Rogers 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER

FINANCIAL REPORTING

Management is responsible for establishing and maintaining adequate

internal controls over financial reporting.

Our internal control system is designed to give management and the

Board reasonable assurance that our financial statements are prepared

and fairly presented in accordance with Generally Accepted Accounting

Principles. The system assures all transactions are authorized by

management, assets are safeguarded and financial records are reliable.

Management also takes steps to assure the flow of information and

communication is effective, and monitors performance and our internal

control procedures.

Management assessed the effectiveness of our internal controls over

financial reporting as of December 31, 2013, based on the criteria set

out in the Internal Control – Integrated Framework (1992) issued by the

Committee of Sponsoring Organizations of the Treadway Commission

(COSO), and concluded that it was effective at that date. Our

independent auditor, KPMG LLP, issued an audit report stating that, as

of December 31, 2013, we had effective internal controls over financial

reporting in all material respects, based on the same criteria.

All internal control systems, however, no matter how well designed,

have inherent limitations, and even systems that have been determined

to be effective can only provide reasonable assurance about the

preparation and presentation of financial statements.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL

REPORTING AND DISCLOSURE CONTROLS AND

PROCEDURES

There were no changes in 2013 that materially affected, or are

reasonably likely to materially affect, our internal controls over financial

reporting.

Other Information

ACCOUNTING POLICIES

Critical Accounting Estimates

Management makes judgments, estimates and assumptions that affect

how accounting policies are applied and the amounts we report in

assets, liabilities, revenue and expenses and our related disclosure about

contingent assets and liabilities. Significant changes in our assumptions,

including those related to our future business plans and cash flows,

could cause our actual results to be materially different.

These estimates are critical to our business operations and

understanding our results of operations. We may need to use additional

judgment because of the sensitivity of the methods and assumptions

used in determining the asset, liability, revenue and expense amounts.

Fair Value

We use considerable judgment to estimate the fair value of tangible

and intangible assets acquired and liabilities assumed in an acquisition,

using the best available information including information from

financial markets. This may include discounted cash flow analyses which

utilize key assumptions such as discount rates, attrition rates, and

terminal growth rates to estimate future earnings. Actual results may

differ from these estimates.

Useful Lives

We depreciate the cost of property, plant and equipment over their

estimated useful lives by considering industry trends and company-

specific factors, including changing technologies and expectations for

the in-service period of certain assets at the time. We reassess our

estimates of useful lives annually or when circumstances change to

ensure they match the anticipated life of the technology from a

revenue-producing perspective. If technological change happens more

quickly, or in a different way than anticipated, we might have to reduce

the estimated life of property, plant and equipment, which could result

in a higher depreciation expense in future periods or an impairment

charge to write down the value. We will change our depreciation

methods, depreciation rates or asset useful lives if they are different

from our previous estimates. We recognize the effect of these changes

in net income prospectively.

Our intangible assets have increased mainly because of acquisitions. We

amortize the cost of intangible assets with finite lives over their

estimated useful lives. We use judgment to determine the life of these

assets, analyzing all relevant factors, including the expected usage of

the asset, the typical life cycle of the asset and anticipated changes in

the market demand for the products and services that the asset helps

generate.

We do not amortize intangible assets with indefinite lives (spectrum and

broadcast licences) because there is no foreseeable limit to the period

that these assets are expected to generate net cash inflows for us. After

review of the competitive, legal, regulatory and other factors, it is our

view that these factors do not limit the useful lives of our spectrum and

broadcast licences.

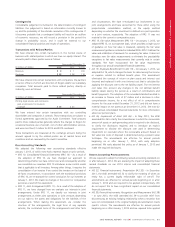

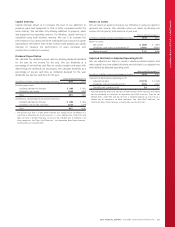

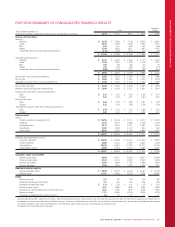

The table below shows the impact that changing the useful lives of the

finite-lived intangible assets by one year would have on annual net

income:

(In millions of dollars)

Amortization

Period

Increase in

Net Income if Life

Increased by 1 year

Decrease in

Net Income if Life

Decreased by 1 year

Brand Names 5 – 20 years $ 1 $ (1)

Customer Relationships 3 – 10 years $ 19 $ (31)

Roaming Agreements 12 years $ 3 $ (4)

Marketing Agreements 3 years $ 1 $ (2)

We will change our depreciation methods, depreciation rates or asset

useful lives if they are determined to be different from our previous

estimates. We recognize the effect of these changes in net income

prospectively.

Capitalizing Direct Labour, Overhead and Interest

Certain direct labour and indirect costs associated with the acquisition,

construction, development or improvements of our networks are

capitalized to property, plant and equipment. The capitalized amounts

are calculated based on estimated costs of projects that are capital in

nature, and are generally based on a rate per hour. In addition, interest

costs are capitalized during development and construction of certain

property, plant and equipment. Capitalized amounts increase the cost of

the asset and result in a higher depreciation expense in future periods.

Impairment of Assets

Indefinite-lived intangible assets (including goodwill and spectrum and/

or broadcast licences) and definite life assets (including property, plant

and equipment and other intangible assets) are assessed for impairment

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 79