Rogers 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

ACQUISITIONS

• Closed our agreement to acquire Metro 14 Montreal for $10 million

on February 4, 2013, and relaunched the station as City Montreal,

expanding the City broadcast TV network into the largest market in

Quebec and increasing the City television network reach to over

80%of Canadian households.

• Finalized our purchase of theScore, Canada’s third largest specialty

sports channel, for $167 million. We later rebranded theScore as

Sportsnet 360.

NHL

• Advanced our strategy of delivering highly sought-after sports

content anywhere, anytime, on any platform and strengthening the

value of our sports brand by entering into an exclusive 12-year

licensing agreement with the NHL which begins with the 2014-2015

season and grants Rogers the following:

- national rights across television broadcasts, wireless and

mobile tablets and Internet streaming

- national rights to all regular season games, all playoff games

and the Stanley Cup Final, and all special events and non-

game events (e.g. NHL All-Star Game, NHL Draft) – in multiple

languages

- out-of-market rights for all regional games

- ownership of all linear and digital highlights, including

condensed games and video archives

- NHL broadcast assets: Rogers to operate NHL Centre Ice and

NHL Game Centre Live

- sponsorship rights to the NHL Shield logo as an official partner

of the NHL

- Canadian representation of ad sales for NHL.com

- ownership of all commercial inventories for the television

broadcasts

- rights to sublicense broadcasting rights to TVA and CBC

- rights to use the Hockey Night In Canada brand through the

CBC sublicense agreement.

Through this agreement, Rogers plans to provide Canadians with a

unique viewing experience that will feature expanded pre- and post-

game coverage of regular season and playoff games and other

enhanced NHL content. We expect this agreement to drive Sportsnet

subscriber growth and to provide highly sought after content in

multiple languages across all of Rogers’ platforms.

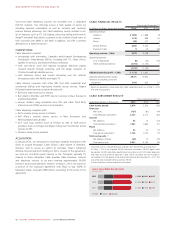

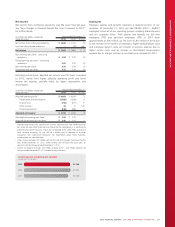

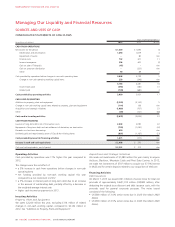

MEDIA FINANCIAL RESULTS

Years ended December 31

(In millions of dollars, except percentages) 2013 12012 %Chg

Operating revenue – Media $ 1,704 $ 1,620 5

Operating expenses (1,543) (1,430) 8

Adjusted operating profit – Media $ 161 $ 190 (15)

Adjusted operating profit margin 9.4%11.7%

Additions to property, plant and equipment $79 $55 44

1Results of operations include theScore’s operating results as of April 30, 2013 (the

date of acquisition).

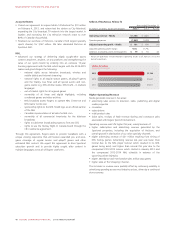

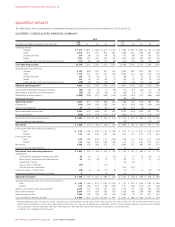

(IN MILLIONS OF DOLLARS)

MEDIA REVENUE

2013

2012

2011

$1,704

$1,620

$1,611

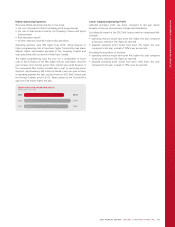

Higher Operating Revenue

Media generates revenue in five areas:

• advertising sales across its television, radio, publishing and digital

media properties

• circulation

• subscriptions

• retail product sales

• ticket sales, receipts of MLB revenue sharing and concession sales

associated with Rogers Sports Entertainment.

Operating revenue was 5%higher this year, mainly because of:

• higher subscription and advertising revenue generated by the

Sportsnet properties, including the acquisition of theScore, and

overall growth in distribution of our other specialty channels

• higher advertising revenue of $21 million resulting from timing of

NHL hockey games. Advertising revenue last year was lower than

normal due to the NHL player lockout which resulted in no NHL

games being aired, and higher than normal this year due to the

compressed 2012-2013 season which started in January 2013 and

the compressed 2013-2014 NHL schedule in advance of the

upcoming winter Olympics

• higher attendance and merchandise sales at Blue Jays games

• higher sales at The Shopping Channel.

The increases in revenue were partially offset by continuing volatility in

advertising spending across most industry sectors, driven by a continued

slow economy.

48 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT