Rogers 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Business Solutions generates revenue from services and equipment

sales.

Next generation revenue is generated by the provision of high-speed,

high-reliability data and voice communications, provided on Rogers

advanced IP and Ethernet and Cloud platforms and mainly over the

extensive Rogers fibre, cable and wireless networks. Next generation

revenue also includes Data Centre services revenue from the 2013 dates

of business acquisitions.

Legacy revenue is generated mainly by long distance, switched voice

services and lower speed data communications, provided over TDM and

end of life data platforms with client access primarily delivered through

the use of third-party networks and tariffed ILEC services.

Business Solutions continues to focus mainly on next generation IP-

based services, and on leveraging higher margin on-net and near-net

service revenue opportunities, using existing network facilities to

expand offerings to the medium and large sized enterprise, public

sector and carrier markets. Next generation services now represent 59%

of total service revenue.

Revenue from the lower margin off-net legacy business generally

includes local and long-distance voice services and legacy data services

which often use facilities that are leased rather than owned.

Following our recent data centre business acquisitions, Business

Solutions is now also focused on data centre colocation, hosting, cloud

and disaster recovery services.

Higher Operating Revenue

Operating revenue was 7%higher this year compared to last year, the

net result of:

• higher revenue from next generation services, which grew by 31%,

reflecting the impact of our acquisitions of Blackiron and Pivot Data

Centres

• continued execution of our plan to grow higher margin on-net and

next generation IP-based services revenue

• partially offset by ongoing decline in the legacy voice and data

business, a trend management expects to continue as customers

move to faster and more reliable IP services.

Higher Operating Expenses

We assess Business Solutions operating expenses in two categories:

• the cost of operating and maintaining telecom and data networking

equipment

• all other expenses involved in day-to-day operations, to service

existing subscriber relationships and attract new subscribers.

Operating expenses were higher this year, the net result of:

• higher expenses related to our data centre acquisitions

• partially offset by expected lower legacy service-related costs related

to lower volumes and customer levels and ongoing initiatives to

improve costs and productivity.

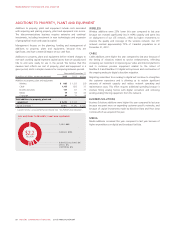

Higher Adjusted Operating Profit

Adjusted operating profit was 19%higher this year because of the

contribution of new data centres, the ongoing growth in the higher

margin on-net next generation business and cost efficiencies.

Excluding the impact of the Blackiron and Pivot Data Centres

acquisitions:

• operating revenue would have been 3%lower this year compared to

last year, instead of 7%higher as reported

• adjusted operating profit would have been 11%higher this year

compared to last year, instead of 19%higher as reported

We continue to work on data centre business integration and the

optimization of Business Solutions’ overall cost structures.

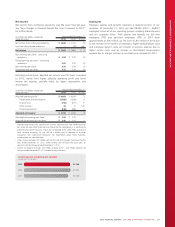

(IN MILLIONS OF DOLLARS)

BUSINESS SOLUTIONS ADJUSTED OPERATING PROFIT

2013

2012

2011

$106

$89

$86

46 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT