Rogers 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

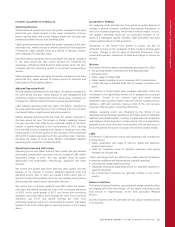

MANAGEMENT’S DISCUSSION AND ANALYSIS

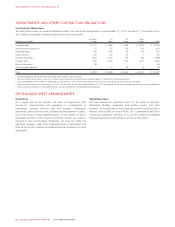

On October 2, 2013, we issued US$1.5 billion of senior notes for total

net proceeds of approximately Cdn$1,528 million (US$1,481 million),

after deducting the original issue discount and debt issuance costs, with

proceeds used for general corporate purposes. The notes issued

consisted of the following:

• US$850 million of 4.1%senior notes due in 2023 (the October 2023

Notes)

• US$650 million of 5.45%senior notes due in 2043 (the October

2043 Notes).

In June 2012, we issued Cdn$1.1 billion senior notes for total net

proceeds of approximately Cdn$1,091 million, after deducting the

original issue discount and debt issuance costs, with the proceeds used

to repay outstanding advances under our bank credit facility and for

general corporate purposes. The notes issued consisted of the

following:

• Cdn$500 million of 3.0%senior notes due 2017 (the June 2017

Notes)

• Cdn$600 million of 4.0%senior notes due 2022 (the June 2022

Notes).

Each of the notes issued in 2013 and 2012 are guaranteed by Rogers

Communications Partnership and rank equally with all of our other

senior unsecured notes and debentures, bank credit and letter of credit

facilities. At December 31, 2013, 100%of the foreign exchange risk on

our US$ denominated senior notes and debentures was hedged against

fluctuations in foreign exchange and interest rates. See “Managing

foreign currency, interest rates and equity compensation” as described

below for information about our hedging transactions.

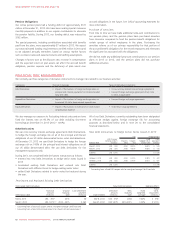

Debt Payments and Related Derivative Settlements

In June 2013, we repaid and bought the entire outstanding principal

amount of our US$350 million ($356 million) 6.25%senior notes.

Concurrent with this repayment, the associated Debt Derivatives were

also settled at maturity, resulting in an aggregate net payment on

settlement of approximately $104 million.

In September 2013, we paid Cdn$263 million to terminate US$1,075

million ($1,360 million) aggregate notional amount of Debt Derivatives

and entered into new Debt Derivatives with a notional amount of

US$1,075 million ($1,110 million) under the same terms, but at the

lower prevailing foreign exchange rate. See “Financial Risk

Management” for further details.

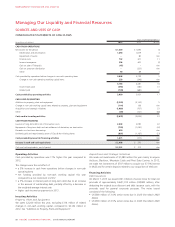

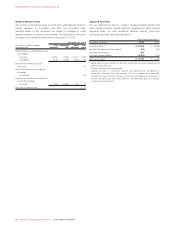

Weighted Average Cost of Debt

Our weighted average cost of debt, including short-term borrowings

was 5.5%with weighted average term to maturity of 11.3 years at

December 31, 2013, compared to 6.1%with a weighted average term

to maturity of 9.2 years at December 31, 2012. This lower average rate

and longer term to maturity primarily reflects the US $2.5 billion of ten

and thirty year notes, issued in 2013 at some of the lowest coupon

rates ever achieved for Rogers corporate debt, combined with the

establishment of our securitization program and the maturity of our

6.25%senior notes due 2013.

(%)

WEIGHTED AVERAGE COST OF LONG-TERM DEBT

2013

2012

2011

5.5%

6.1%

6.2%

Debt Tender Offer

On January 29, 2014, we announced that one of our wholly-owned

subsidiaries had commenced cash tender offers for any and all of our

US $750 million 6.375%senior notes due 2014 and our US $350

million 5.500%senior notes due 2014. The tender offer consideration

will be US$1,000 for each $1,000 principal amount of notes (plus

accrued and unpaid interest to, but not including, the settlement date)

and a consent payment equal to US$2.50 per US$1,000 principal

amount of notes.

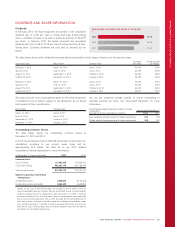

RATIO OF DEBT TO ADJUSTED OPERATING PROFIT

2013

2012

2011

2.4x

2.3x

2.2x

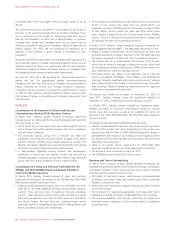

Accounts Receivable Securitization

We received funding of $650 million under our accounts receivable

securitization program during 2013. We have committed funding under

the program up to a maximum of $900 million. We continue to service

and retain substantially all of the risks and rewards relating to the

accounts receivable we sold, and therefore, the receivables remain

recognized on our statement of financial position and the funding

received is recorded as short-term borrowings on our statement of

financial position.

The buyer’s interest in these secured trade receivables ranks ahead of

our interest. The buyer of our trade receivables has no claim on any of

our other assets. The terms of our accounts receivable securitization

program are committed by the participating financial institution until

expiry on December 31, 2015.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 59