Rogers 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9: INCOME TAXES

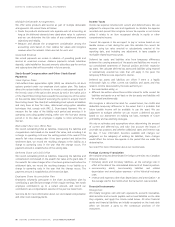

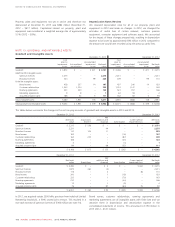

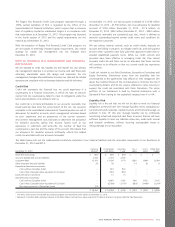

Income Tax Expense (Benefit)

Years ended December 31 Note 2013 2012

Continuing operations:

Current income tax expense $ 513 $ 428

Deferred tax expense (benefit):

Origination and reversal of

temporary differences 89 160

Revaluation of deferred tax

balances due to legislative

changes 854

Recognition of previously

unrecognized deferred tax assets (14) (22)

Total deferred tax expense 83 192

Income tax expense from continuing

operations 596 620

Income tax expense from discontinued

operations 6–(10)

Total income tax expense $ 596 $ 610

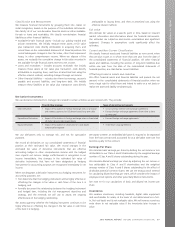

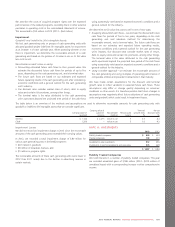

The table below shows the difference between income tax expense from

continuing operations, and income tax expense computed by applying

the statutory income tax rate to income before income taxes.

2013 2012

Statutory income tax rate 26.5% 26.4%

Computed income tax expense $ 600 $ 619

Increase (decrease) in income taxes resulting

from:

Revaluation of deferred tax balances due to

legislative changes 854

Non-taxable portion of capital gains (9) (61)

Recognition of previously unrecognized

deferred tax assets (14) (22)

Impairment of goodwill and intangible assets –11

Non-deductible stock-based compensation 89

Other items 310

Income tax expense from continuing operations $ 596 $ 620

Our statutory income tax rate increased from 26.4% in 2012 to 26.5%

in 2013 because of changes in Canadian provincial corporate income

tax rates.

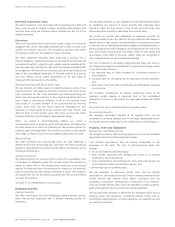

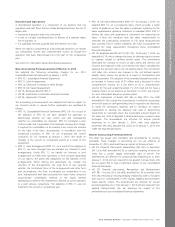

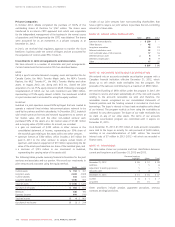

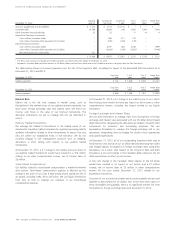

Deferred Tax Assets and Liabilities

2013 2012

Deferred tax assets $31 $31

Deferred tax liabilities (1,702) (1,501)

Net deferred tax liability $ (1,671) $ (1,470)

The table below summarizes the movement of net deferred tax assets and liabilities during 2013 and 2012.

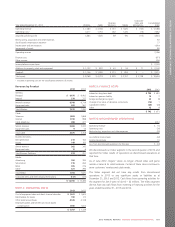

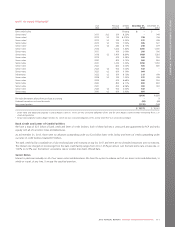

Deferred tax assets (liabilities)

Property, plant and

equipment and

Inventory

Goodwill and

other

intangibles

Stub period

income and

partnership

reserve

Non-capital loss

carryforwards Other Total

January 1, 2012 $ (484) $ (421) $ (807) $ 104 $ 248 $ (1,360)

Benefit (expense) in net income (117) 61 72 (79) (129) (192)

Benefit (expense) in other comprehensive income – – – – 82 82

December 31, 2012 (601) (360) (735) 25 201 (1,470)

Benefit (expense) in net income (135) (9) 141 19 (99) (83)

Benefit (expense) in other comprehensive income – – – – (49) (49)

Acquisitions (16) (60) – 2 5 (69)

December 31, 2013 $ (752) $ (429) $ (594) $ 46 $ 58 $ (1,671)

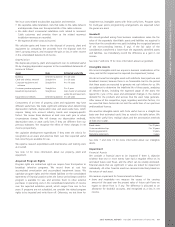

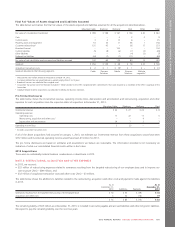

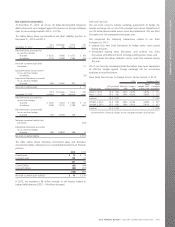

As at December 31, 2013 and 2012, we had not recognized deferred

tax assets for the following items.

2013 2012

Capital losses in Canada that can be applied against future

capital gains $43 $44

Tax losses in foreign jurisdictions that expire between 2023

and 2033 17 34

Deductible temporary differences in foreign jurisdictions 32 45

$92 $ 123

There are taxable temporary differences associated with our investment

in Canadian domestic subsidiaries. We do not record deferred tax

liabilities for temporary differences when we are able to control the

timing of the reversal, and the reversal is not probable in the

foreseeable future. Reversing these temporary differences would not

result in any significant tax implications.

106 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT