Rogers 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

on an annual basis or more often if events or circumstances warrant. A

cash generating unit is the smallest identifiable group of assets that

generates cash inflows that are largely independent of the cash inflows

from other assets or groups of assets. Goodwill and indefinite life

intangible assets are allocated to cash generating units (or groups of

cash generating units) based on the level at which management

monitors goodwill, which is not higher than an operating segment. The

allocation involves significant estimates of future cash flows, estimated

periods of use, applicable discount rates and considerable management

judgment, and is made to cash generating units (or groups of cash

generating units) that are expected to benefit from the synergies of the

business combination. If key estimates differ unfavourably in the future,

we could experience impairment charges that could decrease net

income. We did not record an impairment charge in 2013 since the

recoverable amounts of the cash generating units exceeded their

carrying values. In 2012, we recorded an impairment charge of $80

million related to certain Media assets, due to the challenging economic

conditions, weakening industry expectations and a decline in

advertising revenues.

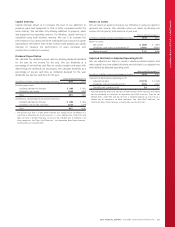

Financial Instruments

The fair values of our Derivatives are recorded using an estimated

credit-adjusted mark-to-market valuation. If the Derivatives are in an

asset position (i.e., the counterparty owes Rogers), the credit spread for

the bank counterparty is added to the risk-free discount rate to

determine the estimated credit-adjusted value. If the Derivatives are in a

liability position (i.e., Rogers owes the counterparty), our credit spread is

added to the risk-free discount rate. The estimated credit-adjusted value

of Derivatives is affected by changes in credit spreads between us and

our counterparties.

Income and Other Taxes

We make income and other tax provisions based on information

currently available in each of the jurisdictions in which we operate.

While we believe we have paid and provided for adequate amounts of

tax, our business is complex and significant judgement is required in

interpreting tax legislation and regulations and estimating future levels

of taxable income. Our tax filings are subject to audit by the relevant

government revenue authorities and the results of the government

audit could materially change the amount of our actual income tax

expense, income taxes payable or receivable, other taxes payable or

receivable and deferred income tax assets and liabilities and could, in

certain circumstances, result in the assessment of interest and penalties.

Pension Benefits

When we account for defined benefit pension plans, assumptions are

made in determining the valuation of benefit obligations. Assumptions

and estimates include the discount rate, the rate of compensation

increase and the mortality rate. Changes to these primary assumptions

and estimates would affect the pension expense, pension asset and

liability and other comprehensive income. Changes in economic

conditions may also have an impact on our pension plan because there is

no assurance that the plan will be able to earn the assumed rate of

return. Market-driven changes may also result in changes in the discount

rates and other variables that would require us to make contributions in

the future that differ significantly from the current contributions and

assumptions incorporated into the actuarial valuation process.

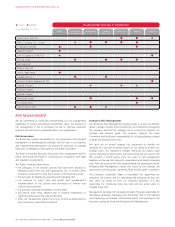

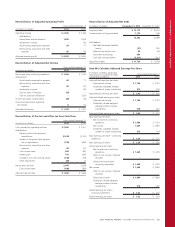

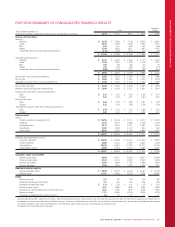

The table below shows what the impact of an increase or decrease in

the primary assumptions and estimates on our accrued benefit

obligation and pension expense for 2013 would be:

(In millions of dollars)

Accrued benefit

obligation at end

of fiscal 2013

Pension

expense

fiscal 2013

Discount rate 5.10%4.50%

Impact of: 0.5%increase $ (105) $ (11)

0.5%decrease 120 13

Rate of compensation increase 3.00%3.00%

Impact of: 0.25%increase $ 14 $ 3

0.25%decrease (14) (2)

Mortality rate

Impact of: 1 year increase $ 26 $ 4

1 year decrease (27) (3)

Stock-Based Compensation

Stock Option Plans

Our employee stock option plans attach cash-settled share appreciation

rights (SARs) to all new and previously granted options. The SARs

feature allows the option holder to elect to receive in cash an amount

equal to the intrinsic value, instead of exercising the option and

acquiring Class B Non-Voting shares.

We measure stock-based compensation to employees at fair value. We

determine fair value of options using our Class B Non-Voting share

price and option pricing models, and record all outstanding stock

options as liabilities. The liability is marked-to-market in each period and

is amortized to expense using a graded vesting approach over the

period when employee services are rendered, or over the period to the

date an employee is eligible to retire, whichever is shorter. The expense

in each period is affected by the change in the price of our Class B Non-

Voting shares during the life of the option.

Restricted Share Unit (RSU) Plan

We record outstanding RSUs as liabilities, measuring our liabilities and

compensation costs based on the award’s fair value, and recording it as

a charge to operating costs over the vesting period of the award. If the

award’s fair value changes after it has been granted and before the

settlement date, we record the resulting changes in the liability as a

charge to operating costs in the year that the change occurs. The

payment amount is established as of the vesting date.

Deferred Share Unit (DSU) Plan

We record outstanding DSUs as liabilities, measuring our liabilities and

compensation costs based on the awards’ fair values at the grant date.

If an award’s fair value changes after it has been granted and before

the settlement date, we record the resulting changes in our liability as a

charge to operating costs in the year that the change occurs. The

payment amount is established as of the exercise date.

80 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT