Rogers 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

retrospectively. We are assessing the impact of this amendment on

our consolidated financial statements.

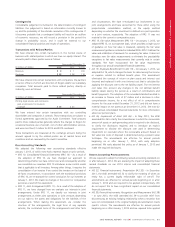

•IFRIC 21, Levies (IFRIC 21) – In May 2013, the IASB issued a new

accounting guidance IFRIC 21, which provides guidance on when to

recognize a liability for a levy imposed by a government, both for

levies that are accounted for in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets and those where the

timing and amount of the levy is certain. The Interpretation identifies

the obligating event for the recognition of a liability as the activity

that triggers the payment of the levy in accordance with the relevant

legislation. It provides the following guidance on recognition of a

liability to pay levies (i) the liability is recognized progressively if the

obligating event occurs over a period of time, and (ii) if an obligation

is triggered on reaching a minimum threshold, the liability is

recognized when that minimum threshold is reached. The standard is

effective for annual periods beginning on or after January 1, 2014,

with early adoption permitted. We are assessing the impact of this

new standard on our consolidated financial statements.

•IFRS 9, Financial Instruments (IFRS 9) – In October 2010, the IASB

issued IFRS 9, which replaces IAS 39, Financial Instruments:

Recognition and Measurement, establishes principles for the financial

reporting of financial assets and financial liabilities that will present

relevant and useful information to users of financial statements for

their assessment of the amounts, timing and uncertainty of an

entity’s future cash flows. This new standard also includes a new

general hedge accounting standard which will align hedge

accounting more closely with risk management. It does not

fundamentally change the types of hedging relationships or the

requirement to measure and recognize ineffectiveness, however it

will provide more hedging strategies that are used for risk

management to qualify for hedge accounting and introduce more

judgment to assess the effectiveness of a hedging relationship. The

mandatory effective date of IFRS 9 has not yet been communicated

by the IASB. We are assessing the impact of this new standard on its

consolidated financial statements.

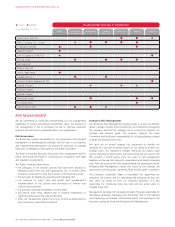

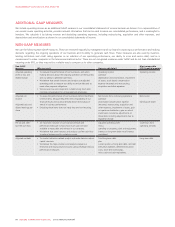

KEY PERFORMANCE INDICATORS

We measure the success of our strategy using a number of key

performance indicators, which are outlined below. We believe these key

performance indicators allow us to appropriately measure our

performance against our operating strategy as well as against the

results of our peers and competitors. The following key performance

indicators are not measurements in accordance with IFRS and should

not be considered as an alternative to net income or any other measure

of performance under IFRS.

Subscriber Counts

We determine the number of subscribers to our services based on active

subscribers. When subscribers are deactivated, either voluntarily or

involuntarily for non-payment, they are considered to be deactivations

in the period the services are discontinued.

Wireless

• A wireless subscriber is represented by each identifiable telephone

number.

• We report wireless subscribers in two categories: postpaid and

prepaid. Postpaid and prepaid include voice-only subscribers, data-

only subscribers, and subscribers with service plans integrating both

voice and data.

• Wireless prepaid subscribers are considered active for a period of 180

days from the date of their last revenue-generating usage.

Cable

• Cable Television and Internet subscribers are represented by a

dwelling unit, and cable Phone subscribers are represented by line

counts.

• When there is more than one unit in one dwelling, like an apartment

building, each tenant with cable service is counted as an individual

subscriber, whether the service is invoiced separately or included in

the tenant’s rent. Institutional units, like hospitals or hotels, are each

considered to be one subscriber.

• Cable Television, Internet, and Phone subscribers include only those

subscribers who have service installed and operating, and who are

being billed accordingly.

Subscriber Churn

Subscriber churn is a measure of the number of subscribers that

deactivated as a percentage of the total subscriber base, usually

calculated on a monthly basis. Subscriber churn tells us our success in

retaining our subscribers. We calculate it by dividing the number of

Wireless subscribers that deactivated (usually in a month) by the

aggregate numbers of subscribers at the beginning of the period. When

used or reported for a period greater than one month, subscriber churn

represents the sum of the number of subscribers deactivating for each

period incurred divided by the sum of the aggregate number of

subscribers at the beginning of each period incurred.

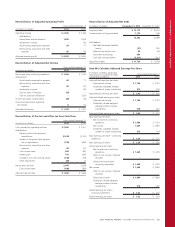

Average Revenue per User

Average Revenue per User (ARPU) helps us identify trends and measure

our success in attracting and retaining higher value subscribers. We

calculate it by dividing revenue (usually monthly) by the average

number of subscribers in the period. For Wireless, ARPU is calculated

using network revenue. When used in connection with a particular type

of subscriber, ARPU is monthly revenue generated from those

subscribers, divided by the average number of those subscribers during

the month.

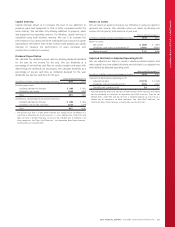

Average Revenue per User Calculations – Wireless

(In millions of dollars, subscribers in

thousands, except ARPU figures and

adjusted operating profit margin)

Years ended December 31

2013 2012

Postpaid ARPU (monthly)

Postpaid (voice and data) revenue $ 6,470 $ 6,402

Divided by: average postpaid

wireless voice and data subscribers 7,957 7,698

Divided by: twelve months for the year 12 12

$ 67.76 $ 69.30

Prepaid ARPU (monthly)

Prepaid (voice and data) revenue $ 278 $ 317

Divided by: average prepaid subscribers 1,481 1,667

Divided by: twelve months for the year 12 12

$ 15.64 $ 15.84

Blended ARPU (monthly)

Voice and data revenue $ 6,748 $ 6,719

Divided by: average wireless voice and

data subscribers 9,438 9,365

Divided by: twelve months for the year 12 12

$ 59.58 $ 59.79

82 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT