Rogers 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

We amortize the costs of acquired program rights over the expected

performances of the related programs, recording them in other external

purchases in operating costs in the consolidated statements of income.

This amounted to $52 million in 2013 (2012 – $64 million).

Impairment

Goodwill and Indefinite Life Intangible Assets

We test cash generating units or groups of cash generating units with

allocated goodwill and/or indefinite life intangible assets for impairment

as at October 1 of each calendar year. When assessing whether or not

there is impairment, we determine the recoverable amount of a cash

generating unit based on the greater of its value in use or its fair value

less costs to sell.

We estimate an asset’s value in use by:

• Discounting estimated future cash flows to their present value. We

estimate the discounted future cash flows for periods of up to five

years, depending on the cash generating unit, and a terminal value.

• The future cash flows are based on our estimates and expected

future operating results of the cash generating unit after considering,

economic conditions and a general outlook for the cash generating

unit’s industry.

• Our discount rates consider market rates of return, debt to equity

ratios and certain risk premiums, among other things.

• The terminal value is the value attributed to the cash generating

unit’s operations beyond the projected time period of the cash flows

using a perpetuity rate based on expected economic conditions and a

general outlook for the industry.

We determine its fair value less costs to sell in one of two ways:

•Analyzing discounted cash flows – we estimate the discounted future

cash flows for periods of five to ten years, depending on the cash

generating unit and valuation method for determining the

recoverable amount, and a terminal value. The future cash flows are

based on our estimates and expected future operating results,

economic conditions and a general outlook for the cash generating

unit’s industry. Our discount rates consider market rates of return,

debt to equity ratios and certain risk premiums, among other things.

The terminal value is the value attributed to the cash generating

unit’s operations beyond the projected time period of the cash flows

using a perpetuity rate based on expected economic conditions and a

general outlook for the industry.

•Using a market approach – we estimate the recoverable amount of

the cash generating unit using multiples of operating performance of

comparable entities and precedent transactions in that industry.

We have made certain assumptions for the discount and terminal

growth rates to reflect variations in expected future cash flows. These

assumptions may differ or change quickly depending on economic

conditions or other events. It is therefore possible that future changes in

assumptions may negatively affect future valuations of cash generating

units and goodwill, which could result in impairment losses.

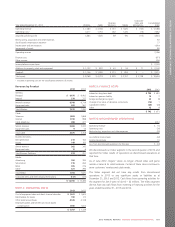

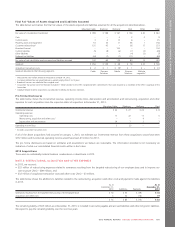

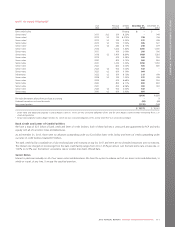

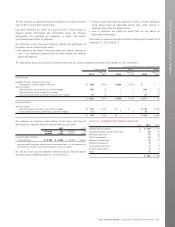

The table below is an overview of the methods and assumptions we used to determine recoverable amounts for cash generating units with

goodwill or indefinite life intangible assets that we consider significant.

Carrying value of

goodwill

Carrying value of

spectrum

licences

Recoverable

method

Periods used

(years)

Terminal

growth rates

%

Pre-tax

discount rates

%

Wireless $ 1,146 $ 2,275 Value in use 5 0.5 8.3

Cable 1,256 – Value in use 5 1.0 9.2

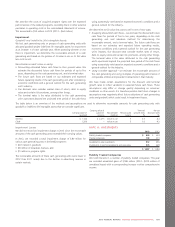

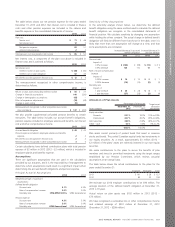

Impairment Losses

We did not record an impairment charge in 2013 since the recoverable

amounts of the cash generating units exceeded their carrying values.

In 2012, we recorded a total impairment charge of $80 million for

various cash generating units in the Media segment:

• $67 million in goodwill,

• $8 million in broadcast licences, and

• $5 million in program rights.

The recoverable amounts of these cash generating units were lower in

2012 than 2011 mainly due to the decline in advertising revenue in

certain markets.

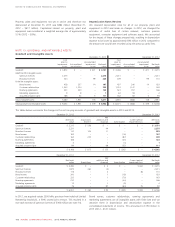

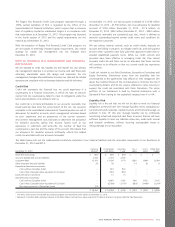

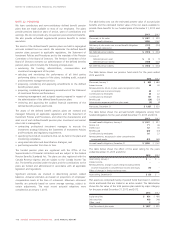

NOTE 14: INVESTMENTS

2013 2012

Publicly traded companies $ 809 $ 624

Private companies 103 231

Available-for-sale investments 912 855

Investments in joint arrangements and associates 575 629

$ 1,487 $ 1,484

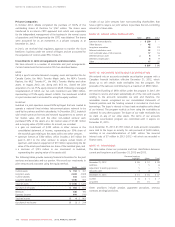

Publicly Traded Companies

We hold interests in a number of publicly traded companies. This year

we recorded unrealized gains of $186 million (2012 – $225 million of

unrealized losses) with a corresponding increase in other comprehensive

income.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 109