Rogers 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Voice-over-cable telephony services are provided over a dedicated

DOCSIS network. Our offerings ensure a high quality of service by

including network redundancy as well as network and customer

premise backup powering. Our cable telephony service includes a rich

set of features, such as TV Call Display, three-way calling and Home &

Away™ voicemail that allows customers to be notified of and listen to

their voicemail over MMS or the Web. In addition, we offer a wireless

alternative to a fixed-line service.

COMPETITION

Cable television competes:

• increasingly with alternative, Canadian multi-channel Broadcasting

Distribution Undertakings (BDUs), including Bell TV, Shaw Direct,

satellite TV services, and Internet Protocol television

• with over-the-air local and regional broadcast television signals

received directly through antennas, and the illegal reception of

US direct broadcast satellite services

• with television shows and movies streaming over the Internet

through providers like Netflix and Apple TV.

Cable Internet competes with other ISPs that offer residential and

commercial dial-up and high-speed Internet access services. Rogers

Hi-Speed Internet services compete directly with:

• Bell’s DSL Internet service in Ontario

• Bell Aliant’s DSL/fibre and FTTH Internet services in New Brunswick

and Newfoundland

• various resellers using wholesale telco DSL and cable Third Party

Internet Access (TPIA) services in local markets.

Cable telephony competes with:

• Bell’s wireline phone service in Ontario

• Bell Aliant’s wireline phone service in New Brunswick and

Newfoundland and Labrador

• ILEC local loop resellers (such as Primus) as well as VoIP service

providers (such as Vonage and Skype) riding over the Internet access

services of ISPs

• Wireless home phone products.

ACQUISITION

In January 2013, we announced a multi-part strategic transaction with

Shaw to acquire Mountain Cable (Shaw’s cable system in Hamilton,

Ontario), and to secure an option to purchase Shaw’s Advanced

Wireless Services spectrum holdings in 2014. As part of the agreement,

we sold our one-third equity interest in the TVtropolis specialty TV

channel to Shaw. Mountain Cable provides cable television, Internet

and telephony services to an area covering approximately 59,000

homes in and around Hamilton, Ontario. On May 1, 2013, we closed on

a portion of the multi-part agreement with Shaw to buy 100%of

Mountain Cable, and paid $398 million, according to the terms of the

agreement.

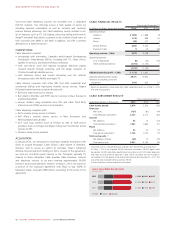

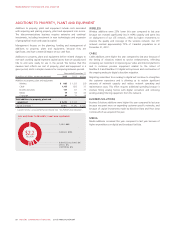

CABLE FINANCIAL RESULTS

(In millions of dollars, except percentages)

Years ended December 31

201312012 %Chg

Operating revenue

Television $ 1,809 $ 1,868 (3)

Internet 1,159 998 16

Phone 498 477 4

Service revenue 3,466 3,343 4

Equipment sales 915 (40)

Operating revenue – Cable 3,475 3,358 3

Operating expenses

Cost of equipment (6) (20) (70)

Other operating expenses (1,751) (1,733) 1

(1,757) (1,753) –

Adjusted operating profit – Cable $ 1,718 $ 1,605 7

Adjusted operating profit margin 49.4%47.8%

Additions to property, plant and

equipment 1,105 832 33

1Results of operations include Mountain Cable’s operating results as of May 1, 2013

(the date of acquisition).

CABLE SUBSCRIBER RESULTS 1

Years ended December 31

(Subscriber statistics in thousands) 2013 2012 Chg

Cable homes passed 3,978 3,810 168

Television

Net losses (127) (83) (44)

Total television subscribers 22,127 2,214 (87)

Internet

Net additions 63 73 (10)

Total Internet subscribers 21,961 1,864 97

Phone

Net additions 42 23 19

Total phone subscribers 21,153 1,074 79

Total service units 2,3

Net additions (losses) (22) 13 (35)

Total service units 5,241 5,152 89

1Subscriber count is a key performance indicator. See “Key Performance Indicators”.

2On May 1, 2013, we acquired 40,000 television subscribers, 38,000 digital cable

households, 34,000 cable high-speed Internet subscribers and 37,000 cable telephony

lines from our acquisition of Mountain Cable. These subscribers are not included in

net additions, but do appear in the ending total balance for December 31, 2013. The

acquisition also increased homes passed by 59,000.

3Includes television, Internet and phone subscribers.

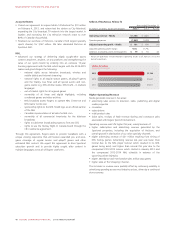

(IN THOUSANDS)

CABLE SUBSCRIBER BREAKDOWN

2013

2012

2011

1,153 1,961

1,074 1,864

1,052 1,793

2,127

2,214

2,297

InternetPhone Television

42 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT