Rogers 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

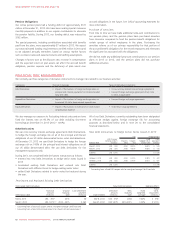

MANAGEMENT’S DISCUSSION AND ANALYSIS

Governance and Risk Management

GOVERNANCE AT ROGERS

Rogers is a family-founded, family-controlled company, and we take

pride in our proactive and disciplined approach to ensuring that our

governance structure and practices instil the confidence of our

shareholders.

With the passing in December 2008 of our founder and previous CEO,

Ted Rogers, his voting control of Rogers Communications passed to a

trust whose beneficiaries are members of the Rogers family. The trust

holds voting control of Rogers Communications for the benefit of

successive generations of the Rogers family. The Rogers family are

substantial stakeholders, and owned approximately 28%of our equity

as of December 31, 2013.

Our Board of Directors is made up of four members of the Rogers

family, and another 13 directors who bring a mix of experience as

business leaders in North America. All of our directors are firmly

committed to strong oversight and the ongoing creation of shareholder

value. The Board as a whole is committed to sound corporate

governance, and continually reviews its governance practices and

benchmarks them against acknowledged leaders and evolving

legislation. The Board believes that Rogers’ governance system is

effective and that there are appropriate structures and procedures in

place.

Governance Best Practices

The majority of our directors are independent and we have adopted

many best practices for effective governance:

• Separation of CEO and chairman roles

• Independent lead director

• Formal corporate governance policy and charters

• Code of business conduct and whistleblower hotline

• Director share ownership guidelines

• Board and committee in camera discussions

• Annual reviews of Board and director performance

• Audit Committee meetings with internal and external auditors

• Orientation programs for new directors

• Regular Board education sessions

• Committee authority to retain independent advisors

• Director material relationship standards.

We comply with corporate governance guidelines and standards as a

Canadian public company listed on the TSX and as a foreign private

issuer listed on the NYSE in the US.

Board Oversight

The Board delegates certain responsibilities to its seven standing

committees to ensure proper oversight and accountability:

•Audit Committee – reviews our accounting policies and practices,

the integrity of our financial reporting processes and procedures and

the financial statements and other relevant disclosure for release

to the public. It also assists the Board in its oversight of our

compliance with legal and regulatory requirements for financial

reporting, and assesses our internal accounting and financial control

systems and the qualifications, independence and work of our

internal and external auditors.

•Corporate Governance Committee – assists the Board so it has

appropriate systems and procedures for carrying out its

responsibilities. This committee develops governance policies and

practices and recommends them to the board for approval, and leads

the Board in its periodic review of board and committee

performance.

•Nominating Committee – identifies prospective candidates to serve

on our Board. Nominated directors are either elected by shareholders

at a meeting, or appointed by the Board. The committee also

recommends nominees for each Board committee, including each

committee chair.

•Human Resources Committee – assists the Board in monitoring,

reviewing and approving compensation and benefit policies and

practices. It is also responsible for recommending the compensation

of senior management and monitoring the senior executive

succession plan.

•Executive Committee – assists the Board in discharging its

responsibilities between meetings, including to act in such areas as

specifically designated and authorized at a preceding board meeting

to consider matters that may arise from time to time.

•Finance Committee – reviews our investment strategies and general

debt and equity structure and reports on them to the Board.

•Pension Committee – oversees the administration of our retiree

pension plans and reviews the investment performance and

provisions of the plans.

You can find more details about governance at Rogers in the Investor

Relations section of our website (rogers.com/governance), including:

• a complete statement of our corporate governance practices

• our codes of conduct and ethics

• full committee charters

• director biographies

• a summary of the differences between the NYSE corporate

governance rules that apply to US-based companies and our

governance practices as a non-US-based issuer listed on the NYSE.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 71