Rogers 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

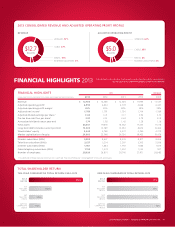

FINANCIAL HIGHLIGHTS 2013

2013 CONSOLIDATED REVENUE AND ADJUSTED OPERATING PROFIT PROFILE

REVENUE ADJUSTED OPERATING PROFIT

(IN MILLIONS OF DOLLARS, EXCEPT PER SHARE, SUBSCRIBER AND EMPLOYEE DATA) 2013 2012 2011 2010 2009

Revenue $ 12,706 $ 12,486 $ 12,346 $ 11,999 $ 11,537

Adjusted operating profit 1 4,993 4,834 4,739 4,668 4,407

Adjusted operating profit margin 1 39% 39% 38% 39% 38%

Adjusted net income 1 1,769 1,781 1,736 1,704 1,569

Adjusted diluted earnings per share 1 3.42 3.41 3.17 2.94 2.53

Pre-tax free cash flow per share 1 3.97 3.91 3.63 3.79 3.09

Annualized dividend rate at year-end 1.74 1.58 1.42 1.28 1.16

Total assets 23,601 19,618 18,362 17,033 17,018

Long-term debt (includes current portion) 13,343 10,789 10,034 8,654 8,464

Shareholders’ equity 4,669 3,768 3,572 3,760 4,273

Market capitalization of equity 24,903 23,346 20,736 19,435 19,476

Wireless subscribers (000s) 9,503 9,437 9,335 8,977 8,494

Television subscribers (000s) 2,127 2,214 2,297 2,305 2,296

Internet subscribers (000s) 1,961 1,864 1,793 1,686 1,619

Cable telephony subscribers (000s) 1,153 1,074 1,052 1,003 937

Number of employees 28,026 26,801 28,745 27,971 28,985

FINANCIAL HIGHLIGHTS

TOTAL SHAREHOLDER RETURN

TEN-YEAR COMPARATIVE TOTAL RETURN: 2004–2013 ONE-YEAR COMPARATIVE TOTAL RETURN: 2013

IFRS CDN GAAP

FOR A DETAILED DISCUSSION OF OUR FINANCIAL AND OPERATING METRICS AND RESULTS,

PLEASE SEE THE ACCOMPANYING MD&A LATER IN THIS REPORT.

TSX

TELECOM

INDEX 193%

S&P

TELECOM

INDEX 119%

S&P/TSX

COMPOSITE

INDEX 115%

TSX

TELECOM

INDEX 11%

S&P

TELECOM

INDEX 11%

S&P/TSX

COMPOSITE

INDEX 13%

RCI.B

ON TSX

RCI.B

ON TSX

470% 11%

WIRELESS 57%

CABLE 27%

MEDIA 13%

BUSINESS SOLUTIONS 3%

$12.7

BILLI

O

N$5.0

BILLI

O

N

WIRELESS 61%

MEDIA 4%

BUSINESS SOLUTIONS 2%

CABLE 33%

1 For a definition of these measures (which are non-GAAP) see “Non-GAAP Measures” in Management’s Discussion and Analysis.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 01