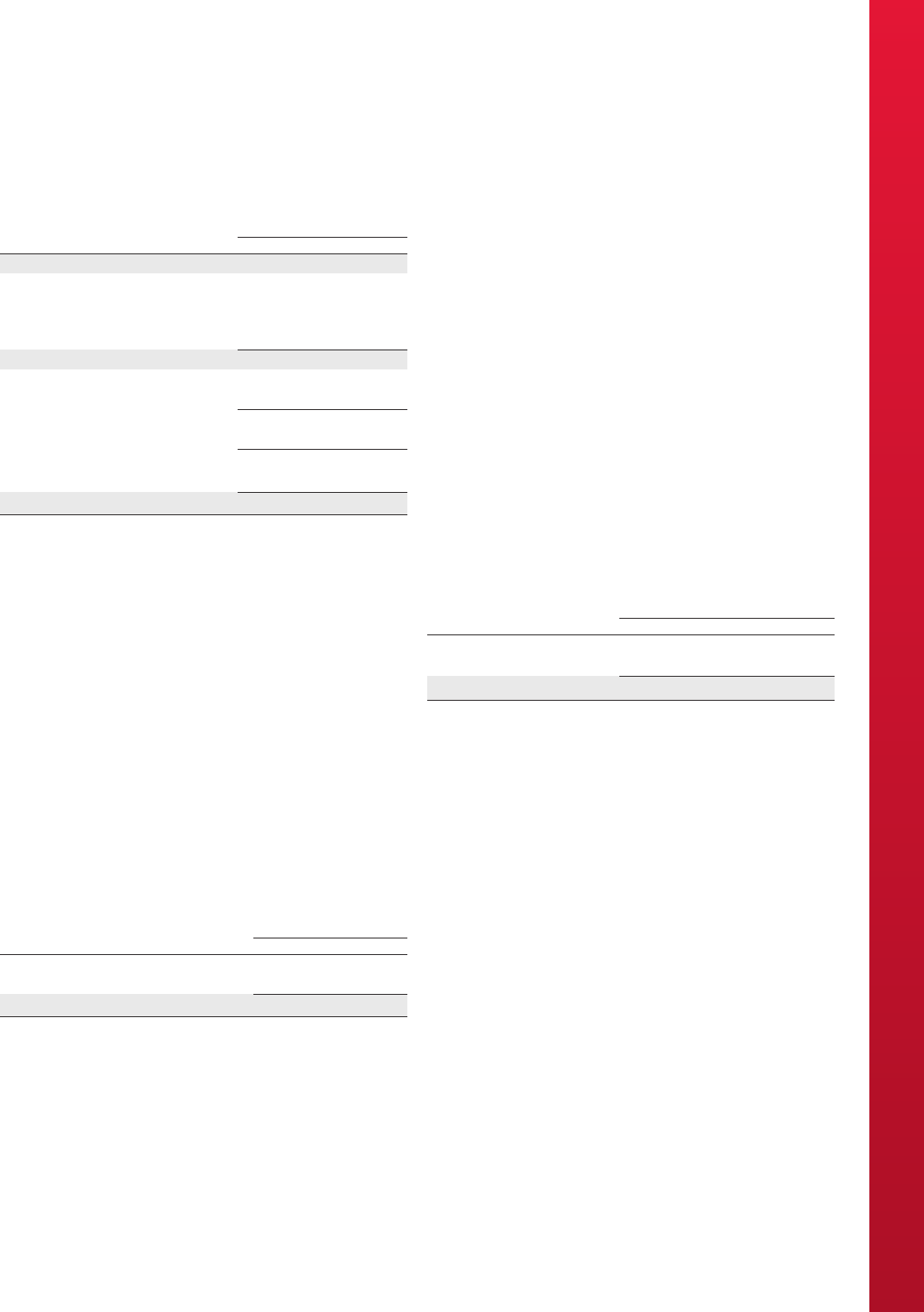

Years ended December 31

(In millions of dollars) 2013 2012

Impact of vesting and change in price $76 $77

Equity derivatives, net of interest receipt 8–

Total stock-based compensation expense $ 84 $77

Stock-based compensation expense increased to $84 million from

$77 million in 2012. Stock-based compensation of $84 million was

mainly the result of the vesting of share-based options and units and

the increase in the RCI Class B share price during the first two months

of this year prior to entering into the Equity Derivatives.

We had a liability of $164 million at December 31, 2013 (2012 – $195

million) related to stock-based compensation recorded at its fair value,

including stock options, restricted share units and deferred share units.

We paid $101 million in 2013 (2012 – $76 million) to holders of stock

options, restricted share units and deferred share units upon exercise.

All stock options holders exercised their stock options through optional

share appreciation rights (SARs). We use derivative instruments from

time to time to manage our exposure to market-based fluctuations in

our stock-based compensation expense.

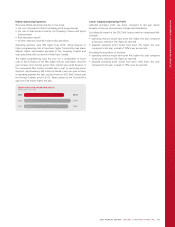

Restructuring, Acquisition and Other Expenses

Restructuring, acquisition and other expenses associated with initiatives

aimed at improving our cost structure mainly included:

• $53 million in severance costs associated with the targeted

restructuring of our employee base (2012 – $89 million)

• $32 million in acquisition transaction costs (2012 – $3 million).

Depreciation and Amortization Expense

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

Depreciation $ 1,748 $ 1,678 4

Amortization 150 141 6

Total depreciation and amortization $ 1,898 $ 1,819 4

Depreciation and amortization expense were both higher this year

mainly because of:

• our significant investment and roll out of new customer premise

equipment, mostly NextBox 2.0 and 3.0 set-top boxes at Cable; these

are now amortized over three years, compared to five years prior to

2012, which also contributed to the increase

• the timing of readiness of certain network and system initiatives,

including the launch of our LTE network in various municipalities

• new property, plant and equipment and intangible assets resulting

from our recent acquisitions in Cable, Business Solutions and Media.

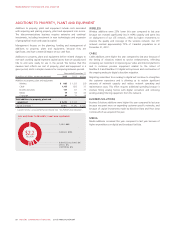

Impairment of Assets

There was no impairment of assets this year. In 2012, we recorded an

$80 million impairment charge in the Media segment that included:

• $67 million in goodwill

• $8 million in broadcast licences

• $5 million in program rights.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 51