Rogers 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

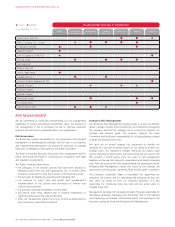

MANAGEMENT’S DISCUSSION AND ANALYSIS

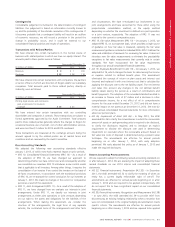

AUDIT CORPORATE

GOVERNANCE

NOMINATINGHUMAN

RESOURCES

EXECUTIVE FINANCEPENSION

CHAIR MEMBER BOARD OF DIRECTORS AND ITS COMMITTEES

AS OF FEBRUARY 11, 2014

AlanD.Horn

John A. MacDonald

Isabelle Marcoux

ThomasI.Hull

Peter C. Godsoe, O.C., O. Ont.

C. William D. Birchall

Stephen A. Burch

John H. Clappison, FCPA, FCA

Guy Laurence

Philip B. Lind, CM

The Hon. David R. Peterson, PC, QC

Edward S. Rogers

LorettaA. Rogers

MarthaL. Rogers

MelindaM. Rogers

Dr. Charles Sirois

John H. Tory, O. Ont.

, CPA, CA

RISK MANAGEMENT

We are committed to continually strengthening our risk management

capabilities to protect and enhance shareholder value. The purpose of

risk management is not to eliminate risk but to optimize trade-offs

between risk and return to maximize value to the organization.

Risk Governance

The Board has overall responsibility for risk governance and oversees

management in identifying the principal risks we face in our business

and implementing appropriate risk assessment processes to manage

these risks. It delegates certain duties to the Audit Committee.

The Audit Committee discusses risk policies with management and the

Board, and assists the Board in overseeing our compliance with legal

and regulatory requirements.

The Audit Committee also reviews:

• the adequacy of the internal controls that have been adopted to

safeguard assets from loss and unauthorized use, to prevent, deter

and detect fraud and to verify the accuracy of the financial records

• the processes for identifying, assessing and managing risks

• our exposure to major risks and trends and management’s

implementation of risk policies and procedures to monitor and

control these exposures

• our business continuity and disaster recovery plans

• any special audit steps adopted due to material weaknesses or

significant deficiencies that may be identified

• other risk management matters from time to time as determined by

the Committee or directed by the Board.

Enterprise Risk Management

Our Enterprise Risk Management program seeks to ensure we identify,

assess, manage, monitor and communicate risk consistently throughout

the company and that we manage risk in a way that supports our

strategic and business goals. This program supports the Audit

Committee and the Board’s responsibility for risk by facilitating a formal

strategic risk assessment process.

We carry out an annual strategic risk assessment to identify our

principal risks and their potential impact on our ability to achieve our

strategic plans. This assessment includes reviewing risk reports, audit

reports and industry benchmarks, and interviewing key risk owners. We

also conduct a formal survey every two years to get management

feedback on the key risks facing the organization and identify emerging

risks. Then we prioritize the risks using standard risk assessment criteria.

Enterprise Risk Management reports the results of the strategic risk

assessment to the Executive Leadership Team and the Audit Committee.

The Executive Leadership Team is responsible for approving our

enterprise risk policies and for identifying and assessing the key risks

that affect our ability to meet our corporate objectives. It is also

responsible for monitoring these key risks and our action plans to

mitigate these risks.

Management develops risk management plans. They are responsible for

identifying, assessing, managing and monitoring risks in the business

units impacting our strategic and business plans, and reporting to the

Executive Leadership Team and Enterprise Risk Management.

72 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT