Rogers 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

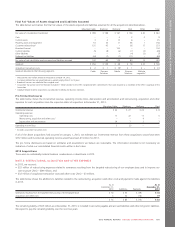

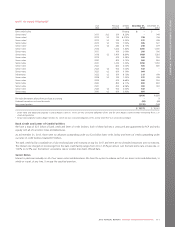

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

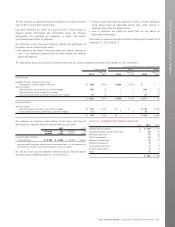

December 31, 2012

Carrying

amount

Contractual

cash flows

Less than

1 year

1to3

years

4to5

years

More than

5 years

Accounts payable and accrued liabilities $ 2,135 $ 2,135 $ 2,135 $ – $ – $ –

Long-term debt 10,789 10,858 348 1,920 1,500 7,090

Other long-term financial liabilities 33 33 – 17 10 6

Expenditure Derivative instruments:

Cash outflow (Canadian dollar) – 366 231 135 – –

Cash inflow (Canadian dollar equivalent of US dollar) – (378) (239) (139) – –

Debt Derivative instruments:

Cash outflow (Canadian dollar) – 4,797 460 2,338 – 1,999

Cash inflow (Canadian dollar equivalent of US dollar) – (4,208) 2(348) 2(1,920) 2– (1,940) 2

Net carrying amount of Derivatives 511

$ 13,468 $ 13,603 $ 2,587 $ 2,351 $ 1,510 $ 7,155

1The terms of our accounts receivable securitization program are committed until it expires on December 31, 2015.

2Represents Canadian dollar equivalent amount of US dollar inflows matched to an equal amount of US dollar maturities in long-term debt for Debt Derivatives.

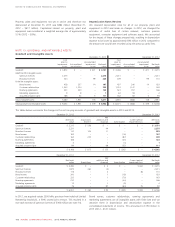

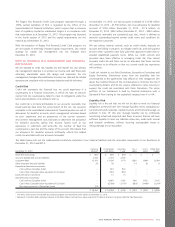

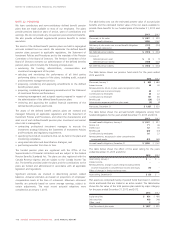

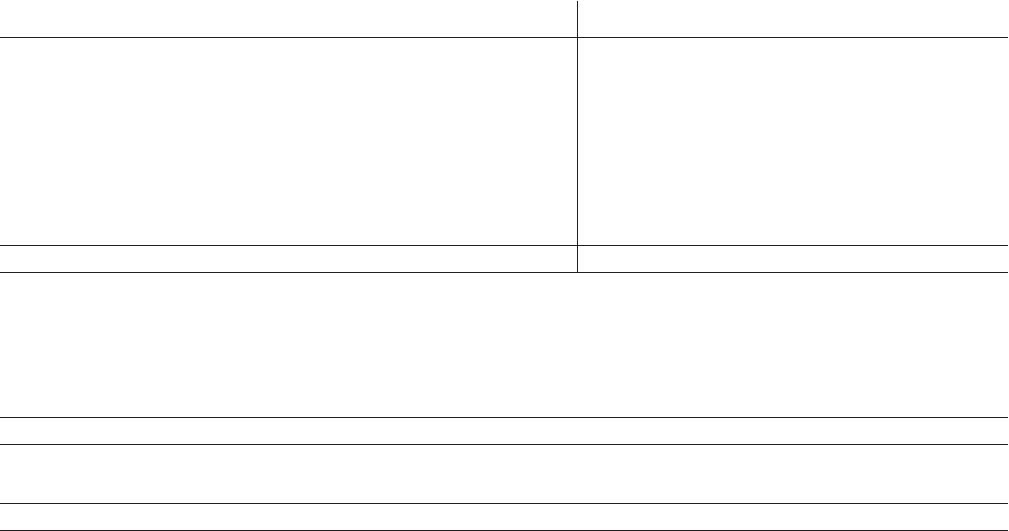

The tables below shows net interest payments over the life of the long-term debt, including the impact of the associated Debt Derivatives as at

December 31, 2013 and 2012:

December 31, 2013

Less than

1 year

1to3

years

4to5

years

More than

5 years

Interest payments $ 743 $ 1,258 $ 1,093 $ 5,341

December 31, 2012

Less than

1 year

1to3

years

4to5

years

More than

5 years

Interest payments $ 686 $ 1,168 $ 901 $ 3,929

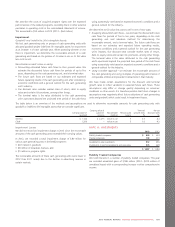

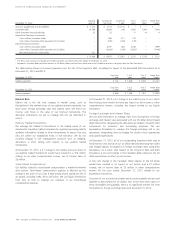

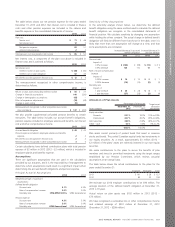

Market Risk

Market risk is the risk that changes in market prices, such as

fluctuations in the market prices of our publicly traded investments, our

share price, foreign exchange rates and interest rates, will affect our

income, cash flows or the value of our financial instruments. The

derivative instruments we use to manage this risk are described in

note 2.

Publicly Traded Investments

We manage risk related to fluctuations in the market prices of our

investments in publicly traded companies by regularly reviewing publicly

available information related to these investments to ensure that any

risks are within our established levels of risk tolerance. We do not

routinely engage in risk management practices such as hedging,

derivatives or short selling with respect to our publicly traded

investments.

At December 31, 2013, a $1 change in the market price per share of

our publicly traded investments would have resulted in a $14 million

change in our other comprehensive income, net of income taxes of

$2 million.

Stock-Based Compensation

Our liability related to stock-based compensation is marked-to-market

each period. Stock-based compensation expense is affected by the

change in the price of our Class B Non-Voting shares during the life of

an award, including SARs, RSUs and DSUs. We use Equity Derivatives

from time to time to manage our exposure in our stock-based

compensation expense.

At December 31, 2013, a $1 change in the market price of our Class B

Non-Voting shares would not have any impact on net income or other

comprehensive income, including the impact related to our Equity

Derivatives.

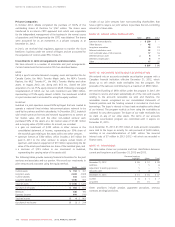

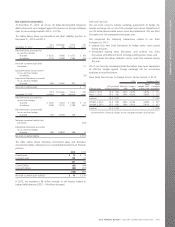

Foreign Exchange and Interest Rates

We use Debt Derivatives to manage risks from fluctuations in foreign

exchange and interest rates associated with our US dollar denominated

debt instruments, designating the derivatives as hedges of specific debt

instruments for economic and accounting purposes. We use

Expenditure Derivatives to manage the foreign exchange risk in our

operations, designating them as hedges for certain of our operational

and capital expenditures.

At December 31, 2013, all of our outstanding long-term debt was at

fixed interest rates and all of our US dollar-denominated long-term debt

was hedged against fluctuations in foreign exchange rates using Debt

Derivatives. As a result, with respect to the long-term debt and Debt

Derivatives, a one cent change in the Canadian dollar relative to the US

dollar would have no effect on net income.

A one cent change in the Canadian dollar relative to the US dollar

would have resulted in no impact to net income and a $7 million

change, net of income taxes of $2 million, in other comprehensive

income for the year ended December 31, 2013 related to our

Expenditure Derivatives.

A portion of our accounts receivable and accounts payable and accrued

liabilities is denominated in US dollars. Due to the short-term nature of

these receivables and payables, there is no significant market risk from

fluctuations in foreign exchange rates as at December 31, 2013.

114 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT