Rogers 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 27: COMMITMENTS AND CONTINGENT LIABILITIES

Commitments

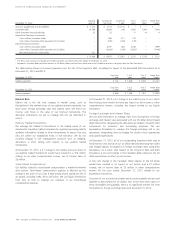

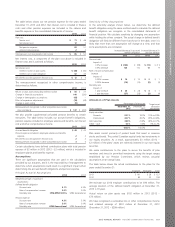

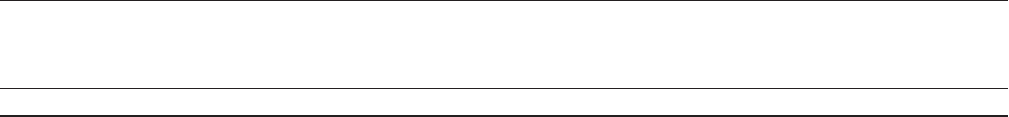

The table below shows the future minimum payments under operating leases and other contractual arrangements at December 31, 2013:

(In millions of dollars)

Less than

1 year 1-3 years 4-5 years

After

5 years Total

Operating leases $ 136 $ 194 $ 95 $ 95 $ 520

Player contracts 136 132 33 7 308

Purchase obligations 1,670 1,019 149 160 2,998

Program rights 699 1,018 974 3,471 6,162

$ 2,641 $ 2,363 $ 1,251 $ 3,733 $ 9,988

Operating leases are for office premises and retail outlets across the

country. The majority of the lease terms range from five to ten years.

Rent expense for 2013 was $198 million (2012 – $189 million).

Player contracts are Blue Jays players’ salary contracts we have entered

into and are contractually obligated to pay.

Purchase obligations are the contractual obligations under service,

product and handset contracts that we have committed to for at least

the next five years.

Program rights are the agreements we have entered into to acquire

broadcasting rights for sports broadcasting programs and films for

periods ranging from one to twelve years.

Contingent Liabilities

We have the following contingent liabilities as at December 31, 2013:

System Access Fee – Saskatchewan

In 2004, a class action commenced against providers of wireless

communications in Canada under the Class Actions Act (Saskatchewan).

The class action related to the system access fee wireless carriers

charged to some of their customers. The plaintiffs are seeking

unspecified damages and punitive damages, which would effectively be

a reimbursement of all system access fees collected.

In 2007, the Saskatchewan Court granted the plaintiffs’ application to

have the proceeding certified as a national, “opt-in” class action where

affected customers outside Saskatchewan must take specific steps to

participate in the proceeding. In 2008, our motion to stay the

proceeding based on the arbitration clause in our wireless service

agreements was granted. The Saskatchewan Court directed that its

order, in respect of the certification of the action, would exclude

customers who are bound by an arbitration clause from the class of

plaintiffs.

We appealed the 2007 certification decision, however, it was dismissed

by the Saskatchewan Court of Appeal and leave to appeal to the

Supreme Court of Canada was denied.

In 2012, the plaintiffs applied for an order seeking to extend the time

they can appeal the “opt-in” decision of the Saskatchewan Court. In

March 2013, the Saskatchewan Court of Appeal denied the plaintiffs’

application.

In August 2009, counsel for the plaintiffs began a second proceeding

under the Class Actions Act (Saskatchewan) asserting the same claims

as the original proceeding. If successful, this second class action would

be an “opt-out’ class proceeding. This second proceeding was ordered

conditionally stayed in 2009 on the basis that it was an abuse of

process.

In April 2013, the plaintiffs applied for an order to be allowed to

proceed with the second system access fee class action. In August

2013, the court denied this application and the second action remains

conditionally stayed. In December 2013 the plaintiff applied for an

order permitting them to amend the Statement of Claim to reintroduce

the claims they were not permitted to proceed with in the 2007

certification decision. We are awaiting the decision of the

Saskatchewan Court. We have not recorded a liability for this

contingency.

System Access Fee – British Columbia

In December 2011, a class action was launched in British Columbia

against providers of wireless communications in Canada about the

system access fee wireless carriers charge to some of their customers.

The class action relates to allegations of misrepresentations contrary to

the Business Practices and Consumer Protection Act (British Columbia),

among other things. The plaintiffs are seeking unspecified damages and

restitution. A certification hearing is scheduled for April 2014. We have

not recorded a liability for this contingency.

911 Fee

In June 2008, a class action was launched in Saskatchewan against

providers of wireless communications services in Canada. It involves

allegations of breach of contract, misrepresentation and false

advertising, among other things, in relation to the 911 fee that had

been charged by us and the other wireless communication providers in

Canada. The plaintiffs are seeking unspecified damages and restitution.

The plaintiffs intend to seek an order certifying the proceeding as a

national class action in Saskatchewan. We have not recorded a liability

for this contingency.

Cellular Devices

In July 2013, a class action was launched in British Columbia against

providers of wireless communications in Canada and manufacturers of

wireless devices. The class action relates to the alleged adverse health

effects incurred by long-term users of cellular devices. The plaintiffs are

seeking unspecified damages and punitive damages, effectively equal to

the reimbursement of the portion of revenues the defendants have

received that can reasonably be attributed to the sale of cellular phones

in Canada. We have not recorded a liability for this contingency.

Income and Indirect Taxes

We provide for income and indirect taxes based on all of the

information that is currently available and believe that we have

adequately provided these items. The calculation of applicable taxes in

many cases, however, requires significant judgment in interpreting tax

rules and regulations. Our tax filings are subject to audits, which could

materially change the amount of current and deferred income tax assets

and liabilities and provisions, and could, in certain circumstances, result

in the assessment of interest and penalties.

124 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT