Rogers 2013 Annual Report Download - page 60

Download and view the complete annual report

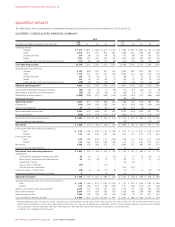

Please find page 60 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

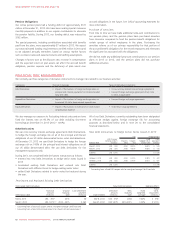

Media

The trends in Media’s results are generally the result of continual

investment in prime-time and specialty programming, higher sports

rights costs, higher subscriber fees, and fluctuations in advertising and

consumer market conditions.

Seasonal fluctuations relate to periods of increased consumer activity

and their impact on advertising and related retail cycles, the MLB

season, where revenues and expenses are concentrated in the spring,

summer and fall months, and the NHL season, where advertising

revenues and programming expenses are concentrated in the fall and

winter months.

2012 FULL YEAR RESULTS COMPARED TO 2011

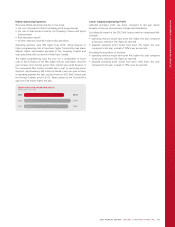

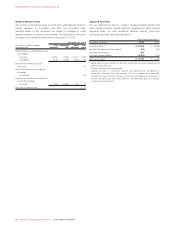

Operating Revenue

Consolidated revenue increased in 2012 by $140 million from 2011,

Wireless contributed $142 million, Cable contributed $49 million and

Media contributed $9 million, partially offset by decreases in revenue

of $54 million in Business Solutions and in corporate items and

intercompany eliminations of $6 million. The increase was due to

overall higher subscriber levels, data revenue and equipment sales at

Wireless and higher Internet revenue at Cable, partially offset by lower

overall revenue at Business Solutions due to the phased exit of the

legacy services business.

Adjusted Operating Profit

Consolidated adjusted operating profit increased in 2012 by $95 million

from 2011, Wireless contributed $27 million, Cable contributed

$56 million, Business Solutions contributed $3 million, and Media

contributed $10 million. The increases at Wireless and Cable were due

to the revenue growth described above combined with cost efficiencies.

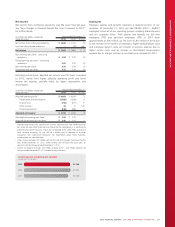

Adjusted Net Income

Consolidated adjusted net income increased to $1,781 million in 2012,

from $1,736 million in 2011, primarily due to increase in adjusted

operating profit of 2%.

56 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT