Rogers 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

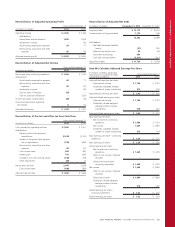

Capital Intensity

Capital intensity allows us to compare the level of our additions to

property, plant and equipment to that of other companies within the

same industry. We calculate it by dividing additions to property, plant

and equipment by operating revenue. For Wireless, capital intensity is

calculated using total network revenue. We use it to evaluate the

performance of our assets and when making decisions about the capital

expenditures. We believe that certain investors and analysts use capital

intensity to measure the performance of asset purchases and

construction in relation to revenue.

Dividend Payout Ratios

We calculate the dividend payout ratio by dividing dividends declared

for the year by net income for the year. We use dividends as a

percentage of pre-tax free cash flow to conduct analysis and assist with

determining the dividends we should pay. We calculate dividends as a

percentage of pre-tax cash flow as dividends declared for the year

divided by pre-tax free cash flow for the year.

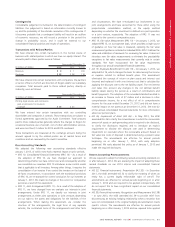

Years ended December 31

(In millions of dollars, except percentages and ratios) 2013 2012

Dividend payout ratio

Dividends declared for the year $ 896 $ 820

Divided by: net income 1,669 1,693

Ratio 54%48%

Dividends as a percentage of pre-tax free cash flow

Dividends declared for the year $ 896 $ 820

Divided by: pre-tax free cash flow 12,044 2,029

Ratio 44%40%

1Pre-tax free cash flow is a Non-GAAP measure and should not be considered as a

substitute or alternative for GAAP measures. It is not a defined term under IFRS, and

does not have a standard meaning, so may not be a reliable way to compare us to

other companies. See “Non-GAAP Measures” for information about these measures,

including how we calculate them.

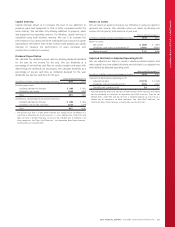

Return on Assets

We use return on assets to measure our efficiency in using our assets to

generate net income. We calculate return on assets by dividing net

income for the year by total assets as at year end.

Years ended December 31

(In millions of dollars, except percentages and ratios) 2013 2012

Return on assets

Net income $ 1,669 $ 1,693

Divided by: total assets as at December 31 23,601 19,618

Return on assets 7.1%8.6%

Adjusted Net Debt to Adjusted Operating Profit

We use adjusted net debt to conduct valuation-related analysis and

make capital structure related decisions and calculate it as adjusted net

debt divided by adjusted operating profit.

Years ended December 31

(In millions of dollars, except percentages and ratios) 2013 2012

Adjusted net debt/adjusted operating profit

Adjusted net debt $11,734 $11,169

Divided by: adjusted operating profit 14,993 4,834

Debt/adjusted operating profit 2.4 2.3

1Adjusted operating profit and adjusted net debt are Non-GAAP measures and should

not be considered as substitutes or alternatives for GAAP measures. They are not

defined terms under IFRS, and do not have a standard meaning, so may not be a

reliable way to compare us to other companies. See “Non-GAAP Measures” for

information about these measures, including how we calculate them.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 83