Rogers 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

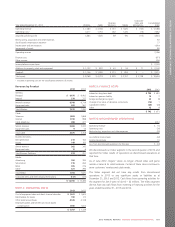

NOTE 18: LONG-TERM DEBT

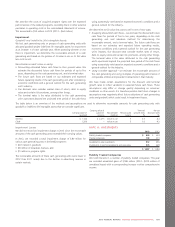

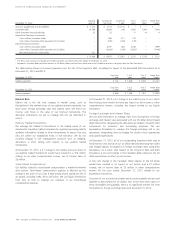

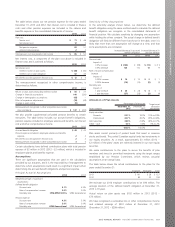

Due

date

Principal

amount

Interest

rate

December 31,

2013

December 31,

2012

Bank credit facility Floating $– $–

Senior notes 12013 $US 350 6.25% –348

Senior notes 22014 US 750 6.375% 798 746

Senior notes 12014 US 350 5.50% 372 348

Senior notes 22015 US 550 7.50% 585 547

Senior notes 12015 US 280 6.75% 298 279

Senior notes 2016 1,000 5.80% 1,000 1,000

Senior notes 2017 500 3.00% 500 500

Senior notes 2018 US 1,400 6.80% 1,489 1,393

Senior notes 2019 500 5.38% 500 500

Senior notes 2020 900 4.70% 900 900

Senior notes 2021 1,450 5.34% 1,450 1,450

Senior notes 2022 600 4.00% 600 600

Senior notes 2023 US 500 3.00% 532 –

Senior notes 2023 US 850 4.10% 904 –

Debentures 12032 US 200 8.75% 213 199

Senior notes 2038 US 350 7.50% 372 348

Senior notes 2039 500 6.68% 500 500

Senior notes 2040 800 6.11% 800 800

Senior notes 2041 400 6.56% 400 400

Senior notes 2043 US 500 4.50% 532 –

Senior notes 2043 US 650 5.45% 691 –

13,436 10,858

Fair value decrement arising from purchase accounting –(1)

Deferred transaction costs and discounts (93) (68)

Less current portion (1,170) (348)

$ 12,173 $ 10,441

1Senior notes and debentures originally issued by Rogers Cable Inc. which are now unsecured obligations of RCI and for which Rogers Communications Partnership (RCP) is an

unsecured guarantor.

2Senior notes originally issued by Rogers Wireless Inc. which are now unsecured obligations of RCI and for which RCP is an unsecured co-obligor.

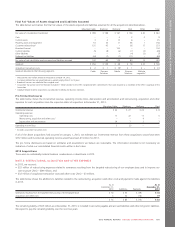

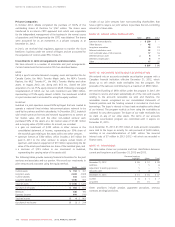

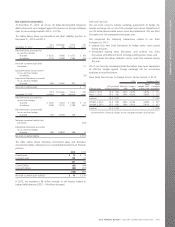

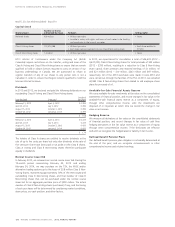

Bank Credit and Letter of Credit Facilities

We have a total of $2.5 billion of bank credit and letter of credit facilities. Each of these facilities is unsecured and guaranteed by RCP and ranks

equally with all of our senior notes and debentures.

As at December 31, 2013, there were no advances outstanding under our $2.0 billion bank credit facility and letters of credit outstanding under

our letter of credit facilities totalled $0.5 billion.

The bank credit facility is available on a fully revolving basis until maturity on July 20, 2017 and there are no scheduled reductions prior to maturity.

The interest rate charged on borrowings from the bank credit facility ranges from nil to 1.25% per annum over the bank prime rate or base rate, or

1.00% to 2.25% over the bankers’ acceptance rate or London Inter-Bank Offered Rate.

Senior Notes

Interest is paid semi-annually on all of our senior notes and debentures. We have the option to redeem each of our senior notes and debentures, in

whole or in part, at any time, if we pay the specified premium.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 111