Rogers 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 22: PENSIONS

We have contributory and non-contributory defined benefit pension

plans that are made available to most of our employees. The plans

provide pensions based on years of service, years of contributions and

earnings. We do not provide any non-pension post-retirement benefits.

We also provide unfunded supplemental pension benefits to certain

executives.

The assets of the defined benefit pension plans are held in segregated

accounts isolated from our assets. We administer the defined benefit

pension plans pursuant to applicable regulations, the Statement of

Investment Policies and Procedures and to the mandate of the Pension

Committee of the Board of Directors. The Pension Committee of the

Board of Directors oversees our administration of the defined benefits

pension plans, which includes the following principal areas:

• overseeing the funding, administration, communication and

investment management of the plans

• selecting and monitoring the performance of all third parties

performing duties in respect of the plans, including audit, actuarial

and investment management services

• proposing, considering and approving amendments to the defined

benefit pension plans

• proposing, considering and approving amendments of the Statement

of Investment Policies and Procedures

• reviewing management and actuarial reports prepared in respect of

the administration of the defined benefit pension plans

• reviewing and approving the audited financial statements of the

defined benefit pension plan funds.

The assets of the defined benefit pension plans are invested and

managed following all applicable regulations and the Statement of

Investment Policies and Procedures, and reflect the characteristics and

asset mix of each defined benefit pension plan. Investment and market

return risk is managed by:

• contracting professional investment managers to execute the

investment strategy following the Statement of Investment Policies

and Procedures and regulatory requirements

• specifying the kinds of investments that can be held in the plans and

monitoring compliance

• using asset allocation and diversification strategies, and

• purchasing annuities from time to time.

The funded pension plans are registered with the Office of the

Superintendent of Financial Institutions and are subject to the Federal

Pension Benefits Standards Act. The plans are also registered with the

Canada Revenue Agency and are subject to the Canada Income Tax

Act. The benefits provided under the plans and the contributions to the

plans are funded and administered in accordance with all applicable

legislation and regulations.

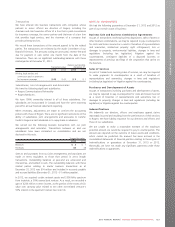

Significant estimates are involved in determining pension related

balances. Actuarial estimates are based on projections of employees’

compensation levels at the time of retirement. Maximum retirement

benefits are primarily based on career average earnings, subject to

certain adjustments. The most recent actuarial valuations were

completed as at January 1, 2013.

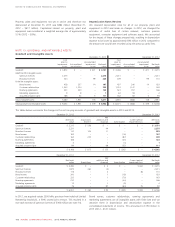

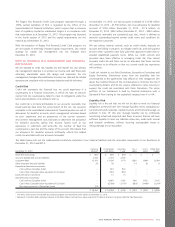

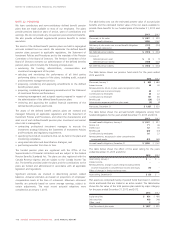

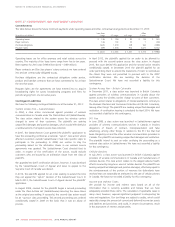

The table below sets out the estimated present value of accrued plan

benefits and the estimated market value of the net assets available to

provide these benefits for our funded plans at December 31, 2013 and

2012.

2013 2012

Plan assets, at fair value $ 1,037 $ 833

Accrued benefit obligations 1,209 1,167

Deficiency of plan assets over accrued benefit obligations (172) (334)

Effect of asset ceiling limit (9) –

Net deferred pension liability $ (181) $ (334)

Consists of:

Deferred pension asset $8$9

Deferred pension liability (189) (343)

Net deferred pension liability $ (181) $ (334)

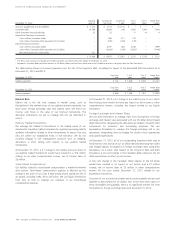

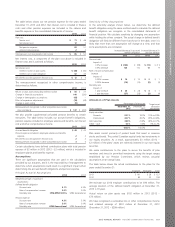

The table below shows our pension fund assets for the years ended

2013 and 2012.

2013 2012

Plan assets, January 1 $ 833 $ 684

Interest income 40 40

Remeasurements, return on plan assets recognized in other

comprehensive income and equity 65 37

Contributions by employees 26 22

Contributions by employer 101 85

Benefits paid (26) (33)

Administrative expenses paid from plan assets (2) (2)

Plan assets, December 31 $ 1,037 $ 833

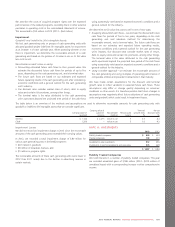

The table below shows the accrued benefit obligations arising from

funded obligations for the years ended December 31, 2013 and 2012.

2013 2012

Accrued benefit obligations, January 1 $ 1,167 $ 817

Service cost 71 46

Interest cost 52 45

Benefits paid (26) (33)

Contributions by employees 26 23

Remeasurements, recognized in other comprehensive

income and equity (81) 269

Accrued benefit obligations, December 31 $ 1,209 $ 1,167

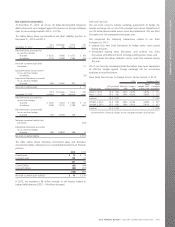

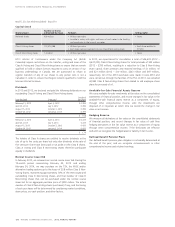

The table below shows the effect of the asset ceiling for the years

ended December 31, 2013 and 2012.

2013 2012

Asset ceiling, January 1 $– $–

Interest income ––

Remeasurements, change in asset ceiling (excluding interest

income) recognized in comprehensive income and equity (9) –

Effect of changes in foreign exchange rates ––

Asset ceiling, December 31 $ (9) $–

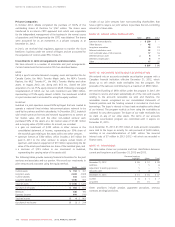

Plan assets are comprised mainly of pooled funds that invest in common

stocks and bonds that are traded in an active market. The table below

shows the fair value of the total pension plan assets by major category

for the years ended December 31, 2013 and 2012.

2013 2012

Equity securities $ 631 $ 480

Debt securities 403 348

Other – cash 35

Total fair value of plan assets $ 1,037 $ 833

118 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT