Rogers 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

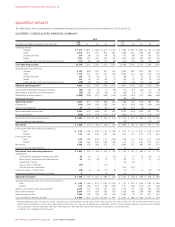

MANAGEMENT’S DISCUSSION AND ANALYSIS

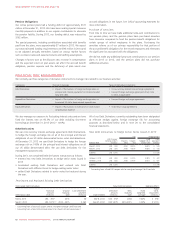

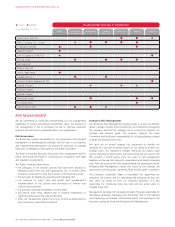

Mark-to-Market Value

We record our derivatives using an estimated credit-adjusted, mark-to-

market valuation, in accordance with IFRS. The estimated credit-

adjusted values of the derivatives are subject to changes in credit

spreads between us and our counterparties. The table below shows the

net asset of our derivative instruments at December 31, 2013:

December 31, 2013

(In millions of dollars, except

exchange rates)

US$

notional Exchange

rate Cdn$

notional Fair

value

Debt Derivatives accounted for as cash

flow hedges:

As assets $ 4,250 1.0285 $ 4,371 $ 184

As liabilities 2,130 1.0769 2,294 (133)

Net mark-to-market asset Debt

Derivatives 51

Equity Derivative not accounted for

as hedges:

As liabilities (13)

Expenditure Derivatives accounted for

as cash flow hedges:

As assets 900 1.0262 923 37

Net mark-to-market asset $ 75

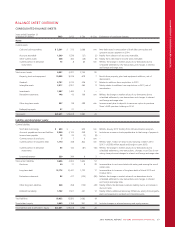

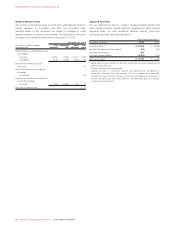

Adjusted Net Debt

We use adjusted net debt to conduct valuation-related analysis and

make capital structure related decisions. Adjusted net debt includes

long-term debt, net debt derivatives liabilities (assets), short-term

borrowings and cash and cash equivalents.

Years ended December 31

(In millions of dollars) 2013 2012

Long-term debt 1,2 $ 13,436 $ 10,858

Net Debt Derivatives liabilities (assets) 2(51) 524

Short-term borrowings 650 —

Cash and cash equivalents (2,301) (213)

Adjusted net debt 3$ 11,734 $ 11,169

1Before deducting any decrease in fair value arising from purchase accounting and

deferred transaction costs.

2Includes current and long-term portions.

3Adjusted net debt is a non-GAAP measure and should not be considered as a

substitute or alternative for GAAP measures. This is not a defined term under IFRS,

and does not have a standard meaning, so may not be a reliable way to compare us

to other companies. See “Non-GAAP Measures” for information about this measure,

including how we calculate it.

64 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT