Rogers 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

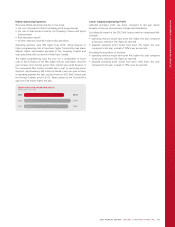

Higher Operating Revenue

Overall Cable revenue grew 3%this year compared to last year, the net

result of:

• continued growth in subscribers for our Internet and phone products

• the May 2013 acquisition of Mountain Cable

• partially offset by television subscriber losses.

Lower Television Revenue

Revenue from television was 3%lower this year, compared to 2012,

the net result of:

• the year-over-year decline in television subscribers

• the impact of promotional and retention pricing activity associated

with heightened pay TV competition from IPTV offerings

• partially offset by pricing increases during the year and the acquisition

of Mountain Cable.

We continue to offer competitive strategic bundling and retention

initiatives to transition portions of the subscriber base to term contracts.

The digital cable subscriber base represents 84%of our total television

subscribers, compared to 80%at the end of 2012. We believe that the

larger selection of digital content, video on-demand, HDTV and PVR

equipment combined with the ongoing analog to digital conversion

initiative continues to contribute to the increasing penetration of the

digital subscriber base as a percentage of our total television subscriber

base.

Higher Internet and Subscribers

Internet revenue increased by 16%in 2013, compared to last year, the

result of a larger Internet subscriber base, general movement to higher

end speed and usage tiers and changes in Internet service pricing. The

increase was also affected by the timing and mix of promotional

programs.

Our Internet customer base is approximately 2.0 million subscribers, and

Internet penetration represents:

•92%of our television subscribers, compared to 84%for 2012

•49%of the homes passed by our cable network; or the same as

2012.

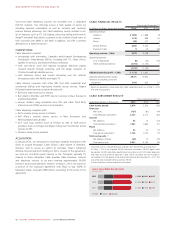

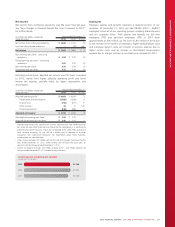

(IN MILLIONS OF DOLLARS)

CABLE TOTAL REVENUE

2013

2012

2011

$3,475

$3,358

$3,309

(IN MILLIONS OF DOLLARS)

CABLE SERVICE REVENUE BREAKDOWN

2013

2012

2011

$498

$477

$478

$1,159

$998

$926

$1,809

$1,868

$1,878

TelevisionInternetPhone

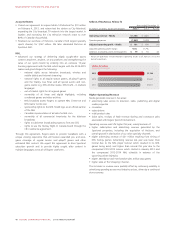

2013

2012

2011

1,961

1,864

1,793

49%

49%

48%

(IN THOUSANDS)

INTERNET SUBSCRIBERS AND INTERNET

PENETRATION OF HOMES PASSED %

2013

2012

2011

1,789

1,768

1,777

84%

80%

77%

(IN THOUSANDS)

DIGITAL HOUSEHOLDS AND DIGITAL PENETRATION

OF TELEVISION CUSTOMERS %

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 43