Rogers 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Network revenue was higher this year compared to last year. This was

the net effect of:

• higher data revenue related to an increase in subscriber levels and

higher usage of wireless data services

• partially offset by our introduction of new lower priced US and

international roaming plans and rates which offer consumers more

value, and

• the continued adoption of customer friendly simplified plans, which

often bundle in certain features like voicemail, caller ID and long

distance that we have charged for separately in the past.

Excluding the decline in US and international roaming revenue this year,

network revenue would have increased 1%.

Data revenue was 17%higher this year mainly because of the

continued penetration and growing use of smartphones, tablet devices

and wireless laptops, which increased the use of e-mail, wireless,

Internet access, text messaging and other wireless data services. Data

revenue represented approximately 47%of total network revenue this

year, compared to approximately 41%last year.

Postpaid churn was 1.24%this year, compared to 1.29%in 2012. The

lower churn rate is partly attributable to the new simplified plans and

the roaming plans we introduced.

Gross postpaid subscriber additions were 1.4 million this year, or 3%

lower than last year, which reduced net postpaid subscriber additions to

228,000, despite a lower postpaid churn. We believe the industry

transition from three year to two year plans resulting from the recent

adoption of the Canadian Radio-television and Telecommunications

Commission (CRTC) Wireless Code may have slowed our overall

wireless subscriber growth from the second half of the year. See

“Regulation in Our Industry” for more information on the Wireless

Code.

We activated and upgraded approximately 2.7 million smartphones this

year, compared to approximately 2.9 million in 2012. Approximately

34%of these were for new subscribers. The decrease was mainly

because there was a 10%reduction in hardware upgrades by existing

subscribers during the year, which we also believe is at least partly due

to the move from three to two year contracts and the associated pricing

changes.

The percentage of subscribers with smartphones increased to 75%of

our overall postpaid subscriber base, compared to 69%at the end of

2012. Smartphone subscribers typically generate significantly higher

ARPU and are less likely to churn.

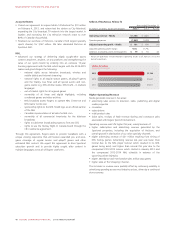

(%)

SMARTPHONES AS A PERCENTAGE OF POSTPAID SUBSCRIBERS

2013

2012

2011

75%

69%

56%

The decrease in prepaid subscriber net additions was mainly because of

increasing competition at the lower end of the wireless market where

prepaid products are mainly sold.

Blended ARPU was down slightly this year compared to last year because

the voice component declined at a faster rate than the data component

increased.

(IN MILLIONS OF DOLLARS)

WIRELESS DATA REVENUE

2013

2012

2011

$3,175

$2,722

$2,325

(%)

DATA REVENUE PERCENT OF BLENDED ARPU

2013

2012

2011

47%

41%

35%

Lower Equipment Sales

Equipment sales (net of subsidies) include revenue from sales to:

• independent dealers, agents and retailers

• directly to subscribers through fulfillment by Wireless’ customer

service groups, websites, telesales and corporate stores.

Revenue from equipment sales was lower this year, mainly because

fewer existing subscribers upgraded their devices and there were fewer

gross activations.

Lower Operating Expenses

We assess operating expenses in two categories:

• the cost of wireless handsets and equipment

• all other expenses involved in day-to-day operations, to service

existing subscriber relationships and attract new subscribers.

The cost of equipment was $50 million lower than last year, or 3%,

mainly because fewer existing subscribers upgraded hardware and

fewer new customers were added during the year as discussed above.

We activated and upgraded fewer devices compared to 2012.

Total customer retention spending (including subsidies on handset

upgrades) was $939 million, 0.3%lower than last year. The reduction

was mainly because fewer existing subscribers upgraded their hardware

as discussed above, which we partially attribute to the recent shift to

two year contracts.

Other operating expenses (excluding retention spending), were down

slightly from 2012, due to a continued focus on cost productivity

initiatives we are implementing across various functions.

Higher Adjusted Operating Profit

Adjusted operating profit was 3%higher this year compared to last

year because of continued growth of wireless data, our improvements

in cost management and efficiency and lower volumes of hardware

sales and upgrades. Adjusted operating profit margin as a percentage

of network revenue increased this year to 46.8%from 45.6%in 2012.

(IN MILLIONS OF DOLLARS)

WIRELESS ADJUSTED OPERATING PROFIT

2013

2012

2011

$3,157

$3,063

$3,036

40 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT