Rogers 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

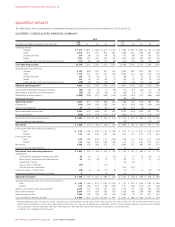

MANAGEMENT’S DISCUSSION AND ANALYSIS

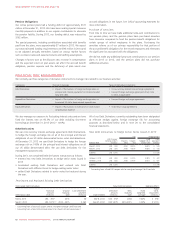

Net Income

Net income from continuing operations was 3%lower than last year.

See “Key Changes in Financial Results this Year Compared to 2012”,

for further details.

(In millions of dollars, except per

share amounts)

Years ended December 31

2013 2012 %Chg

Net income from continuing operations $ 1,669 $ 1,725 (3)

Loss from discontinued operations –(32) n/m

Net income $ 1,669 $ 1,693 $ (1)

Basic earnings per share – continuing

operations $ 3.24 $ 3.32 (2)

Diluted earnings per share – continuing

operations 3.22 3.30 (2)

Basic earnings per share 3.24 3.26 (1)

Diluted earnings per share 3.22 3.24 (1)

Excluding certain items, adjusted net income was 1%lower compared

to 2012, mainly from higher adjusted operating profit and lower

income tax expense, partially offset by higher depreciation and

amortization.

(In millions of dollars, except per

share amounts)

Years ended December 31

2013 2012 %Chg

Adjusted operating profit 1$ 4,993 $ 4,834 3

Depreciation and amortization (1,898) (1,819) 4

Finance costs (742) (671) 11

Other income 234 17 100

Income tax expense 3(618) (580) 7

Adjusted net income 1$ 1,769 $ 1,781 (1)

Adjusted basic earnings per share 1$ 3.43 $ 3.43 –

Adjusted diluted earnings per share 1$ 3.42 $ 3.41 –

1Adjusted operating profit, adjusted net income, adjusted basic and diluted earnings

per share are non-GAAP measures and should not be considered as a substitute or

alternative for GAAP measures. These are not defined terms under IFRS, and do not

have standard meanings, so may not be a reliable way to compare us to other

companies. See “Non-GAAP Measures” for information about these measures,

including how we calculate them.

2Other income excludes $47 million gain on the sale of TVtropolis investment for the

year ended December 31, 2013. Other income also excludes the $233 gain on

spectrum sale for the year ended December 31, 2012.

3Income tax expense excludes $22 million recovery (2012 – $40 million expense) for

the year ended December 31, 2013 related to adjusted items.

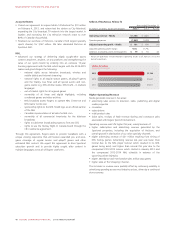

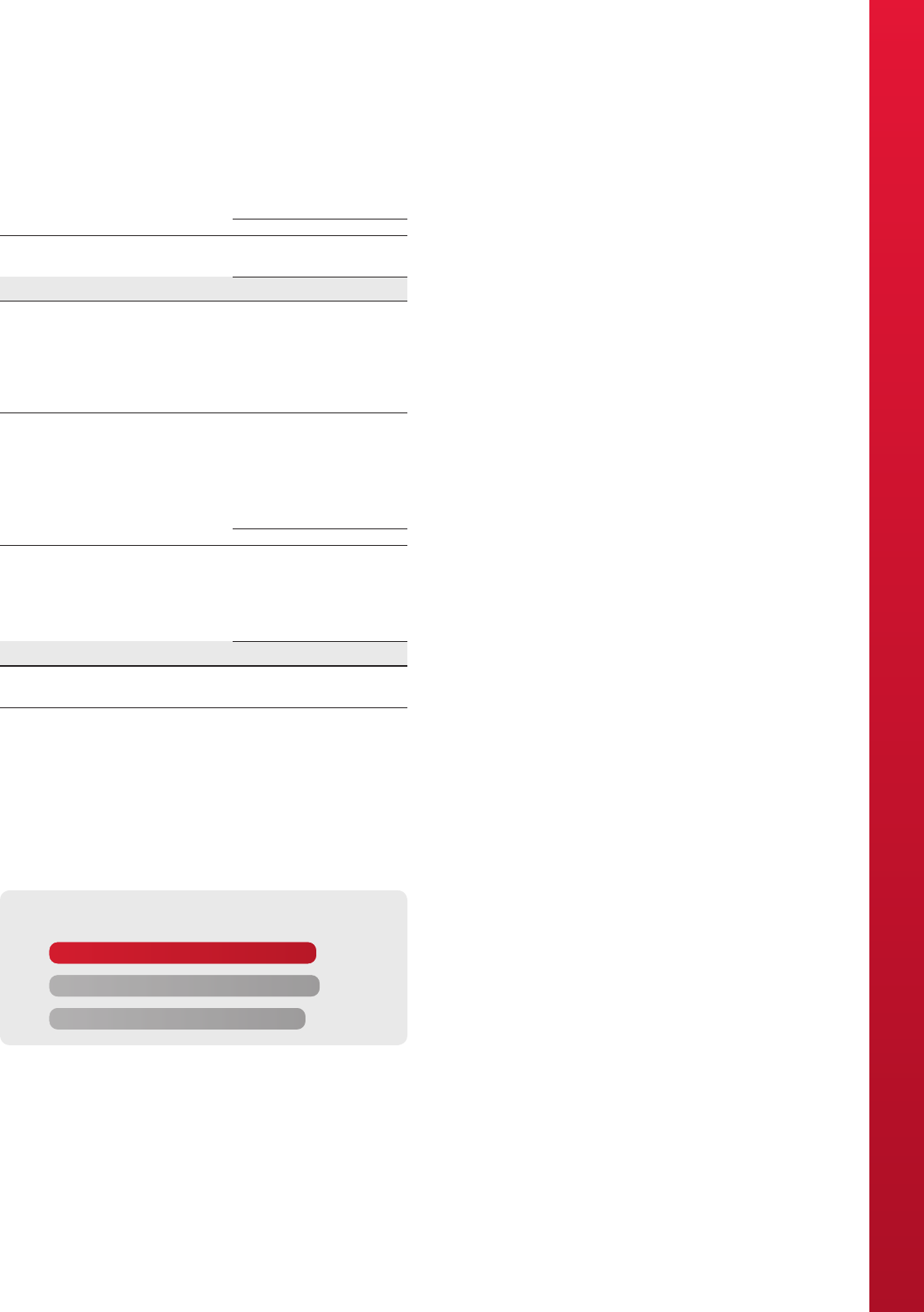

(IN MILLIONS OF DOLLARS)

CONSOLIDATED ADJUSTED NET INCOME

2013

2012

2011

$1,769

$1,781

$1,736

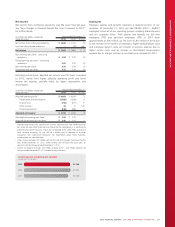

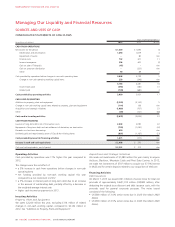

Employees

Employee salaries and benefits represent a material portion of our

expenses. At December 31, 2013, we had 28,026 (2012 – 26,801)

employees across all of our operating groups, including shared services

and the corporate office. Total salaries and benefits for full time

employees (FTE) and part-time employees (PTE) in 2013 were

approximately $1,940 million, up 7%from $1,813 million in 2012 due

to the increase in the number of employees, higher baseball player costs

and employee benefit costs, an increase in pension expense due to

higher service costs, and an increase in stock-based compensation

expense due to a larger increase in our share price compared to 2012.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 53