Rogers 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Derivative Instruments

At December 31, 2013, all of our US dollar-denominated long-term

debt instruments were hedged against fluctuations in foreign exchange

rates for accounting purposes (2012 – 91.7%).

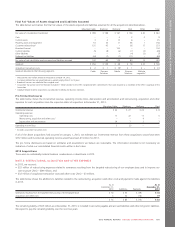

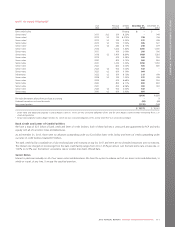

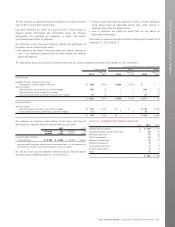

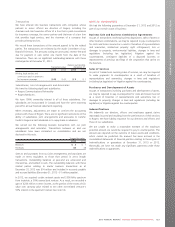

The tables below show our Derivatives net asset (liability) position at

December 31, 2013 and 2012.

December 31, 2013

US $

notional

Exchange

rate

Cdn $

notional

Fair

value

Debt Derivatives accounted for

as cash flow hedges:

As assets $ 4,250 1.0285 $ 4,371 $ 184

As liabilities 2,130 1.0769 2,294 (133)

Net mark-to-market asset Debt

Derivatives 51

Equity Derivatives not accounted

for as cash flow hedges:

As liabilities (13)

Expenditure Derivatives accounted

for as cash flow hedges:

As assets 900 1.0262 923 37

Net mark-to-market asset $ 75

December 31, 2012

US $

notional

Exchange

rate

Cdn $

notional

Fair

value

Debt Derivatives accounted for

as cash flow hedges:

As assets $ 1,600 1.0252 $ 1,640 $ 34

As liabilities 2,280 1.2270 2,798 (561)

Debt Derivatives not accounted

for as cash flow hedges:

As assets 350 1.0258 359 3

Net mark-to-market liability Debt

Derivatives (524)

Expenditure Derivatives accounted

for as cash flow hedges:

As assets 380 0.9643 366 13

Net mark-to-market liability $ (511)

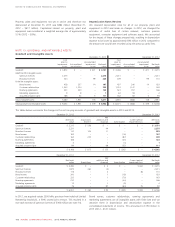

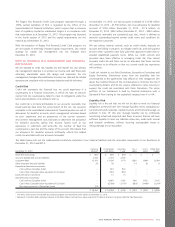

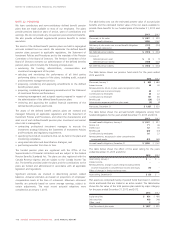

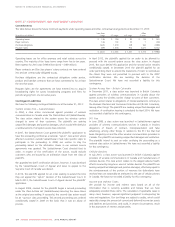

The table below shows derivative instruments asset and derivative

instruments liability reflected in our consolidated statements of financial

position.

2013 2012

Current asset $73 $8

Long-term asset 148 42

221 50

Current liability (63) (144)

Long-term liability (83) (417)

(146) (561)

Net mark-to-market asset (liability) $75 $ (511)

In 2013, we recorded a $4 million increase to net income related to

hedge ineffectiveness (2012 – $4 million decrease).

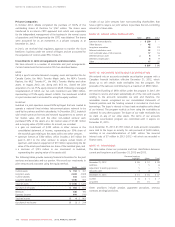

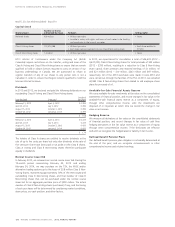

Debt Derivatives

We use cross currency interest exchange agreements to hedge the

foreign exchange risk on all of the principal and interest obligations of

our US dollar-denominated senior notes and debentures. We use Debt

Derivatives for risk-management purposes only.

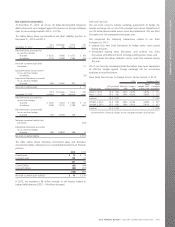

We completed the following transactions related to our Debt

Derivatives in 2013:

• entered into new Debt Derivatives to hedge senior notes issued

during the year,

• terminated existing Debt Derivatives and entered into Debt

Derivatives with different terms to hedge existing senior notes, and

• settled Debt Derivatives related to senior notes that matured during

the year.

All of our currently outstanding Debt Derivatives have been designated

as effective hedges against foreign exchange risk for accounting

purposes as described below.

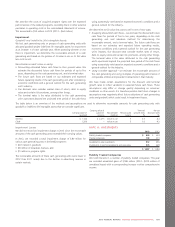

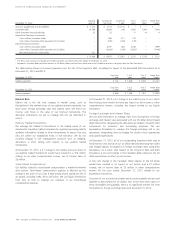

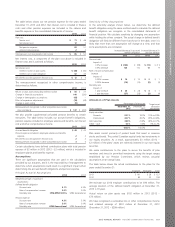

New Debt Derivatives to Hedge Senior Notes Issued in 2013

US $ Hedging effect

Effective date

US$ principal/

notional amount

Maturity

date

Coupon

rate

Fixed

hedged Cdn$

interest rate 1

Fixed

Canadian

equivalent

March 7, 2013 US $ 500 2023 3.00% 3.60% $ 515

March 7, 2013 US $ 500 2043 4.50% 4.60% $ 515

Subtotal US $ 1,000 $ 1,030

October 2, 2013 US $ 850 2023 4.10% 4.59% $ 877

October 2, 2013 US $ 650 2043 5.45% 5.61% $ 671

Subtotal US $ 1,500 $ 1,548

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 115