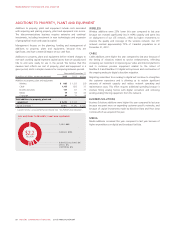

Rogers 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

We used a combination of value-in-use and fair-value-less-costs-to-sell

methodologies with pre-tax discount rates of approximately 10%in

arriving at the impairment amount in 2012. The recoverable amounts of

the cash generating units declined in 2012 mainly because advertising

revenue was lower in certain markets.

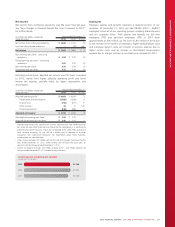

Finance Costs

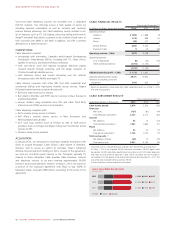

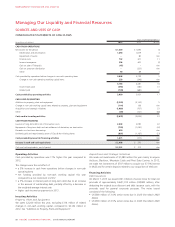

Years ended December 31

(In millions of dollars) 2013 2012 %Chg

Interest on long-term debt $ 734 $ 691 6

Interest on pension liability 14 7 100

Foreign exchange (gain) loss 23 (9) n/m

Change in fair value of derivative

instruments (16) 1 n/m

Capitalized interest (25) (28) (11)

Other 12 933

Total finance costs $ 742 $ 671 11

Interest on long-term debt was higher in 2013, the net effect of an

increase in the amount of outstanding debt, partially offset by a decrease

in the weighted average interest rate on our outstanding debt, mainly

related to refinancing activities completed in 2013. See “Managing Our

Liquidity and Financial Resources” for more information.

In 2013, the foreign exchange loss of $23 million primarily relates to

the depreciation in the Canadian dollar relative to the US dollar and its

impact on our US$350 million of senior notes due 2038, which was not

hedged for accounting purposes prior to March 6, 2013. Most of the

foreign exchange loss was offset by the change in the fair value of the

associated Debt Derivatives as discussed below. We use cross currency

interest rate exchange agreements (Debt Derivatives) to hedge the

foreign exchange risk on all of our US$ denominated senior notes and

debentures.

The non-cash gain on the fair value of derivative instruments in 2013

was primarily from the change in fair value of the Debt Derivatives prior

to March 6, 2013. Subsequently, all Debt Derivatives were designated

as hedges for accounting purposes.

Other Income

Other income was lower this year, largely due to a $233 million gain

recorded in 2012 related to the sale of spectrum licenses by Inukshuk, a

50%owned joint venture, to the other non-related venture.

Other income of $81 million this year mainly reflects a $47 million gain

from the sale of TVtropolis and certain other investment income.

Income Taxes

Our effective income tax rate was 26.3%for 2013 and 26.4%for

2012.

The 2013 and 2012 effective income tax rates were consistent with the

statutory income tax rates. For both years, this is the net effect of

several offsetting adjustments to our income tax expense. The most

significant adjustments were:

• realizing capital gains (of which only 50%are taxable)

• recognizing and using losses and other tax attributes that were not

previously recognized

• offset by a tax charge relating to the revaluation of our net deferred

tax liability to reflect an increase in tax rates and non-deductible

stock-based compensation.

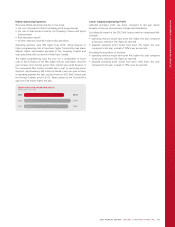

We paid $116 million more in cash income taxes in 2013 than in 2012,

mainly because we used substantially all of our remaining non-capital

income tax loss carryforwards in 2012. In 2011, legislative changes

eliminated the deferral of partnership income, accelerating the payment

of approximately $700 million of previously deferred cash taxes over a

five year amortization period, beginning in 2012 at 15%,20%in each

of 2013 through 2015, and 25%in 2016. Our cash tax payments for

the 2014 to 2016 taxation years will include these additional amounts.

While the elimination of the partnership deferral affects the timing of

cash tax payments, it does not impact our income tax expense for

accounting purposes.

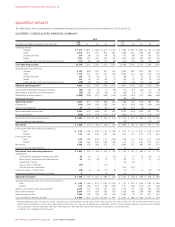

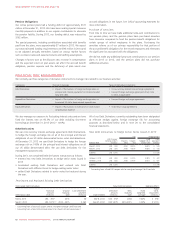

The table below shows the difference between income tax expense

from continuing operations, and income tax expense computed by

applying the statutory income tax rate to income before income taxes:

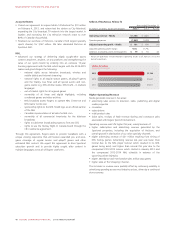

Years ended December 31

(In millions of dollars, except tax rate) 2013 2012

Statutory income tax rate 26.5%26.4%

Income before income taxes $ 2,265 $ 2,345

Computed income tax expense using statutory

income tax rate 600 619

Revaluation of deferred tax balances due to legislative

changes 854

Non-taxable portion of capital gains (9) (61)

Recognition of previously unrecognized deferred tax

assets (14) (22)

Impairment of goodwill and intangible assets –11

Non-deductible stock-based compensation 89

Other items 310

Income tax expense $ 596 $ 620

Effective income tax rate 26.3%26.4%

Cash income taxes paid $ 496 $ 380

Discontinued Operations

As discussed in the Cable segment, the second quarter of 2012 was the

last period of operations for our Video business, from which point the

associated results were treated as discontinued operations for

accounting and reporting purposes.

52 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT