Rogers 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Pension Obligations

Our retiree pension plans had a funding deficit of approximately $172

million at December 31, 2013. We have been making special minimum

monthly payments in addition to our regular contributions to eliminate

the pension liability. During 2013, our funding deficit was reduced by

$162 million.

The special payments, including contributions associated with benefits

paid from the plans, were approximately $7 million in 2013. We expect

our total estimated funding requirements to be $96 million in 2014 and

to be adjusted annually thereafter, based on various market factors

such as interest rates and expected returns and staffing assumptions.

Changes in factors such as the discount rate, increase in compensation

and the expected return on plan assets can affect the accrued benefit

obligation, pension expense and the deficiency of plan assets over

accrued obligations in the future. See Critical accounting estimates for

more information.

Purchase of Annuities

From time to time we have made additional lump-sum contributions to

our pension plans, and the pension plans have purchased annuities

from insurance companies to fund the pension benefit obligations for

certain groups of retired employees in the plans. Purchasing the

annuities relieves us of our primary responsibility for that portion of

the accrued benefit obligations for the retired employees and eliminates

the significant risk associated with the obligations.

We did not make any additional lump-sum contributions to our pension

plans in 2013 or 2012, and the pension plans did not purchase

additional annuities.

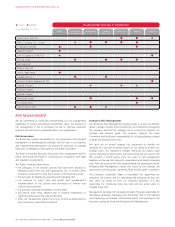

FINANCIAL RISK MANAGEMENT

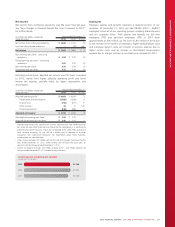

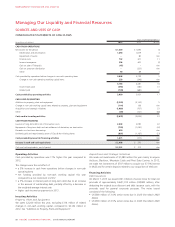

We normally use three categories of derivative instruments to manage risks related to our business activities:

Categories The risk it manages Types of derivative instruments

Debt Derivatives • Impact of fluctuations in foreign exchange rates on

principal and interest payments for US denominated

long-term debt

• Cross-currency interest rate exchange agreements

• Forward foreign exchange agreements (from time

to time, as applicable)

Expenditure Derivatives • Impact of fluctuations in foreign exchange rates on

forecasted US dollar denominated expenditures

• Forward foreign exchange agreements

Equity Derivatives • Impact of fluctuations in share price on stock-based

compensation expense

• Total return swap agreements

We also manage our exposure to fluctuating interest rates and we have

fixed the interest rate on 95.3%of our debt including short-term

borrowings at December 31, 2013 (2012 – 100%).

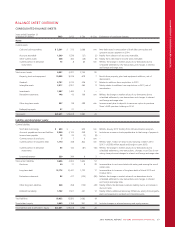

Debt Derivatives

We use cross currency interest exchange agreements (Debt Derivatives),

to hedge the foreign exchange risk on all of the principal and interest

obligations of our US dollar denominated senior notes and debentures.

At December 31, 2013 we used Debt Derivatives to hedge the foreign

exchange risk on 100%of the principal and interest obligations on all

our US dollar denominated debt. We use Debt Derivatives for risk

management purposes only.

During 2013, we completed Debt Derivatives transactions as follows:

• entered into new Debt Derivatives to hedge senior notes issued in

2013

• terminated existing Debt Derivatives and entered into Debt

Derivatives with different terms to hedge existing senior notes

• settled Debt Derivatives related to senior notes that matured during

the year.

All of our Debt Derivatives currently outstanding have been designated

as effective hedges against foreign exchange risk for accounting

purposes as described below and in note 20 to the consolidated

financial statements.

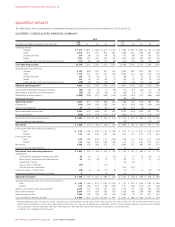

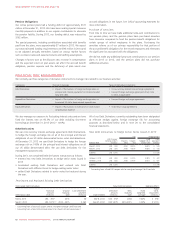

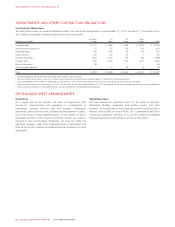

New Debt Derivatives to Hedge Senior Notes Issued In 2013

Effective date

US$ Principal/

notional amount

(millions)

US$ Hedging effect

Maturity

date

Coupon

rate

Fixed

hedged Cdn.$

interest rate 1

Cdn$

equivalent

(millions)

March 7, 2013 US$ 500 2023 3.00%3.60%$ 515

March 7, 2013 US$ 500 2043 4.50%4.60%$ 515

Subtotal US$ 1,000 $ 1,030

October 2, 2013 US$ 850 2023 4.10%4.59%$ 877

October 2, 2013 US$ 650 2043 5.45%5.61%$ 671

Subtotal US$ 1,500 $ 1,548

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

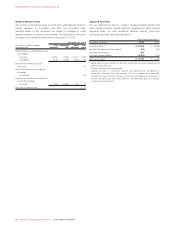

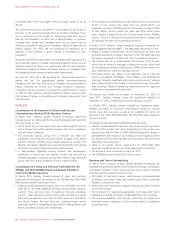

Terminated and Replaced Existing Debt Derivatives

Terminated Debt Derivatives New Debt Derivatives Hedging effect

Termination date

Notional

amount

(millions)

Original

maturity

date

Cash settlement

payment

(millions) Date entered

Derivative

amount

(millions)

New

maturity

date

Fixed

weighted

average 1

Fixed

Cdn$

equivalent

(millions) 2

Mar 6, 2013 US$ 350 22018 Nil Mar 6, 2013 US$ 35022038 7.62%$ 356

Sep 27, 2013 US$ 1,075 3,4 2014 – 2015 $ 263 Sep 27, 2013 US$ 1,07532014-2015 7.42%$ 1,110

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

2Converting from a fixed US$ principal amount to a fixed Cdn$ principal amount.

62 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT