Rogers 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FINANCIAL CONDITION

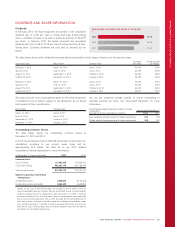

Capital Resources

Our capital resources consist primarily of cash flow from operations,

cash and cash equivalents, available lines of credit, funds available

under our accounts receivable securitization program and issuances of

long-term debt.

This information is forward-looking and should be read in conjunction

with “About forward-looking information” and “Risks and

Uncertainties Affecting Our Business” and other disclosure about

various economic, competitive and regulatory assumptions, factors and

risks that could cause our actual future financial and operating results

to differ from those currently expected.

We anticipate generating a net cash surplus in 2014 from our cash from

operations. We expect that we will have sufficient capital resources to

satisfy our cash funding requirements in 2014, including the funding of

dividends on our common shares, repayment of maturing long-term

debt and other financing activities, investing activities, and other

requirements, taking into account our opening cash balance, cash from

operations, the amount available under our $2.0 billion bank credit

facility, and our accounts securitization program and from the issuance

of short-term and, or long-term debt from time to time. At

December 31, 2013, there were no significant restrictions on the flow

of funds between Rogers and its subsidiary companies.

We believe that we can satisfy foreseeable additional funding

requirements by issuing additional debt financing, which, depending on

market conditions, could include restructuring our existing bank credit

and letter of credit facilities, issuing public or private debt, amending

the terms of our accounts receivable securitization program or issuing

equity. We may also refinance a portion of existing debt depending on

market conditions and other factors. There is no assurance, however,

that this will or can be done.

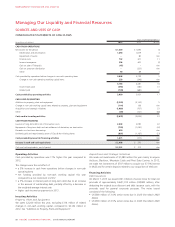

Bank Credit and Letter of Credit Facilities

We have $2.5 billion of bank credit and letter of credit facilities. Each of

these facilities is unsecured and guaranteed by Rogers Communications

Partnership and ranks equally with all of our senior notes and

debentures. The terms of our bank credit facility are committed by the

participating financial institutions until it expires in July 2017. As at

December 31, 2013, there were no advances outstanding under our

$2.0 billion bank credit facility and there were letters of credit totalling

$0.5 billion outstanding under our letter of credit facilities.

Liquidity

We had approximately $4.5 billion of available liquidity at December 31,

2013, as compared to $3.1 billion available at December 31, 2012:

• $2.3 billion in cash and cash equivalents (2012 – $0.2 billion)

• $2.0 billion available under our bank credit facility (2012 – $2.0 billion)

• $0.2 billion available under the $0.9 billion accounts receivable

securitization program (2012 – $0.9 billion).

Covenants

We are currently in compliance with all covenants under our debt

instruments. At December 31, 2013, there were no financial leverage

covenants in effect other than those under our bank credit and letter of

credit facilities (see Terms and conditions under Note 18 to the 2013

audited consolidated financial statements).

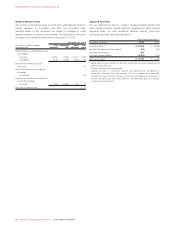

Credit Ratings

Credit ratings provide an independent measure of credit quality of an

issue of securities, and can affect our ability to obtain short-term and

long-term financing and the terms of the financing. If rating agencies

lower the credit ratings on our debt, particularly a downgrade below

investment grade, it could adversely affect our cost of financing and

access to liquidity and capital.

We have engaged each of Fitch Ratings (Fitch), Moody’s Investors

Service (Moody’s) and Standard & Poor’s Ratings Services (Standard &

Poor’s) to rate our public debt issues. In May 2013, each of Fitch and

Standard & Poor’s upgraded RCI’s senior unsecured debt to BBB+ (from

BBB) with a stable outlook. Moody’s comparably equivalent rating of

Baa1 with a stable outlook has not changed from last year.

The table below shows the credit ratings on our borrowings received

from the rating agencies as of December 31, 2013:

2013

Corporate credit issuer

default rating Senior unsecured debt

Standard and Poor’s BBB+ with a stable outlook BBB+ with a stable outlook

Fitch BBB+ with a stable outlook BBB+ with a stable outlook

Moody’s Baa1, stable outlook Baa1, stable outlook

Ratings for debt instruments across the universe of composite rates

range from AAA (Standard & Poor’s and Fitch) or Aaa (Moody’s)

representing the highest quality of securities rated, to D (Standard &

Poor’s), C (Moody’s) and Substantial Risk (Fitch) for the lowest quality of

securities rated.

Credit ratings are not recommendations for investors to purchase, hold

or sell the rated securities, nor are they a comment on market price or

investor suitability. There is no assurance that a rating will remain in

effect for a given period of time, or that a rating will not be revised or

withdrawn entirely by a rating agency if it believes circumstances

warrant it. The ratings on our senior debt provided by Standard &

Poor’s, Fitch and Moody’s are investment grade ratings.

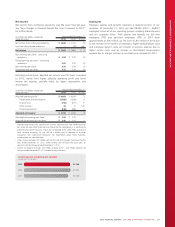

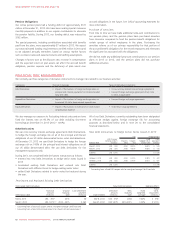

RATIO OF ADJUSTED OPERATING PROFIT TO INTEREST

2013

2012

2011

6.8x

6.8x

7.1x

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 61