Rogers 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

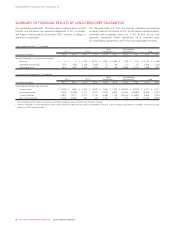

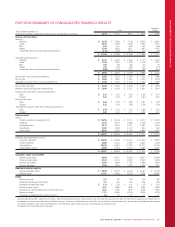

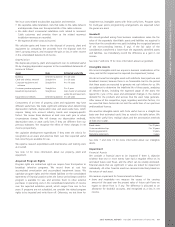

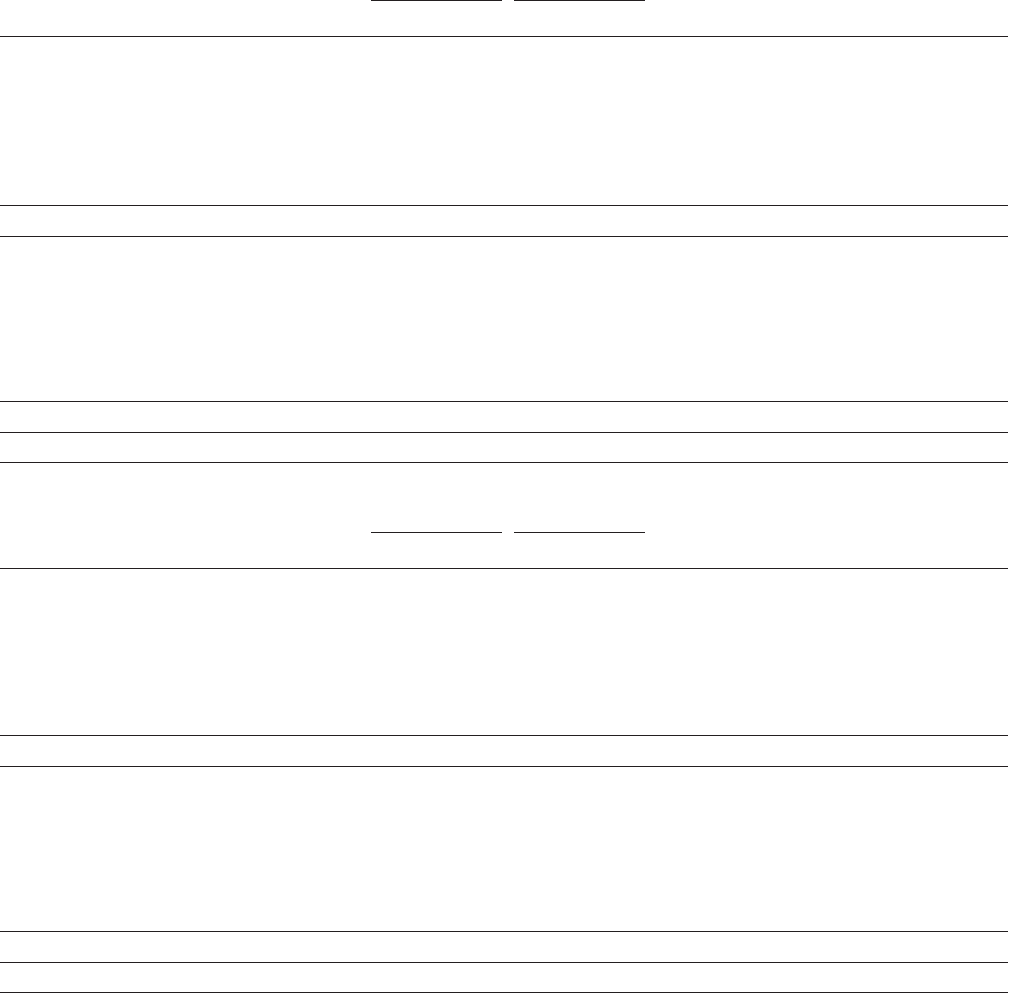

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statements of Changes in Shareholders’ Equity

(In millions of Canadian dollars)

Class A

Voting shares

Class B

Non-Voting shares

Available-

for-sale

financial

assets

reserve

Total

shareholders’

equityYear ended December 31, 2013 Amount

Number

of shares Amount

Number

of shares

Share

premium

Retained

earnings

Hedging

reserve

(000s) (000s)

Balances, January 1, 2013 $ 72 112,462 $ 397 402,788 $ – $ 3,046 $ 243 $ 10 $ 3,768

Net income for the year – – – – – 1,669 – – 1,669

Other comprehensive income (loss):

Defined benefit pension plans, net of tax – – – – – 98 – – 98

Available-for-sale investments, net of tax – – – – – – 158 – 158

Derivative instruments, net of tax – – – – – – – (111) (111)

Total other comprehensive income (loss) – – – – – 98 158 (111) 145

Comprehensive income for the year – – – – – 1,767 158 (111) 1,814

Transactions with shareholders, recorded directly in

equity:

Repurchase/cancellation of Class B Non-Voting

shares (note 23) – – (1) (591) – (21) – – (22)

Dividends declared – – – – – (896) – – (896)

Shares issued on exercise of stock options – – 5 84 – – – – 5

Total transactions with shareholders – – 4 (507) – (917) – – (913)

Balances, December 31, 2013 $ 72 112,462 $ 401 402,281 $ – $ 3,896 $ 401 $ (101) $ 4,669

Class A

Voting shares

Class B

Non-Voting shares

Available-

for-sale

financial

assets

reserve

Hedging

reserve

Total

shareholders’

equity

Year ended December 31, 2012 Amount

Number

of shares Amount

Number

of shares

Share

premium

Retained

earnings

(000s) (000s)

Balances, January 1, 2012 $ 72 112,462 $ 406 412,395 $ 243 $ 2,443 $ 433 $ (25) $ 3,572

Net income for the year – – – – – 1,693 – – 1,693

Other comprehensive income (loss):

Defined benefit pension plans, net of tax – – – – – (173) – – (173)

Available-for-sale investments, net of tax – – – – – – (190) – (190)

Derivative instruments, net of tax – – – – – – – 35 35

Total other comprehensive income (loss) – – – – – (173) (190) 35 (328)

Comprehensive income for the year – – – – – 1,520 (190) 35 1,365

Transactions with shareholders, recorded directly in

equity:

Repurchase of Class B Non-Voting shares

(note 23) – – (10) (9,637) (243) (97) – – (350)

Dividends declared – – – – – (820) – – (820)

Shares issued on exercise of stock options – – 1 30 – – – – 1

Total transactions with shareholders – – (9) (9,607) (243) (917) – – (1,169)

Balances, December 31, 2012 $ 72 112,462 $ 397 402,788 $ – $ 3,046 $ 243 $ 10 $ 3,768

The accompanying notes are an integral part of the consolidated financial statements.

92 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT