Rogers 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

•available-for-sale financial assets – we measure the excess of the cost

to acquire the asset (less any impairment loss we have previously

recognized), over its current fair value, if any. The difference is

reclassified from the available-for-sale reserve in equity to net

income.

Investments in Associates and Joint Arrangements

At the end of each reporting period, we assess whether there is

objective evidence that impairment exists in our investments in

associates and joint arrangements. If objective evidence exists, we

compare the carrying amount of the investment to its recoverable

amount and recognize the excess over the recoverable amount, if any,

as a loss in net income (see Recognition of Impairment Charge, below).

Goodwill and Indefinite-Life Intangible Assets

We test goodwill and indefinite-life intangible assets for impairment

once a year, or more frequently if we identify indicators of impairment.

Goodwill is allocated to cash generating units (or groups of cash

generating units) based on the level at which management monitors

goodwill, which cannot be higher than an operating segment. The

allocation involves considerable management judgement, and is made

to cash generating units (or groups of cash generating units) that are

expected to benefit from the synergies of the business combination

from which the goodwill arose.

A cash generating unit is the smallest identifiable group of assets that

generates cash inflows largely independent of the cash inflows from

other assets or groups of assets.

Non-Financial Assets with Finite Useful Lives

Our non-financial assets with finite useful lives include property, plant

and equipment, and intangible assets. We test these assets for

impairment whenever an event or change in circumstances indicates

that their carrying amounts may not be recoverable. The asset is

impaired if the recoverable amount is less than the carrying amount. If

we cannot estimate the recoverable amount of an individual asset

because it does not generate independent cash inflows, we test the

entire cash generating unit for impairment.

Recognition of Impairment Charge

The recoverable amount of a cash generating unit or asset is the higher

of:

• its fair value less costs to sell, or

• its value in use.

We estimate an asset’s (or cash generating unit’s) fair value less costs to

sell using the best information available to estimate the amount we

could obtain from disposing the asset in an arm’s length transaction,

less the estimated cost of disposal.

We estimate value in use by discounting estimated future cash flows

from a cash generating unit or asset to their present value using a pre-

tax rate that reflects current market assessments of the time value of

money and the risks specific to the asset. Estimated cash flows are

based on management’s assumptions and are supported by external

information.

The above concepts used to determine the recoverable amount require

significant estimates such as:

• future cash flows

• terminal growth rate, and

• the discount rate applied.

If our estimate of the asset’s or cash generating unit’s recoverable

amount is less than its carrying amount, we reduce its carrying amount

to the recoverable amount, and recognize the loss in net income.

We reverse a previously recorded impairment loss if our estimate of a

previously impaired asset’s or cash generating unit’s recoverable

amount has increased such that the impairment recorded in the

previous year has reversed. The reversal is recognized by increasing the

asset’s or cash generating unit’s carrying amount to our new estimate

of its recoverable amount. The new carrying amount cannot be higher

than the carrying amount we would have recorded if we had not

recognized an impairment loss in previous years. We do not reverse

impairment losses recognized for goodwill.

Investments

Investments in Associates and Joint Arrangements

An entity is an associate when we have a significant influence on the

entity’s financial and operating policies but do not control it. We are

generally presumed to have significant influence over an entity when

we hold more than 20% of the voting power.

A joint arrangement exists when there is a contractual agreement that

establishes joint control over its activities and requires unanimous

consent for strategic financial and operating decisions. We classify our

interests in joint arrangements into one of two categories:

• Joint operations, when we have the rights to the assets and

obligations for the liabilities related to the arrangement

• Joint ventures, when we have the rights to the net assets of the

arrangement.

We use the equity method to account for our investments in associates

and joint ventures, and we use the proportionate consolidation method

to account for our investments in joint operations.

We recognize our investments in associates and joint ventures initially at

cost, and then increase or decrease the carrying amounts based on our

share of each entity’s income or loss after initial recognition.

Distributions we receive from these entities reduce the carrying amount

of our investments.

We eliminate unrealized gains and losses from our investments in

associates or joint ventures against our investment, up to the amount of

our interest in the entity.

Investments in Publicly Traded and Private Companies

We classify our investments in publicly traded and private companies

where we have no control or significant influence as available-for-sale

investments, and account for them as follows:

• publicly traded companies: we record them at fair value based on

publicly quoted prices

• private companies: we record them at fair value using well

established market or asset based techniques, or projected income

valuation techniques, applying them to each investment’s future

operating and profitability prospects.

We record changes in the fair value of these investments in other

comprehensive income until we dispose of the investments or they

become impaired.

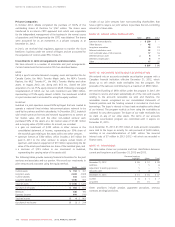

See note 14 for more information about our investments.

100 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT