Rogers 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Issuance of Senior Notes

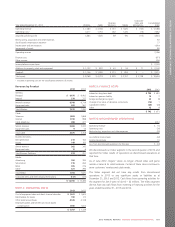

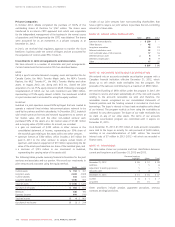

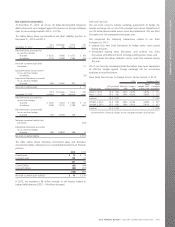

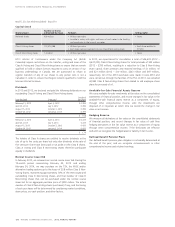

The table below provides a summary of the senior notes that we issued in 2013 and 2012.

Date Issued Principal amount Due date Interest rate

Discount at

issuance

Total gross

proceeds 1

Transaction costs

and discounts 2

2013 Issuances

March 7, 2013 US $ 500 2023 3.00% 99.845%

March 7, 2013 US $ 500 2043 4.50% 99.055%

Subtotal US $ 1,000 Cdn $1,030 Cdn $15

October 2, 2013 US $ 850 2023 4.10% 99.813%

October 2, 2013 US $ 650 2043 5.45% 99.401%

Subtotal US $ 1,500 Cdn $1,548 Cdn $20

2012 Issuances

June 4, 2012 Cdn $ 500 2017 3.00% 99.921%

June 4, 2012 Cdn $ 600 2022 4.00% 99.600%

Subtotal Cdn $1,100 Cdn $1,100 Cdn $ 9

1Gross proceeds before transaction costs and discounts.

2Transaction costs and discounts are included as deferred transaction costs in the carrying value of the long-term debt, and recognized in net income using the effective interest

method.

Each of the above senior notes are unsecured and guaranteed by RCP,

ranking equally with all of RCI’s other senior notes and debentures,

bank credit and letter of credit facilities. We use derivatives to hedge

the foreign exchange risk associated with the principal and interest

components of all our US dollar denominated senior notes and

debentures (see note 20).

Repayment of Senior Notes and Related Derivative Settlements

In June 2013, we repaid or bought the entire outstanding principal

amount of our US $350 million ($356 million) senior notes due 2013.

At the same time, the associated Debt Derivatives were also settled at

maturity. See note 20 for more information about our Debt Derivatives.

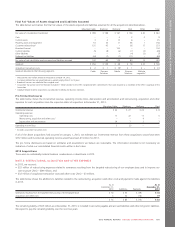

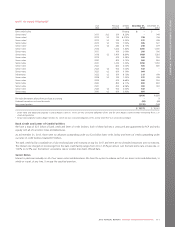

Principal Repayments

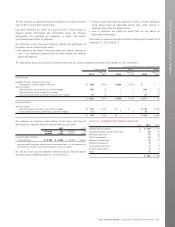

The table below shows the principal repayments on our long-term debt

due in each of the next five years and thereafter as at December 31, 2013.

2014 $ 1,170

2015 883

2016 1,000

2017 500

2018 1,489

Thereafter 8,394

$ 13,436

Foreign Exchange

We recorded $23 million in foreign exchange losses in 2013 (2012 –

$9 million gain) in finance costs in the consolidated statements of

income. These were related to the translation of long-term debt that

was not hedged on an accounting basis.

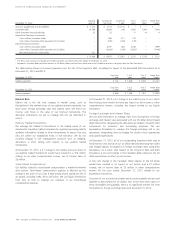

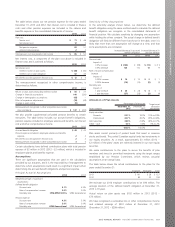

Weighted Average Interest Rate

Our effective weighted average rate on all debt and short-term borrowings,

as at December 31, 2013, including the effect of all of the associated Debt

Derivative instruments (see note 20), was 5.5% (2012 – 6.1%).

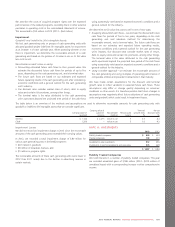

Terms and Conditions

The provisions of our $2.0 billion bank credit facility described above

impose certain restrictions on our operations and activities, the most

significant of which are leverage related maintenance tests.

The 8.75% debentures due in 2032 contain debt incurrence tests and

restrictions on additional investments, sales of assets and payment of

dividends, all of which are suspended in the event the public debt

securities are assigned investment grade ratings by at least two of three

specified credit rating agencies. As at December 31, 2013, these public

debt securities were assigned an investment grade rating by each of the

three specified credit rating agencies and, accordingly, these restrictions

have been suspended as long as the investment grade ratings are

maintained. Our other senior notes do not have any of these

restrictions, regardless of the related credit ratings.

The repayment dates of certain debt agreements can also be

accelerated if there is a change in control of RCI.

At December 31, 2013 and 2012, we were in compliance with all

financial covenants, financial ratios and all of the terms and conditions

of our long-term debt agreements.

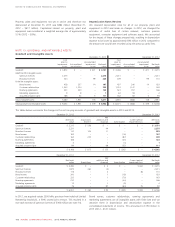

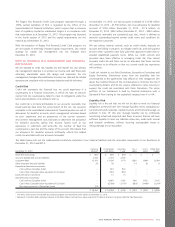

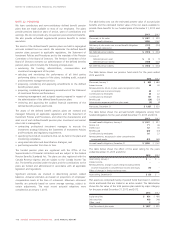

NOTE 19: CAPITAL RISK MANAGEMENT

Our objectives in managing capital are to ensure we have sufficient

liquidity to meet all of our commitments and to execute our business

plan. We define capital that we manage as shareholders’ equity

(including issued capital, share premium, retained earnings, hedging

reserve and available-for-sale financial assets reserve) and indebtedness

(including current portion of our long-term debt, long-term debt and

short-term borrowings).

We manage our capital structure commitments and maturities and make

adjustments based on general economic conditions, financial markets

and operating risks and our investment and working capital

requirements. To maintain or adjust our capital structure, we may, with

approval from our Board of Directors, issue or repay debt and/or short-

term borrowings, issue shares, repurchase shares, pay dividends or

undertake other activities as deemed appropriate under the

circumstances. The board reviews and approves any material transactions

that are not part of the ordinary course of business, including proposals

for acquisitions or other major investments or divestitures, financing

transactions and annual capital and operating budgets.

We monitor debt leverage ratios such as adjusted net debt to adjusted

operating profit as part of the management of liquidity and

shareholders’ return to sustain future development of the business,

conduct valuation-related analyses and make decisions about capital.

112 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT