Rogers 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

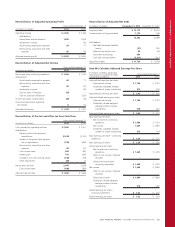

ADDITIONAL GAAP MEASURES

We include operating income as an additional GAAP measure in our consolidated statements of income because we believe it is a representative of

our normal course operating activities, provides relevant information that can be used to assess our consolidated performance, and is meaningful to

investors. We calculate it by taking revenue and deducting operating expenses, including restructuring, acquisition and other expenses, and

depreciation and amortization as shown in our consolidated statements of income.

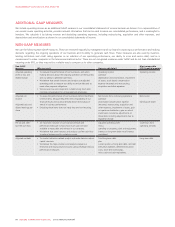

NON-GAAP MEASURES

We use the following Non-GAAP measures. These are reviewed regularly by management and our Board in assessing our performance and making

decisions regarding the ongoing operations of our business and its ability to generate cash flows. These measures are also used by investors,

lending institutions and credit rating agencies as an indicator of our operating performance, our ability to incur and service debt, and as a

measurement to value companies in the telecommunications sector. These are not recognized measures under GAAP and do not have standardized

meaning under IFRS, so they may not be a reliable way to compare us to other companies.

Non-GAAP

measure Why we use it How we calculate it Most comparable

IFRSfinancial measure

Adjusted operating

profit or loss and

related margin

• To evaluate the performance of our businesses, and when

making decisions about the ongoing operations of the business

and our ability to generate cash flows.

• We believe that certain investors and analysts use adjusted

operating profit to measure our ability to service debt and to

meet other payment obligations.

• We also use it as one component in determining short-term

incentive compensation for all management employees.

Operating income

add back

depreciation and amortization, impairment

of assets, stock-based compensation

expense (recovery) and restructuring,

acquisition and other expenses

Operating income

Adjusted net

income

Adjusted basic and

diluted earnings per

share

• To assess the performance of our businesses before the effects

of these items, because they affect the comparability of our

financial results and could potentially distort the analysis of

trends in business performance.

• Excluding these items does not imply they are non-recurring.

Net income from continuing operations

add back

stock-based compensation expense

(recovery), restructuring, acquisition and

other expenses, impairment of assets, gain

on spectrum distribution, gain on sale of

investment, income tax adjustments on

these items including adjustments due to

legislative change

Net income

Earnings per share

Pre-tax and after-

tax free cash flow

• An important indicator of our financial strength and

performance because it shows how much cash we have

available to repay debt and reinvest in our company.

• We believe that some investors and analysts use free cash flow

to value a business and its underlying assets.

Adjusted operating profit

minus

spending on property, plant and equipment,

interest on long-term debt net of interest

capitalized

Cash flows from

operating activities

Adjusted net debt • To conduct valuation-related analysis and make decisions about

capital structure.

• We believe this helps investors and analysts analyze our

enterprise and equity value and assess various leverage ratios as

performance measures.

Total long-term debt

plus

current portion of long-term debt, net Debt

Derivatives liabilities, deferred transaction

costs, short-term borrowings,

minus cash and cash equivalents.

Long-term debt

84 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT