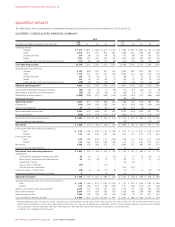

Rogers 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

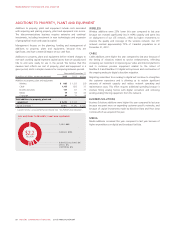

ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT

Additions to property, plant and equipment include costs associated

with acquiring and placing property, plant and equipment into service.

The telecommunications business requires extensive and continual

investments, including investment in new technologies and expansion

of geographical reach and capacity capital.

Management focuses on the planning, funding and management of

additions to property, plant and equipment, because they are

significant, and have a material impact on our cash flow.

Additions to property, plant and equipment before related changes to

non-cash working capital represent capital assets that we actually took

title to and were ready for use in the period. We believe that this

measure best reflects our cost of property, plant and equipment in a

given period, and is a simpler measure for comparing between periods.

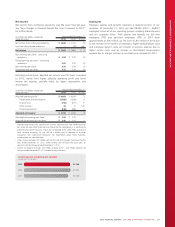

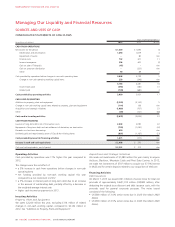

Year ended December 31

(In millions of dollars, except percentages) 2013 2012 %Chg

Additions to property, plant and equipment

Wireless $ 865 $ 1,123 (23)

Cable 1,105 832 33

Business Solutions 107 61 75

Media 79 55 44

Corporate 84 71 18

Total additions to property, plant and

equipment $ 2,240 $ 2,142 5

Capital intensity 117.6%17.2%0.4 pts

1Capital intensity is a key performance indicator. See “Key Performance Indicators”.

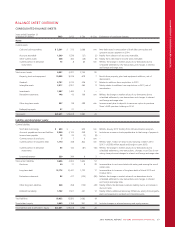

$2.2

BILLION

(%)

2013 ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT

CABLE 49%

WIRELESS 39%

MEDIA 4%

CORPORATE 3%

BUSINESS SOLUTIONS 5%

WIRELESS

Wireless additions were 23%lower this year compared to last year

because we invested significantly less in HSPA capacity and spent less

on deployment of our LTE network, offset by higher investments to

improve the quality and coverage of the wireless network. Our LTE

network reached approximately 73%of Canada’s population as at

December 31, 2013.

CABLE

Cable additions were higher this year compared to last year because of

the timing of initiatives related to service enhancements, reflecting

increasing our investment in improving our video and Internet platforms

and in customer premise equipment related to the rollout of

NextBox 2.0 and NextBox 3.0 digital set-top boxes and continuation of

the ongoing analog to digital subscriber migration.

Migrating subscribers from analog to digital will continue to strengthen

the customer experience and is allowing us to reclaim significant

amounts of network capacity and reduce network operating and

maintenance costs. This effort requires additional spending because it

involves fitting analog homes with digital converters and removing

existing analog filtering equipment from the network.

BUSINESS SOLUTIONS

Business Solutions additions were higher this year compared to last year

because we spent more on expanding customer specific networks, and

because of capital investments made by Blackiron Data and Pivot Data

Centres which we acquired this year.

MEDIA

Media additions increased this year compared to last year because of

higher expenditures on digital and broadcast facilities.

50 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT