Rogers 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

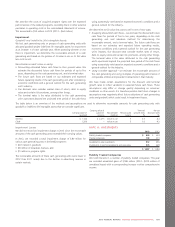

•IFRIC 21, Levies (IFRIC 21) – In May 2013, the IASB issued IFRIC 21,

which provides guidance on when to recognise a liability for a levy

imposed by a government, both for levies that are accounted for in

accordance with IAS 37 Provisions, Contingent Liabilities and

Contingent Assets and those where the timing and amount of the

levy is certain. The Interpretation identifies the obligating event for

the recognition of a liability as the activity that triggers the payment

of the levy in accordance with the relevant legislation. It provides the

following guidance on recognition of a liability to pay levies (i) the

liability is recognised progressively if the obligating event occurs over

a period of time, and (ii) if an obligation is triggered on reaching a

minimum threshold, the liability is recognised when that minimum

threshold is reached. The standard is effective for annual periods

beginning on or after January 1, 2014, with early adoption

permitted. We are assessing the impact of this new standard on our

consolidated financial statements.

•IFRS 9, Financial Instruments (IFRS 9) – The IASB issued IFRS 9, which

replaces IAS 39, Financial Instruments: Recognition and

Measurement, establishes principles for the financial reporting of

financial assets and financial liabilities that will present relevant and

useful information to users of financial statements for their

assessment of the amounts, timing and uncertainty of an entity’s

future cash flows. This new standard also includes a new general

hedge accounting standard which will align hedge accounting more

closely with risk management. It does not fundamentally change the

types of hedging relationships or the requirement to measure and

recognize ineffectiveness, however it will provide more hedging

strategies that are used for risk management to qualify for hedge

accounting and introduce more judgment to assess the effectiveness

of a hedging relationship. The IASB has not yet communicated the

mandatory effective date of IFRS 9. We are assessing the impact of

this new standard on our consolidated financial statements.

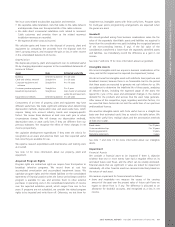

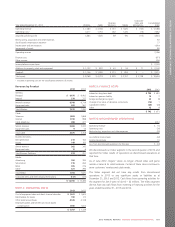

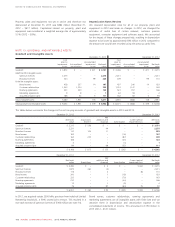

NOTE 3: SEGMENTED INFORMATION

Our reportable segments are Wireless, Cable, Business Solutions and

Media. All four segments operate substantially in Canada. Corporate

items and eliminations includes our interests in businesses that are not

reportable operating segments, corporate administrative functions and

eliminations of inter-segment revenue and costs. We follow the same

accounting policies for our segments as those described in note 2 to

these consolidated financial statements. Segment results include items

directly attributable to a segment as well as those that can be allocated

on a reasonable basis. We account for transactions between reportable

segments in the same way we account for transactions with external

parties and eliminate them on consolidation.

The Chief Executive Officer and Chief Financial Officer are the chief

operating decision makers and regularly review our operations and

performance by segment. They review adjusted operating profit as a

key measure of performance for each segment and to make decisions

about the allocation of resources. Adjusted operating profit is income

before restructuring, acquisition and other expenses, stock-based

compensation expense, depreciation and amortization, impairment of

assets, finance costs, other income, and income taxes. This measure of

segment operating results is different from operating income on the

consolidated statements of income.

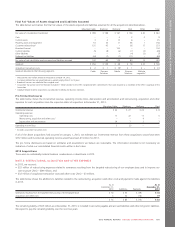

Information by Segment

Year ended December 31, 2013 Wireless Cable

Business

Solutions Media

Corporate

items and

eliminations

Consolidated

totals

Operating revenue $ 7,270 $ 3,475 $ 374 $ 1,704 $ (117) $ 12,706

Operating costs 14,113 1,757 268 1,543 32 7,713

Adjusted operating profit 3,157 1,718 106 161 (149) 4,993

Restructuring, acquisition and other expenses 85

Stock-based compensation expense 184

Depreciation and amortization 1,898

Operating income 2,926

Finance costs (742)

Other income 81

Income before income taxes $ 2,265

Additions to property, plant and equipment $ 865 $ 1,105 $ 107 $ 79 $ 84 $ 2,240

Goodwill $ 1,146 $ 1,256 $ 426 $ 923 $ – $ 3,751

Total assets $ 9,775 $ 5,527 $ 1,195 $ 2,247 $ 4,857 $ 23,601

1Included in operating costs on the consolidated statements of income.

102 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT